|

Getting your Trinity Audio player ready...

|

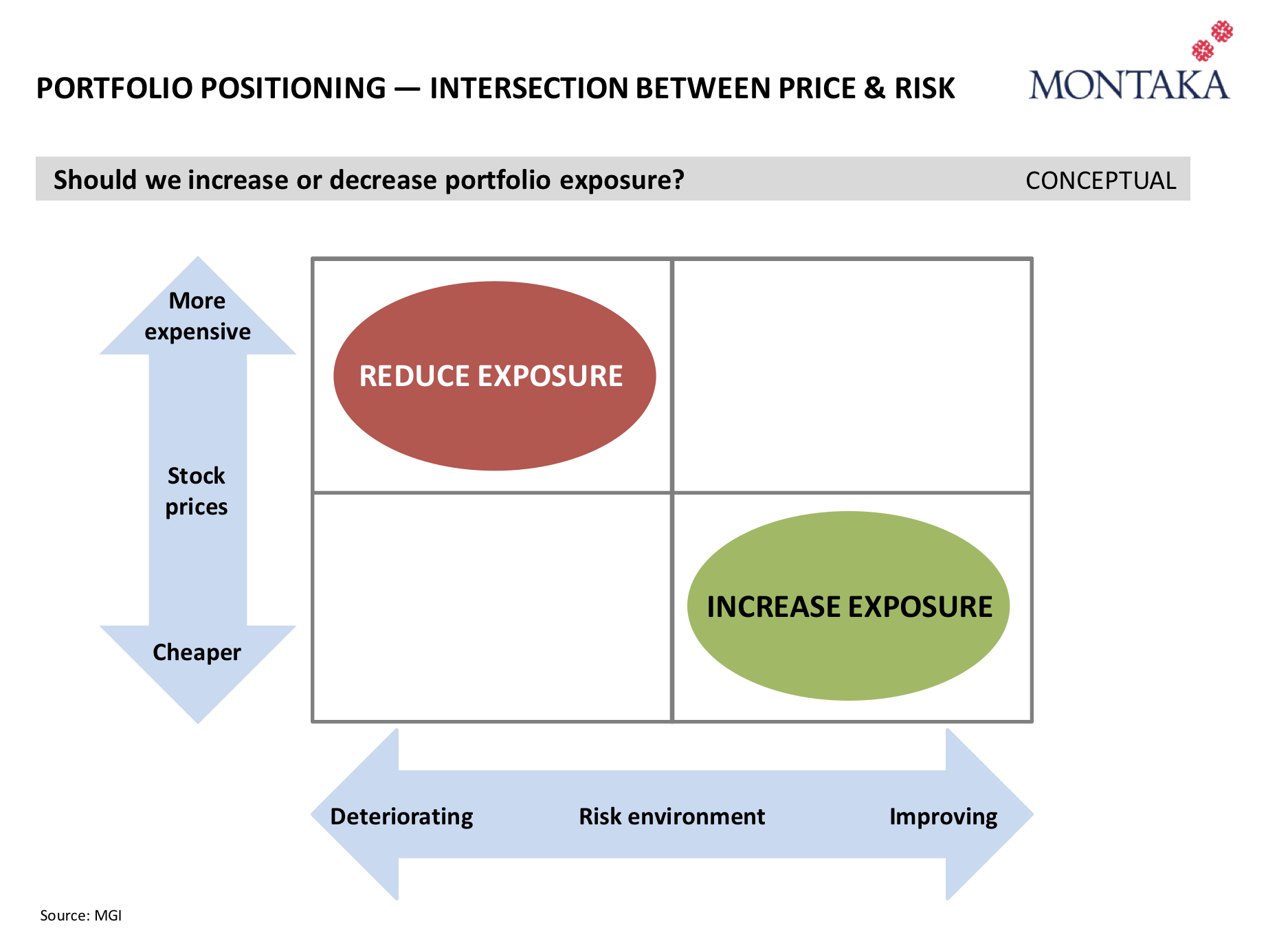

In Part I, we described Montaka’s top down process which helps determine the appropriate positioning of our long portfolio, short portfolio and the resulting net market exposure. The framework described can be simplified by the framework illustrated below.

Put simply:

- When stock prices are implying undemanding valuations AND the global risk environment is improving: we view these conditions as conducive for systematically ratcheting up Montaka’s net exposure; and

- When stock prices are implying more demanding valuations AND the global risk environment is deteriorating: we view these conditions as conducive for systematically reducing Montaka’s net exposure.

Let us now go back in time and illustrate three historical scenarios when this top down process resulted in material systematic changes to Montaka’s portfolio.

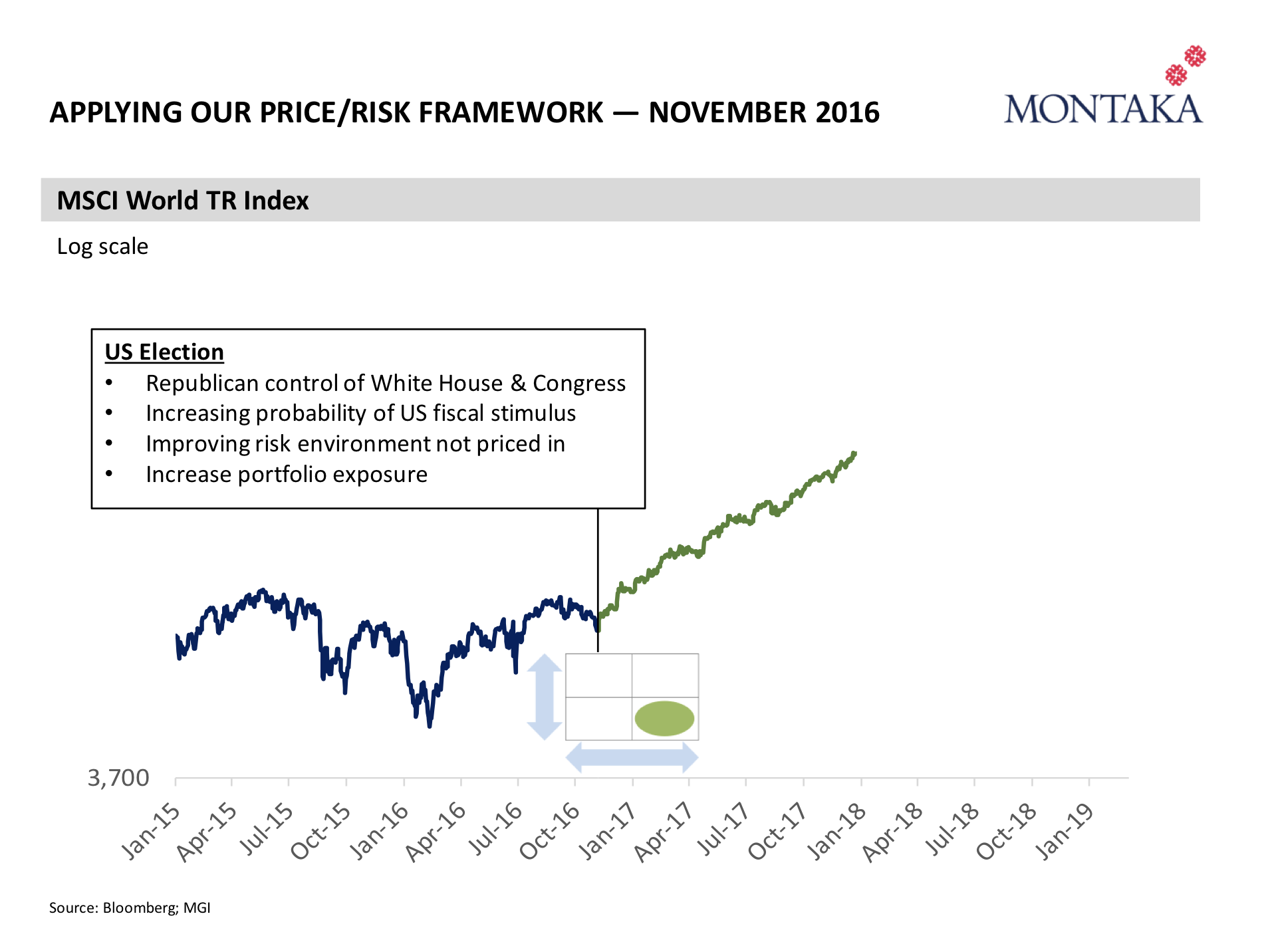

We begin by going back to November 2016. Here, we were just days after the result of the US general election. And obviously, we learned that the Republicans took control of the White House, the House of Representatives and the Senate. This Republican clean-sweep meant to us that the probability of genuine fiscal stimulus in the US economy had gone from what was effectively zero (because of the gridlock in Washington) to materially greater than zero. This was a form of a significantly improved risk environment.

At the same time, we believed that this increased probability of fiscal stimulus was not being priced in by the stock market at that time. To us, this meant we were in the bottom right-hand quadrant of our price/risk framework, meaning it was a logical time to increase portfolio exposure. At the time, Montaka’s net market exposure increased from the 40s up to nearly 60%. And that turned out to be a sensible course of action, given the significant market rally that followed.

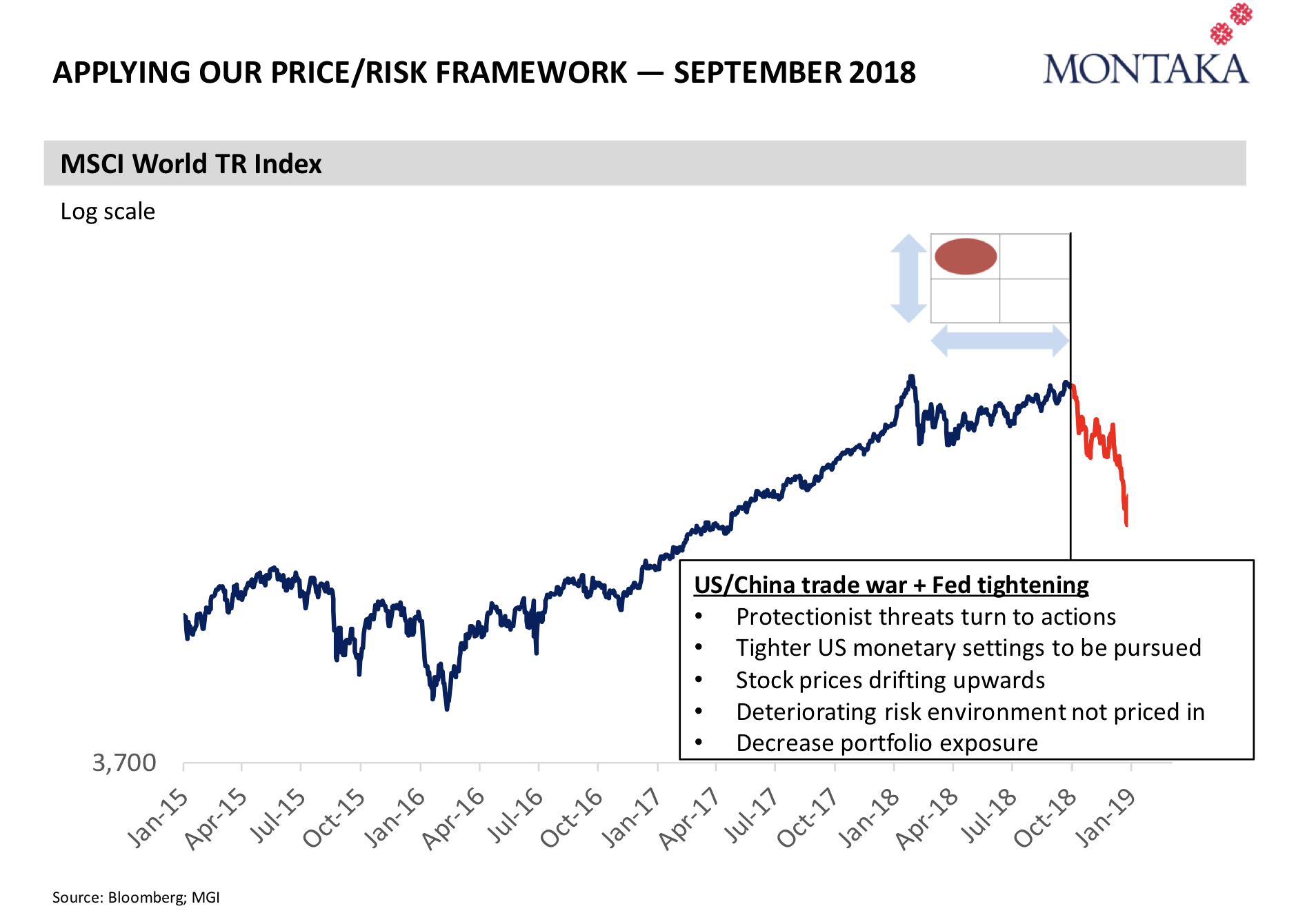

Fast forward now to September 2018, and it was a very different story. If you cast your mind back in September 2018, there were some strange things happening in the market. We would describe some stock price moves as being non-fundamental in nature. At the time, the US-China trade dispute was just starting to heat up; Trump was becoming increasingly erratic; and the Fed was focused on raising interest rates and normalizing its balance sheet. So, in our view, this information was consistent with a deteriorating risk environment.

Now, in terms of the price environment at the time, they had just been meandering upwards in the preceding months. So in our view, stocks were generally becoming more risky, not less.

This combination of stock prices that were more risky, at a time when the risk environment was deteriorating, led us to take some risk off the table – as per our price/risk framework.

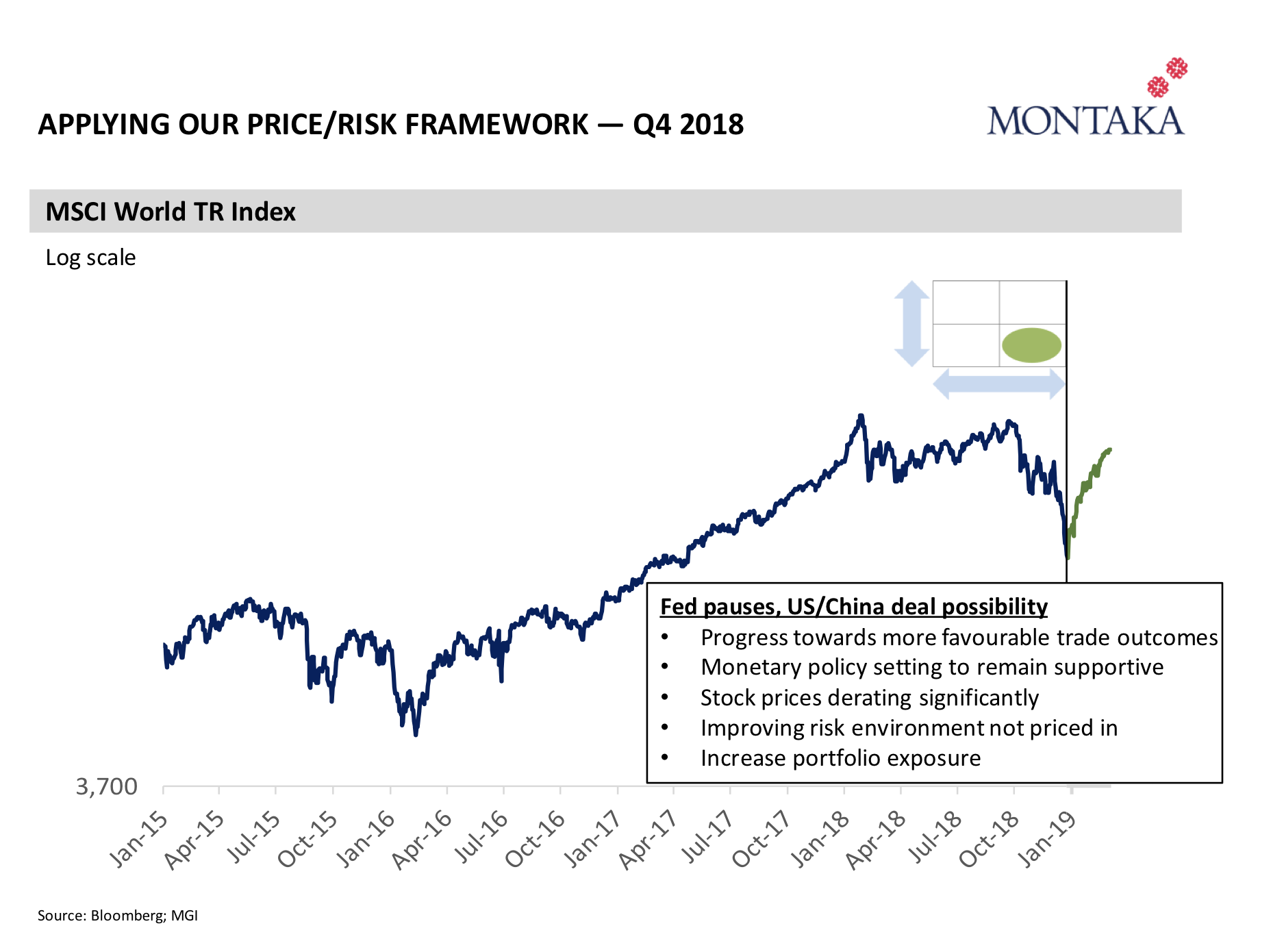

And then Q4 2018 hit.

Now, you might recall that, on a daily basis, the global financial press was telling investors that we were heading for another Great Depression, or another financial crisis, or a bear market. The sentiment had really deteriorated at the time. But let’s see what happened when we applied our top-down price/risk framework.

First, what did we know about the risk environment? Well, in terms of the US-China trade dispute, we learned that Presidents Trump and Xi had dinner together in Argentina and it went very well. So this was a small, incremental positive. To us, some really negative possible scenarios were taken off the table as a result of this successful meeting.

Even more significant to us was the new information that emerged on US monetary policy. We learned in early December that the Fed had essentially paused. They were going to stop hiking rates and potentially stop normalizing their balance sheet. This represented a major improvement of the risk environment.

And then from a price perspective, in December 2018, stock prices had fallen significantly. This means they had become less risky, not more.

So to us, the risk environment was clearly improving at a time when stock prices had become significantly less risky. Under our price/risk framework, this meant it was a logical time to increase Montaka’s net market exposure – which we did through significant buying in our long portfolio and some covering of exposure in our short portfolio. And this, of course, positioned us well for the market bounce back in beginning of 2019.

One final but important point to reiterate with respect to the above examples. This framework we employ seeks to maximise the probability that Montaka’s portfolio will be positioned appropriately for the market conditions that unfold. But it is not a deterministic formula. For instance, after our significant buying in December 2018, it may well have been the case that global equity markets continued to fall in January 2019. We had no idea what markets would do. All we believed was that the probability of a bounce-back was increasing the further the market fell. Had it been the case that the market continued to fall in January, you would have seen us increasing Montaka’s net market exposure even further still.

Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.