|

Getting your Trinity Audio player ready...

|

– Andrew Macken

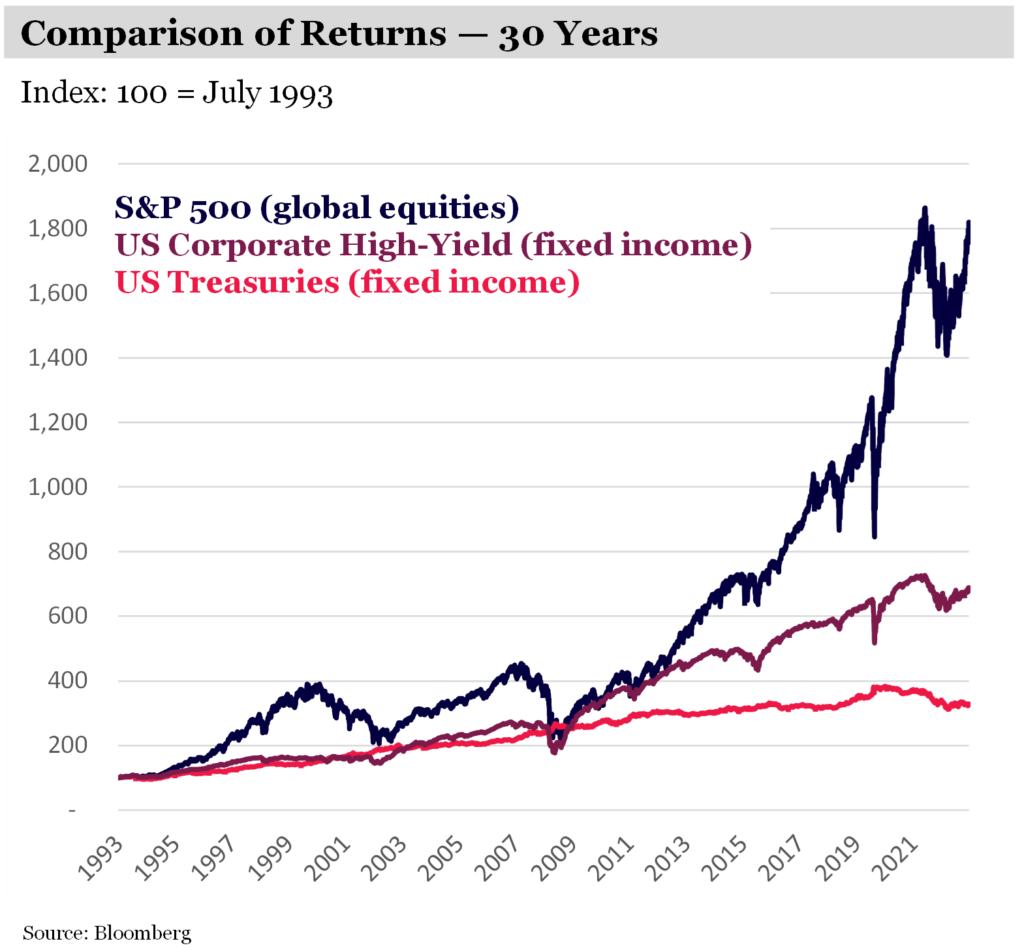

News reports are piling up of investors ‘rotating’ out of equities – particularly global equities, and into fixed income asset classes on recession fears.

But is now really the time to ditch global equities?

For me, global equities should be portfolio permanents.

My own personal story – of finding a career in global equities – might help investors appreciate the benefits of the asset class. And help investors understand why you should hold on to global equities if you want to build superior long-term wealth.

A menu of career options

When I was younger and more naïve, I experimented with a lot of different professions.

I tried electrical engineering, software development, management consulting, and in-house corporate strategy. I worked across businesses both large and small, and both domestic and international.

I learnt that running a business is hard.

Yet, I also learnt that talented leaders and operators, given resources, could achieve extraordinary results for shareholders when incentives were aligned.

Today, I am reminded of businesses like Meta – where Mark Zuckerberg remains fully committed to evolving his business for our new AI-enhanced world, and fully invested in his company’s equity at the same time; or KKR, where the firm’s extremely talented dealmakers own around 30% of the company’s outstanding shares.

The wide variety of early experiences was so rich with learnings that I decided to become an investor. My theory was that I had so much to learn – and only as an investor would I have the opportunity to continually transverse the many dimensions of business to uncover these learnings. Furthermore, to the extent these learnings were also valuable to clients, I could hopefully become an important partner to others.

Why equities?

After deciding to become an investor, I then realized the powerful difference between being a lender (fixed income) and an owner (equities), which led me to focus on equities rather than fixed income.

As a student of business and finance, I had studied equity markets, of course – but I also studied debt markets. Debt, or fixed income, markets are much larger than equity markets, and I found them intellectually fascinating. But fixed income is very different to equities.

While the return to debt-holders is limited, the return potential to shareholders is unlimited. As a firm’s assets compound in value over time, the growth accrues to shareholders. Yes, the journey is a little more bumpy along the way. But for the patient, long-term investor, equities are unambiguously compelling. That’s probably why the world’s wealthiest men and women have typically built their wealth through equities.

Finding a special class of stocks at special prices

But within equities, I found there are a class of ‘privileged’ businesses that have highly-entrenched positions, operate in structurally growing sectors, and which have very high entry-barriers to would-be competitors. And from time to time, these businesses became extraordinarily mispriced by the market.

How could this be? Well, if you asked me in my early 20s as a fresh postgraduate student of finance, I would have said it couldn’t be. My university at that time subscribed to a more classical view of finance theory – that markets were essentially efficient and the value of an asset was simply its price.

This never really sat right with me. At the time, Australia was starting to realize the value of its iron ore resources as China’s economic growth accelerated. Rio Tinto’s share price was on its way to increasing 6x over the subsequent few years. Clearly, price and true intrinsic value were not the same thing – the iron ore always had immense intrinsic value. And clearly the market was not always efficient in understanding and recognizing true value.

The penny dropped for me when I later studied finance (again… slow learner) at the same university attended by Warren Buffett – and the home of value investing – Columbia Business School. There I learnt from some of the best professors in the world that, no, markets are not always efficient. And that price and true value can deviate from each other from time to time – and occasionally, quite substantially.

The magic happens when these two things combine. That is, when privileged businesses are really mispriced by the market. When this happens (assuming the mispricing is an underpricing, not an overpricing) the upside for shareholders in these businesses can be supernormal.

Amazon is a great example.

It’s wild to think about Jeff Bezos slowly crafting his new business in the 1990s, a business that would become Amazon, which is today a clear global leader in ecommerce, advertising, logistics, cloud computing and AI. Time and time again, the market underpriced the shares of Amazon – failing to appreciate its advantages and the enormity of the end-markets into which it was growing. We believe this underpricing continues today. And Bezos probably does too, given he is not selling his more than US$130 billion personal stake in the company.

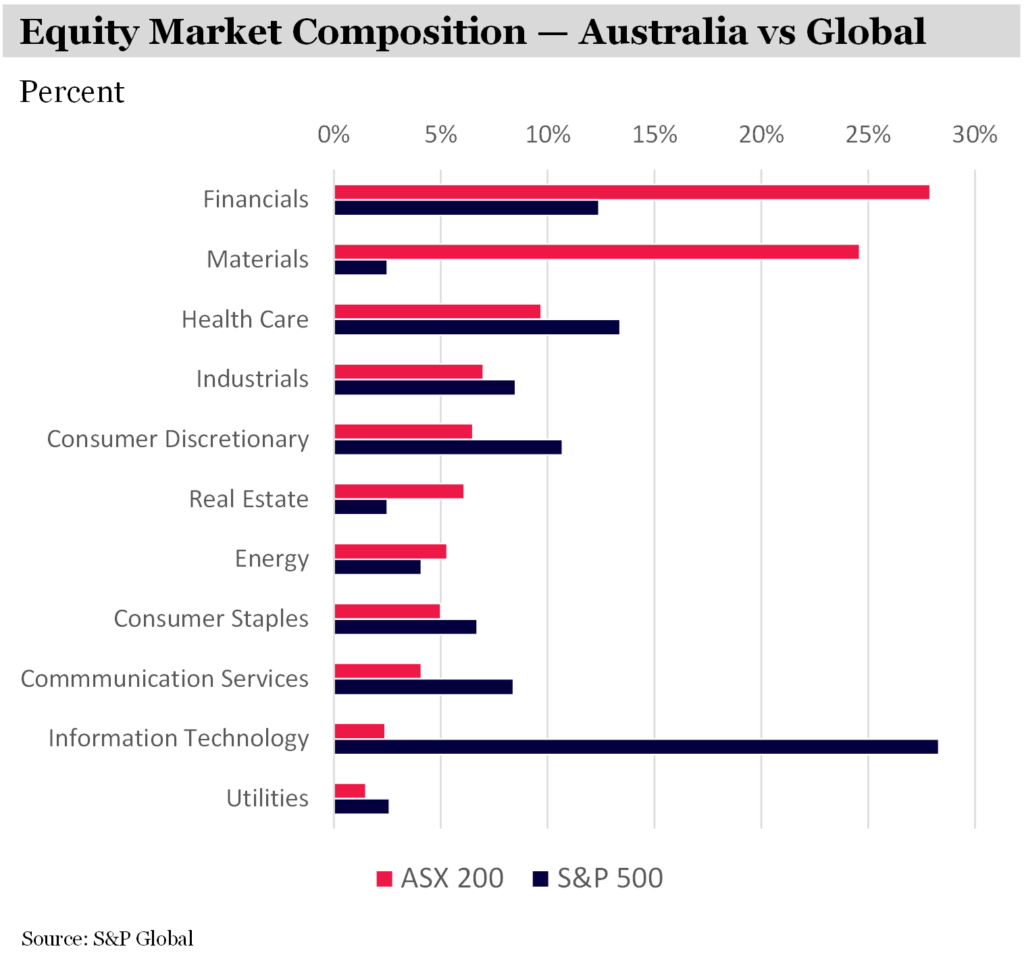

But how many of these ‘privileged’ businesses would I find in Australia?

Going global

As a boy growing up in Wagga Wagga, devoting a professional life to understanding and analyzing businesses located outside of Australia seemed farfetched.

But at the same time, the Australian market looked quite unusual relative to the rest of the world – dominated by a handful of banks, telcos, mining companies and supermarkets.

Fortunately, my early experiences as a management consultant exposed me to global enterprises in the UK, EU, and Singapore. And my subsequent professional experiences in New York further opened my eyes to the bigness of the world and how many talented people are out there working on so many amazing ideas.

I realised that the world’s best businesses were probably not all located in Australia.

My early inklings that the world’s highest-quality businesses could improve the lives of their shareholders have been reinforced time and time again.

Two fantastic examples are Microsoft, which has privileged access to enterprises as we enter the age of AI, and Blackstone, which has a world-leading global investment platform that will benefit from structural flows to alternative assets.

These two truly extraordinary businesses – located 4,000km apart from each other – are more than 10,000km from the shores of Australia.

Global stocks will win in a new era

A global perspective is more important now than ever.

We are entering a new global environment – one of extraordinary technological and geopolitical change. It is the world’s very best businesses which are in the greatest position to be flexible, adapt to change, and ultimately thrive.

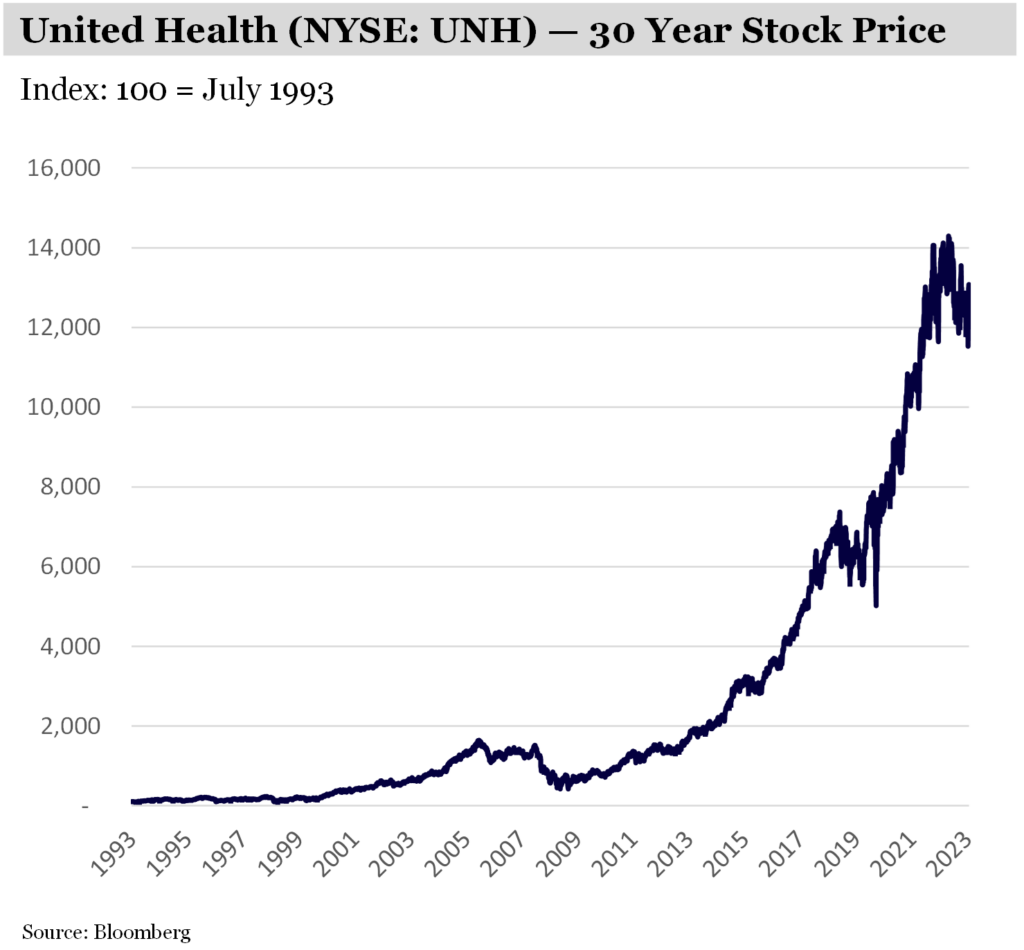

UnitedHealth, the largest health insurer in the US, which is based in Minnesota, for example, far be it from being disrupted by technology – is instead using software and AI to more efficiently deliver healthcare to more than 100 million patients that are insured clients of both UnitedHealth and more than 100 third-party insurers.

Similarly, California-based Salesforce is integrating AI into its offering. Its entrenched market position allows it to charge higher prices for capabilities – something that is rarely an option for lower-quality businesses. In July, Salesforce announced a +9% average price increase across the board for its products – and even higher prices for its new AI-infused capabilities.

Lots of lessons, with more to come

The great thing about investing is that the learnings arrive thick and fast, irrespective of one’s experience level. Despite working at this for more than 20 years, my learning curve has never felt steeper.

But the greatest lesson so far is one of patience. If you own the world’s highest-quality businesses you will do well over time – but they really do need time.

The journey to investing success in global equities can be quite bumpy. The world’s highest-performing equities routinely draw-down by more than one third.

The antidote to this uncomfortable journey is time and patience.

But if you can patiently own the world’s best businesses over the long term, you will do well and likely reach your important financial and retirement goals.

To request a copy of our latest whitepaper & know the top 5 stocks poised to lead the tech recovery, please share your details with us:

Note:

Montaka is invested in Microsoft, Amazon, UnitedHealth, Salesforce, Meta & Blackstone.