|

Getting your Trinity Audio player ready...

|

-Andrew Macken

Charlie Munger, rest in peace, said in one of his final interviews a few weeks ago: “All investment is intrinsically damn difficult!”

Hear, hear! We continually remind ourselves that investing is not simply the pursuit of forecasting the future and putting money behind these assessments. It’s about taking a different view to that which is priced-in by the market – and, of course, the view needs to be right. This is hard because the market is approximately right most of the time.

And if that weren’t challenging enough, it is generally true that one’s ‘pay day’ from such an investment is the result of others in the marketplace coming around to one’s differentiated view. Of course, the timing of this dynamic is unknowable. It could happen over several weeks, or it could take several years. And it may also be the case that the market’s incorrect view happens to get more wrong before it gets right. (And along every step of the way, how does one know for sure they are right, and the market is wrong?)

To summarize the above, a great investor needs to: (i) develop views that are generally closer to truth than others’, (ii) hold views that others disagree with, (iii) look stupid a lot of the time, and (iv) give up substantially all notions of control over any short-term outcomes. Damn difficult!

The good news is that great rewards exist for those who can understand and work within these dynamics. We assess that one of the greatest advantages an investor can arm themselves with (but most do not) is a genuine long-term perspective.

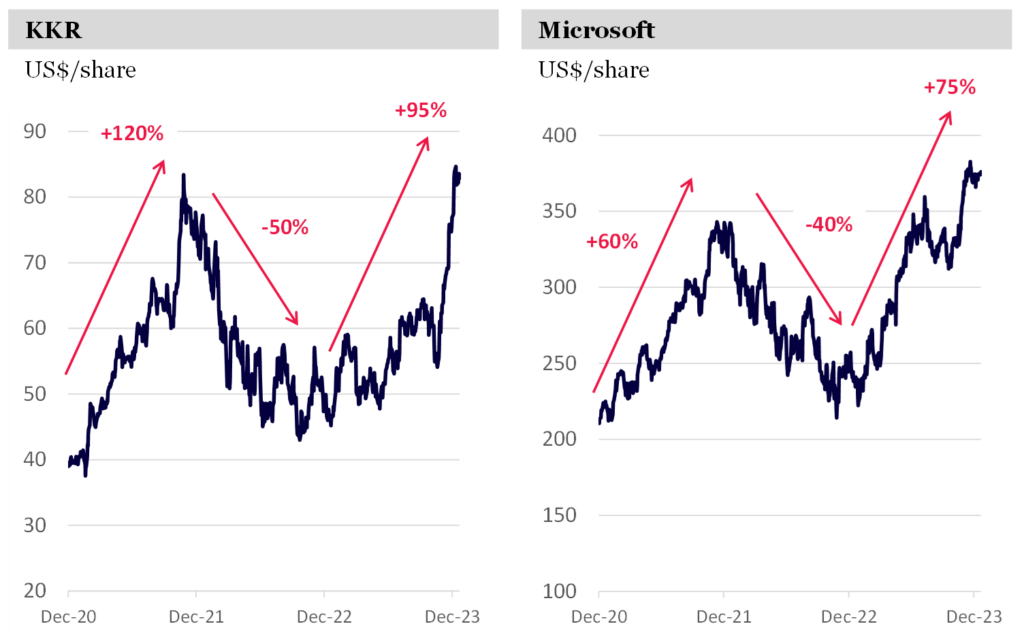

History clearly demonstrates that equities do well over long periods of time – while turning positive or negative with the probability of a coin flip over short periods of time. History also clearly demonstrates that the ‘price of admission’ for owning the world’s highest-returning businesses is frequent and large draw-downs over the holding period.

Just take a look at the experience of KKR and Microsoft – two of the world’s greatest businesses – over the last three years. Great returns, but a frightening ride along the way!

Source: Bloomberg

Montaka focuses on the world’s most advantaged businesses that are well-positioned within large structural transformations. And we seek to own the ones for which our assessment of future earnings power is materially higher than that which is priced-in by today’s stock prices.

And by freeing ourselves from the worry of uncontrollable stock price journeys over the short term, we can hang on to these great investment opportunities – with great long-term reward.

Of course, this is only possible because of the extraordinary patience of Montaka’s investors, team members, and stakeholders. And for this, we are extremely grateful.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stockpicks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka

To request a copy of our latest paper which explores the empirical research around the 3 pillars of active management outperformance, please share your details with us:

Note: Montaka is invested in KKR and Microsoft.

Andrew Macken is Chief Investment Officer with Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or leave us a line on montaka.com/contact-us