|

Getting your Trinity Audio player ready...

|

By Andrew Macken

Alphabet, owner of Google, has been making headlines of late – but in our view for the wrong reasons.

The news has been dominated by the US Department of Justice asking the courts to force Google to divest parts of its business, including the Chrome browser.

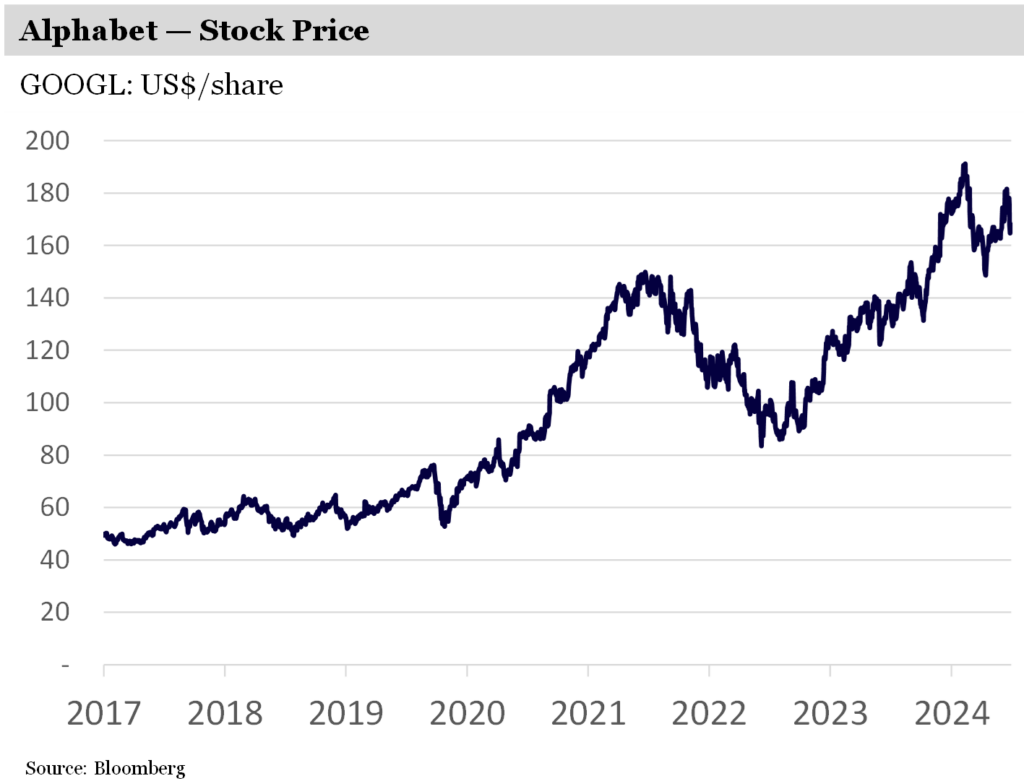

After peaking at US$191/share in July, the recent news and concerns have seen Alphabet’s stock drift down below US$170/share.

But while many are focused on the evolving regulatory environment, we believe the real news is this: Google’s advantages and future opportunities in its core business, Search, are strengthening, not weakening as has been feared.

Over the last 18 months, Google’s Search business has faced uncertainty, with many concerned that AI-based large language models (LLMs) and tools like ChatGPT could (i) erode Google’s more than 90% global marketshare in Search, (ii) erode Google’s profitability by increasing the cost of delivering new AI-infused search features, or (iii) both.

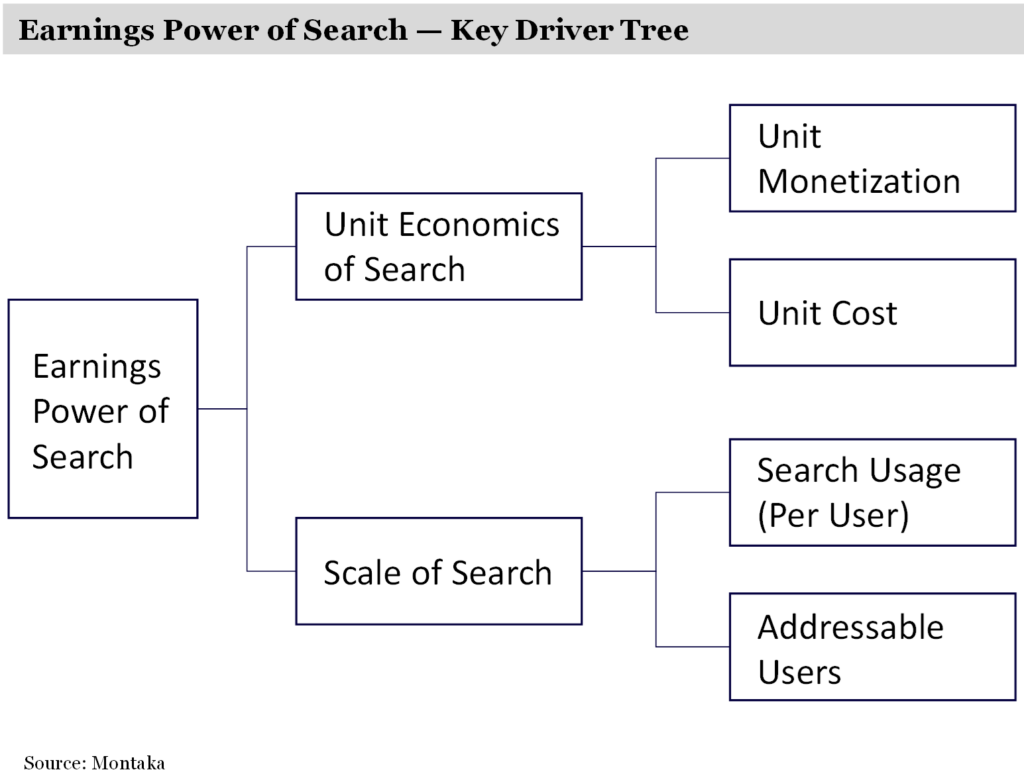

Google’s Search business is obviously extremely important to Alphabet. It represents around two-thirds of total group gross profits. Any erosion in the earnings power of Search would almost certainly translate into a substantially lower stock price.

But rather than eroding Google’s advantages over its competition in Search, today’s technology shift to AI is strengthening them. While search unit costs have increased structurally due to AI, search unit revenues are set to increase by even more. So Google is better off – but unit costs are now much higher, which represents an even greater barrier to entry for its competition.

As we discuss below, AI – and Google’s superior capabilities to harness its power – are improving the key drivers of Search’s future earnings power.

-

AI enhances Google’s Search unit economics

AI is firstly improving the unit economics of Search – i.e. improving, on average, the profitability of each individual search.

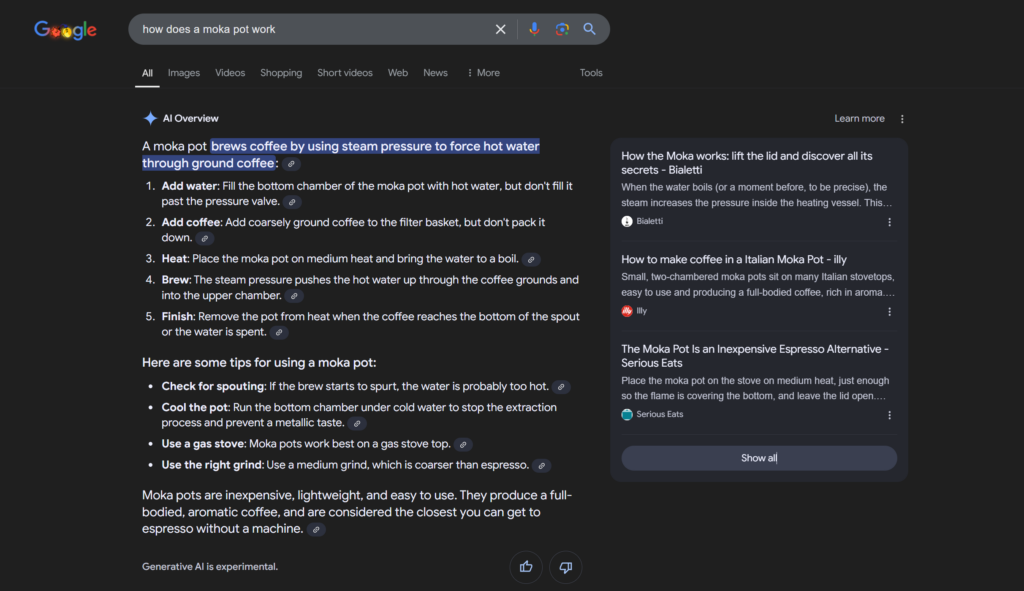

Many of you would have noticed that when you perform a google search now, at the top you receive AI Overviews – a new search result produced by generative AI.

AI Overviews is a great example of how Google is infusing the power of LLMs into search results.

Google recently started running ads within AI Overviews, which has enhanced the connection between users and relevant business, products and services.

Despite AI Overviews taking up valuable screen real estate, Google’s Chief Business Officer, Philipp Schindler, recently disclosed that monetization was already at “approximately the same rate” as equivalent non-AI-Overviews search results.

AI’s ability to understand user intent is helping such strong monetization. By understanding intent, Google’s ad-targeting (also facilitated by large-scale AI models) can be more effective in connecting highly relevant users with the most helpful ads.

Of course, the power of AI does not come for free. Inferencing AI models (when the model generates an output) can become very expensive.

Some have been concerned that new AI-based search features could increase the average unit cost of each query far beyond whatever incremental monetization benefit was unlocked. If so, the average unit profitability of each query would fall, and so too would the aggregate profits of Alphabet, and its stock price would likely follow.

But Google – a world leader in technical infrastructure – has done an extraordinary job of reducing these new inferencing costs. According to the company, machine learning costs per query have been engineered down by more than 90% over the last 18 months.

In part, this is because Google is one of the rare companies that has the expertise to design their own AI chips, or TPUs as they’re named, which they can substantially optimize specifically for low-cost search workloads.

To be clear, search unit costs have increased structurally due to AI. It’s just that the increase is likely much smaller for Google than it is for its competition.

-

Scale of Google’s Search improving

We are also seeing evidence that AI is driving greater search intensity (or usage per user) and allowing Google Search to access more users around the world.

AI Overviews is not the only new AI-infused Search feature launched by Google lately. Others include Google Lens – an image-based search used for more than 20 billion visual searches per month. (You can, for example, upload a picture of a dress you’ve seen to find out where to buy it.)

Lens also has a new feature, Circle to Search, which allows you to search anything on your android phone, by circling, highlighting or tapping, without switching apps.

These new features appear to be driving a relatively higher ‘search usage’ per user. After the launch of Circle to Search, for example, Google has noticed that users are coming to Search more often for more of their information needs.

Image source: https://www.weetechsolution.com/blog/google-circle-to-search-introducing-ai-revolution-for-seamless-information-retrieval

With AI Overviews, users are asking more complex questions and exploring a wider range of websites. Google has also observed that an individual’s usage actually grows over time as people learn to adapt to that new behavior.

AI Overviews has already been rolled out to more than one billion users across more than 100 countries.

Alphabet CEO, Sundar Pichai, sees no technical or economic constraint to rolling this out more broadly around the world.

Given the extraordinary rate of deflation taking place in Google’s machine learning costs per query, this claim by Pichai seems very reasonable. This points to more people using Google’s Search products more frequently than otherwise imagined.

Barriers to entry in Search soar

While the future opportunity for Google in Search appears to be even larger today than it has ever been, it is still true that the costs of capturing this opportunity have skyrocketed (it’s just that the revenue opportunity is skyrocketing by even more).

But this is fantastic news for Google because the higher costs of delivering low-latency, high-efficacy, AI-infused Search at a global scale act as a near-insurmountable barrier to entry for would-be competitors.

The barriers to entry for Search were already sky high. Now they are going even higher.

It’s difficult to imagine any other business in the world that could economically deliver the Search experience that Google is delivering – with lots of new innovation and additional search features to come.

Owning business advantages

We see a bright future ahead for Alphabet, with Google Search a major contributor to company earnings for the foreseeable future. And importantly, we believe the market is significantly underestimating this future today.

At Montaka, we are focused on owning business advantages, not technologies per se.

Alphabet, and its subsidiary Google, are successfully using today’s new AI technologies to build and strengthen advantages in the world’s market for Search.

Andrew Macken is the Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100 or leave us a line at montaka.com/contact-us

Note: Montaka is invested in Alphabet.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stock picks. Click below to listen. Alternatively, click on this link: https://podcasters.spotify.com/pod/show/montaka