|

Getting your Trinity Audio player ready...

|

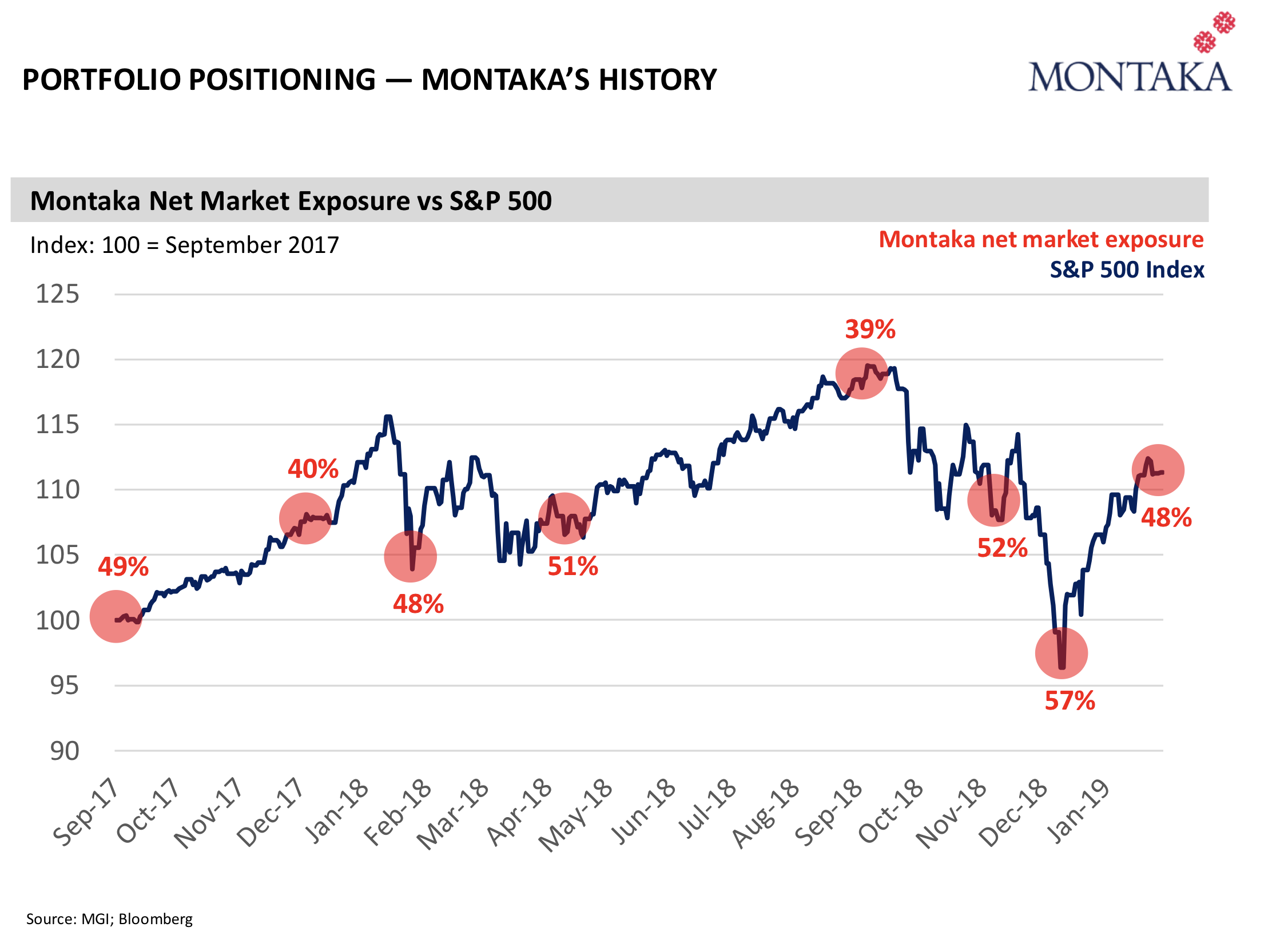

Montaka’s net market exposure is the difference between our long portfolio exposure and our short portfolio exposure. It tells us something about how Montaka is exposed to the overall movements of global equity markets.

For example, since our inception nearly four years ago, for every $100 of investor capital, we have positioned the Montaka portfolios $92 long and $46 short, resulting in an average net market exposure of $92 – $46 = $46. This means that Montaka has been less than half-exposed to the overall movements in the market over this period. This has been wonderfully helpful to our investors in periods like Q4 2018 when markets turn down: Montaka tends to significantly preserve capital in these scenarios.

But Montaka’s net market exposure is not static. We can vary it over time by changing the size of our long portfolio, or the size of our short portfolio, or both. Different market conditions warrant different net exposures – which, in the case of Montaka, will typically vary between 30% and 70%. Now, by far the majority of the movements in Montaka’s net exposures over time stems from the organic bottom-up changes of individual positions, both long and short, for stock-specific reasons.

In addition to the bottom-up process, however, we continually ensure that Montaka’s positioning is consistent with our top-down considerations. And from time to time, our top-down process leads us to systematically ratchet up or down Montaka’s net market exposure, depending on what is warranted by market conditions at the time.

MONTAKA’S TOP DOWN POSITIONING PROCESS

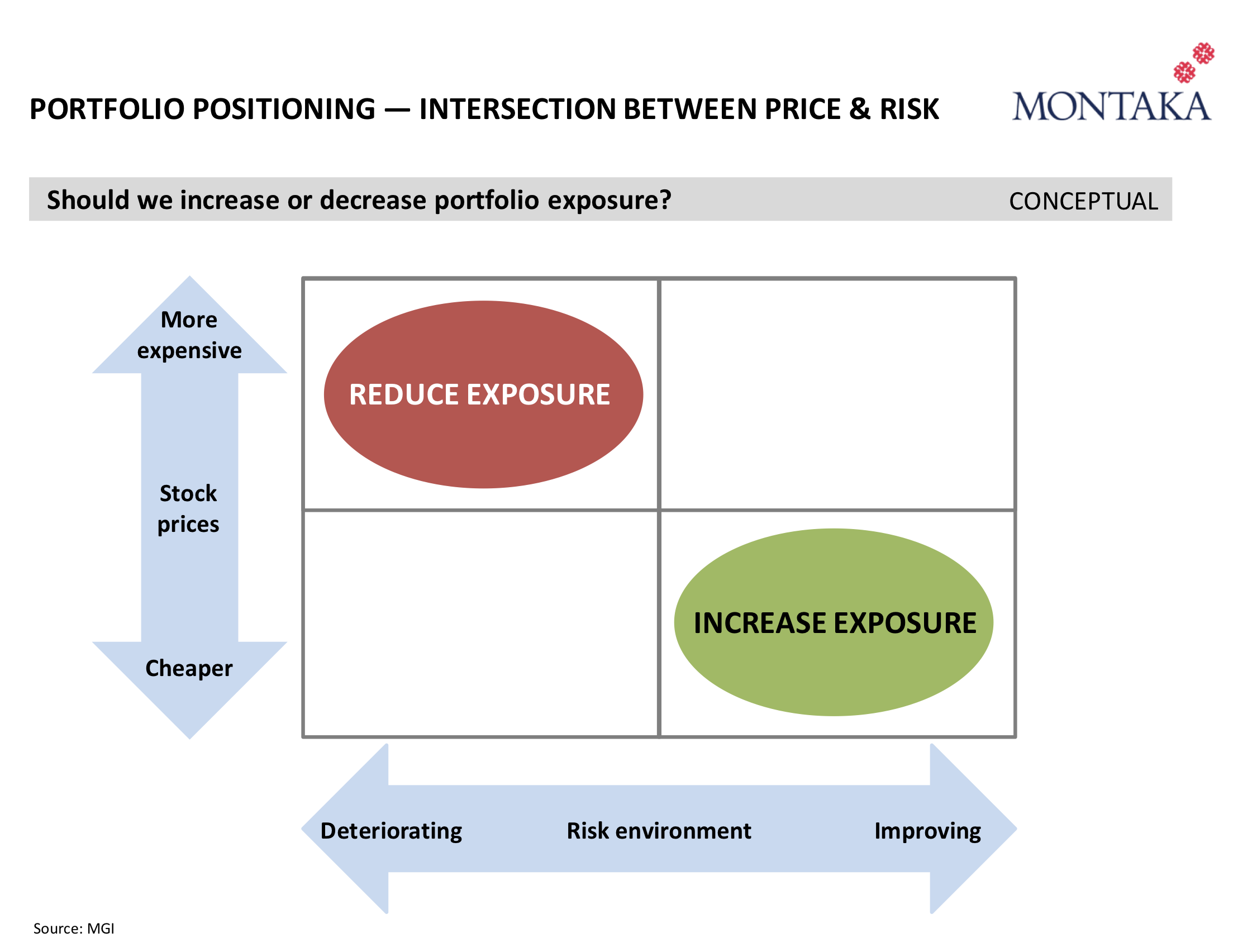

From a top-down perspective, what matters to us is the intersection of two dynamics, we call: (i) the price environment; and (ii) the risk environment. While we address these in turn below, the executive summary is as follows:

- When stock prices are implying undemanding valuations AND the global risk environment is improving: we view these conditions as conducive for systematically ratcheting up Montaka’s net exposure; and

- When stock prices are implying more demanding valuations AND the global risk environment is deteriorating: we view these conditions as conducive for systematically reducing Montaka’s net exposure.

We unpack this process below. And while the frameworks we employ are often abstract and unobservable, we believe they are powerful and go to the heart of successful risk management over a long period of time.

The Price Environment

In evaluating the price environment, we are seeking to make some sensible general determinations about the valuation levels of global stocks. As regular readers will be aware, we think about valuation through the lens of the expectations that are being implied by current stocks prices. To the extent current stock prices are implying a general set of expectations about global economic growth and corporate profits which are unreasonably conservative, then stock prices are implying undemanding valuations. And vice versa.

Broadly speaking, there are two situations in which the global price environment changes in the eyes of the Montaka research team. Either: (i) global stock prices change significantly without a commensurate change in Montaka’s expectations of future economic growth and corporate profits; or (ii) Montaka’s expectations of future economic growth and corporate profits changes significantly without a commensurate change in global stock prices.

Montaka’s research team spends all day, every day, reverse engineering the expectations built into the stock prices of global businesses we are analysing. This exercise is a core part of our investment process – both on the long side and the short side. A valuable side-effect of our dedication to our expectations analysis is that we believe we are well-armed to make sensible general determinations about the valuation levels of global stocks. And hence, the price environment.

The Risk Environment

In evaluating the risk environment, we are seeking to estimate the shape, and the change in shape, of the probability distribution profile of the potential outcomes associated with specific, significant global risks. In recent times, examples of such risks include the US/China trade dispute, the evolution of global monetary policies or the resolution of Brexit. We are never trying to predict specifically how these risks will be resolved – that would be a deterministic prediction, which is near-impossible to make with any degree of sustainable accuracy. Instead, we think through the range of possible outcomes for each risk; and effectively estimate the probability of each outcome. Through this process, we effectively construct the shape of the probability distribution profile to each major global risk on the horizon.

This might seem entirely arbitrary. After all, the shape of a probability distribution profile is entirely unobservable for any risk that you cannot test and repeat, time and time again. That said, it must be true that if, for example, the Montaka research team can assess the shapes of the probability distribution profiles for major global risks (in addition to for individual global businesses and their respective equities) more accurately than others, then we should also expect to generate higher risk-adjusted returns than others.

What is perhaps easier to digest – and incidentally is more relevant to the question of Montaka’s net market exposure – is the change in the shape of the distribution for any global risk. The process here is rather simple. For any given global risk:

- If the probabilities of the more favourable outcomes are increasing; and the probabilities of the more negative outcomes are decreasing: we define this as an “improvement” for this risk.

- And vice versa for a “deterioration” of the risk.

Upon giving careful consideration to all of the global risks out there, the Montaka research team seeks to make some sensible assessment of the overall global risk environment as either improving, deteriorating, or – as is the case the majority of the time – no meaningful change.

The Intersection of Price and Risk

As we stated up front, it is the intersection of the price environment and the risk environment that interests the Montaka research team. As illustrated by the matrix below:

- When stock prices are implying undemanding valuations AND the global risk environment is improving: we view these conditions as conducive for systematically ratcheting up Montaka’s net exposure; and

- When stock prices are implying more demanding valuations AND the global risk environment is deteriorating: we view these conditions as conducive for systematically reducing Montaka’s net exposure.

Why is this true? At the heart of everything we do is the identification of unrealistic market-implied expectations which are built into stock prices. We do this at the stock-specific level – in both our long and short portfolios – and we do it from a top-down perspective leveraging the process described above.

Furthermore, as is already well and truly evident, we think probabilistically in everything we do, not deterministically. Said another way, we spend little time thinking about what will happen in the future; and we spend an enormous amount of time thinking about what could happen – and the likelihood of each scenario.

These concepts go to the core of the analysis and management of risk. At Montaka, we spend our life trying to accurately assess and manage risk. To the extent we can manage risk well – and we continually look for positive enhancements to our process – then we stand a very good chance of delivering on our objective of seeking to preserve and grow the wealth of our investors.

In Part II, we illustrate the above concepts with some tangible examples from our recent history.

Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.