|

Getting your Trinity Audio player ready...

|

The Montaka team is constantly trying to find great businesses for inclusion in the Montaka Global Fund. We have a preference for businesses that maintain near-impenetrable positions relative to competitors, are in industries with secular growth tailwinds, demonstrate a track-record for producing above-average returns on invested capital, and have opportunities to continue to deploy large amounts of capital at these high rates of return. These are the types of businesses that can be thought of as “compounders”; over time the ability of these businesses to reinvest capital has a compounding effect that can create significant value for shareholders. We believe CVS Health (NYSE: CVS) is a company that exhibits the above characteristics.

What does CVS do?

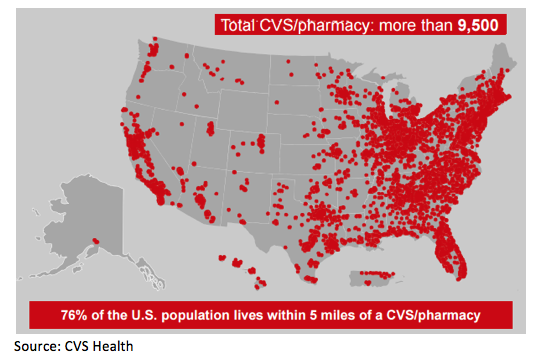

CVS has an incredibly unique business model, combining retail pharmacy assets with pharmacy benefits management (PBM) services to create an integrated healthcare delivery platform. In the Retail segment, the company sells prescription drugs, over-the-counter drugs and an assortment of general merchandise through CVS/pharmacy-branded stores. To gain a better sense of the scale of CVS’s retail pharmacy network of 9,500 stores, it is worth noting that 76% of the U.S. population lives within 5 miles of a CVS/pharmacy.

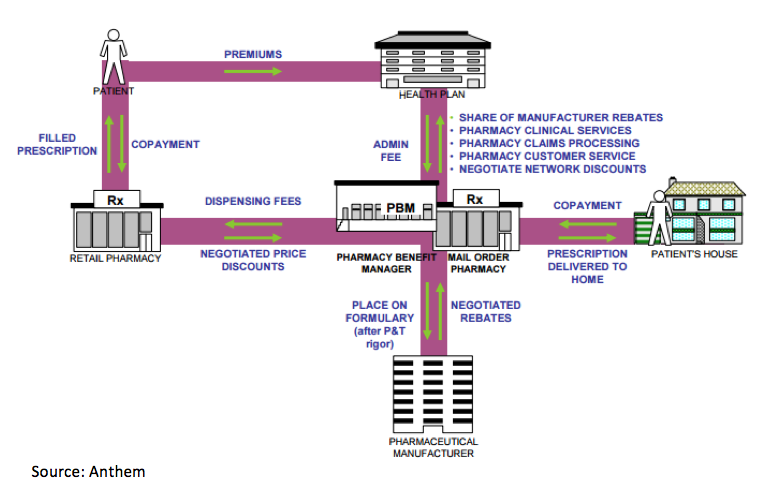

In addition, CVS has a pharmacy benefits manager (PBM) with more than 75 million plan members, a result of the merger between CVS (the retailer) and Caremark (the PBM) in 2007. A PBM can be thought of as an aggregator that acts as a touchpoint for health plans (e.g., insurers and employers, sometimes referred to as payors), pharmaceutical manufacturers, and retail pharmacies.

CVS is a low-cost provider of pharmacy care, given its procurement capabilities and claims scale, and it can use its significant clout to extract cost savings for health plans when purchasing drugs from pharmaceutical companies. CVS’s entire PBM business is predicated on having scale to drive cost savings for clients, a positive for the company given that it has more than 20% market share. The fact that CVS has captured an outsized portion of prescriptions growth in the U.S. – CVS captured 39% of the $710m of prescription growth over the last five years – highlights that the Company continues to drive market share gains.

CVS is a low-cost provider of pharmacy care, given its procurement capabilities and claims scale, and it can use its significant clout to extract cost savings for health plans when purchasing drugs from pharmaceutical companies. CVS’s entire PBM business is predicated on having scale to drive cost savings for clients, a positive for the company given that it has more than 20% market share. The fact that CVS has captured an outsized portion of prescriptions growth in the U.S. – CVS captured 39% of the $710m of prescription growth over the last five years – highlights that the Company continues to drive market share gains.

CVS’s model poised to create shareholder value

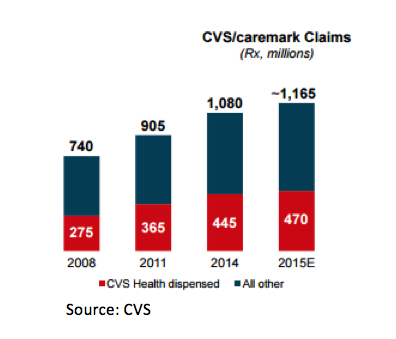

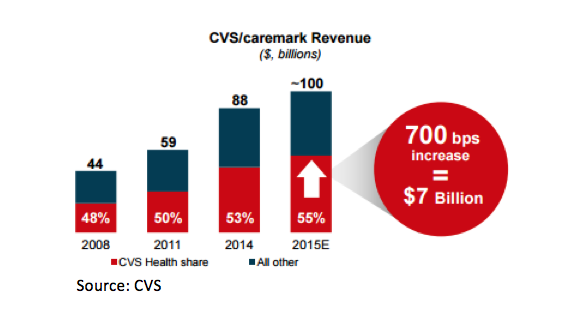

CVS’s integrated healthcare model, with the combination of a PBM and a retail network, creates a platform through which healthcare can be delivered at a low cost and value can be created for shareholders. One of the benefits of CVS’s unique model is that it allows the retail pharmacy business to capture growth in CVS/caremark claims (i.e., through dispensing the prescription volumes of the PBM through CVS Health pharmacy stores). The number of CVS/caremark claims dispensed through CVS Health pharmacies has materially increased.

More importantly, CVS Health’s share of CVS/caremark revenues has improved by 700 bps since 2008, allowing CVS to capture an incremental $7bn in dispensed revenue. Such revenue capture opportunities are unavailable to CVS’s pure-play peers, whether they are PBMs or operators of pharmacy retail chains.

More importantly, CVS Health’s share of CVS/caremark revenues has improved by 700 bps since 2008, allowing CVS to capture an incremental $7bn in dispensed revenue. Such revenue capture opportunities are unavailable to CVS’s pure-play peers, whether they are PBMs or operators of pharmacy retail chains.

In the U.S., persistent medical cost inflation poses risks for healthcare insurers; CVS’s PBM has tools at its disposal to help curtail these cost pressures. CVS/caremark maintains a formulary which specifies the drugs that will be covered for reimbursement by insurers – a bargaining chip that provides CVS enormous negotiating leverage over pharmaceutical manufacturers. The PBM essentially acts as a shield for insurers against pharmaceutical companies seeking to make hefty margins on drugs; manufacturers seeking exorbitant prices risk being excluded from the formulary and their drugs would become ineligible for reimbursement by the PBM’s clients. Furthermore, CVS can also curb medical cost trend through the use of generic drugs.

In the U.S., persistent medical cost inflation poses risks for healthcare insurers; CVS’s PBM has tools at its disposal to help curtail these cost pressures. CVS/caremark maintains a formulary which specifies the drugs that will be covered for reimbursement by insurers – a bargaining chip that provides CVS enormous negotiating leverage over pharmaceutical manufacturers. The PBM essentially acts as a shield for insurers against pharmaceutical companies seeking to make hefty margins on drugs; manufacturers seeking exorbitant prices risk being excluded from the formulary and their drugs would become ineligible for reimbursement by the PBM’s clients. Furthermore, CVS can also curb medical cost trend through the use of generic drugs.

Brand-to-generic conversions for drugs provide a cost saving opportunity for insurers as well as a significant profit driver for CVS, given the higher margin it earns on generics. At present 84% of prescriptions in CVS pharmacies are filled with generics and there is an expected $26.4bn of branded drugs moving to generic status between 2016 and 2018, a large opportunity for CVS to drive further profit growth (particularly given its Red Oak generic sourcing venture which provides scale).

Favorable demographics

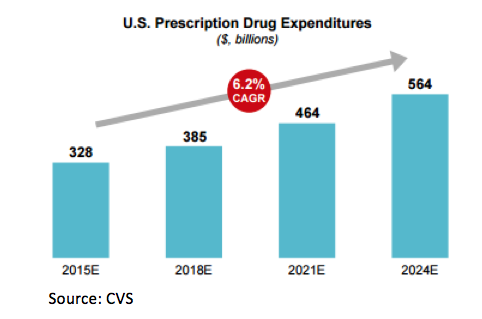

CVS is in a prime position to benefit from an ageing U.S. population through higher prescription volumes. Consider that 10,000 baby boomers are projected to turn 65 every day for the next 15 years. This is especially relevant given that Americans in the 65+ category have more than double the prescription utilization of under 65 year olds. These demographic trends are likely to result in solid growth in prescription expenditures as well as underpin a strong growth trajectory for CVS.

But is CVS a good investment?

So far no mention has been made about the price of CVS and whether it represents compelling value for investors. Even the highest quality business can fail to be a good investment if purchased for an unjustifiably high price. Fortunately the market has failed to reflect many of the high quality aspects of CVS’s business in its share price, creating an opportunity for Montaka to purchase a great business at a good price.

A number of short term factors and a mix shift within the business have created opportunity for investors. Stronger growth in lower gross margin business segments is causing margin compression, but the positive volume impact is likely to drive increases in gross profit dollars over time. This mix shift is being caused by: 1) CVS’s lower-margin PBM business growing faster than its retail segment; 2) within the retail business, lower margin pharmacy growth is outpacing front store retail sales growth; and 3) Medicare and Medicaid are growing to become a larger proportion of the patient mix (although higher utilization of scripts should offset the lower margin rate and dollars per script).

It is likely that the market is looking at the headline gross margin declines and misunderstanding the complete impact on CVS. For example, despite much talk about reimbursement rate pressures for Medicare patients, Medicare Part D members need approximately 45 prescriptions per year compared to 8 prescriptions per year for a typical under-65 life. The lifetime value of Medicare beneficiaries is arguably higher due to the enormous uplift in utilization.

The current c.$100 share price for CVS implies roughly 7% revenue growth over the next 10 years as well as modest operating leverage as the business continues to scale. This is arguably too conservative. Revenues have grown at an average annual rate of 10% over the last 5 years and on the $10 billion by which CVS has increased its asset base since 2010, the Company earned a 19% return after tax.

Many of the Company’s growth initiatives in specialty, long term care management, as well as the CVS/minuteclinic health services rollout suggest CVS will be able to maintain, if not surpass its prior record of growth. If CVS continues to execute on its growth plan, the stock could well be worth in excess of $130/share. CVS remains one of the only companies with the power to impact patients, payors, and providers, positioning the company to benefit from an ageing U.S. population as well as underwriting continued value generation for CVS shareholders.

Ge![]() orge Hadjia is a Research Analyst with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.

orge Hadjia is a Research Analyst with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.