|

Getting your Trinity Audio player ready...

|

On 29th October Lufthansa (Xetra: LHA GR) reported the results of its fiscal third quarter. A strong summer travel season and low oil price helped Europe’s largest airline achieve underlying earnings of €1.7 billion for the first 9 months of 2015, an astounding 70% increase on the prior year, and management upgraded its full-year earnings forecast to almost €2 billion – a company record. Rather than signal the imminent ascent of Lufthansa’s stock price, this pleasing financial performance not only masks deep problems at Lufthansa, but has indeed contributed to them in recent weeks! Let’s see why this is the case…and why Lufthansa is an attractive short.

Earlier this year we intensively researched Air France-KLM, Europe’s second-largest airline, as a potential short and ultimately decided to include it in the Montaka Global Fund. We wrote in detail about this process in July.

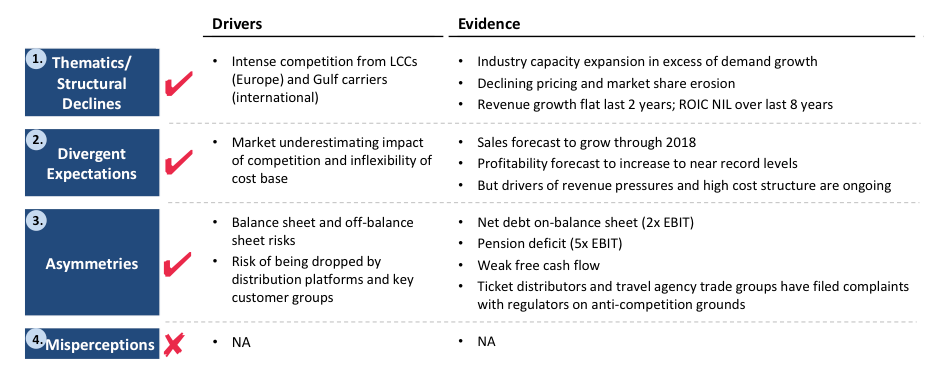

It is often the case that the research flight path of one particular stock opens our eyes to several other interesting routes – in this case, our work on Air France-KLM led us to Lufthansa. Armed with the knowledge of the European passenger airline market we quickly determined that Lufthansa met the criteria of three out of the four classifications that comprise the unique Montaka short framework as shown below. Despite robust earnings in 2015, we believe there is continued evidence for the key drivers of the short thesis.

Intense competition is ongoing. The Gulf carriers have expanded seat capacity by double-digit rates so far this year compared to around 3% for Lufthansa; low-cost carriers are moving into Lufthansa’s primary German airports as exemplified by Ryanair opening in Berlin – its 6th German base; Lufthansa’s ticket prices fell 3% in local currencies and management expects they will “fall again significantly” heading into 2016. Moreover, if one-time currency benefits are removed, Lufthansa’s year to date traffic revenue would have been down compared to 2014.

All the while the cost base is persistently high. Outside of fuel price and foreign exchange rate fluctuations, unit costs increased by 1%. Certainly, the 47% decline in oil prices has been the biggest help to Lufthansa’s earnings so far this year (and again next year according to management guidance) with a lower fuel bill accounting for €2 billion of incremental earnings. Said another way, without the benefit of cheaper oil Lufthansa would have reported earnings down by €1.3 billion! Unfortunately for Lufthansa oil prices and the Euro won’t fall forever. On the other hand, it appears that ticket prices almost will. We find it very unlikely that Lufthansa’s sales will continue to grow and company profitability remain at peak levels as reflected in market consensus expectations.

While the fundamentals for Lufthansa appear weak in the long term, the strength of earnings and cash flow in 2015 has emboldened management to speak about paying a dividend. The near term sweetness of a little cash in the hand could become extremely bitter longer term when the company may need to face up to its €2 billion-plus indebtedness, almost €7 billion of pension obligations and a cash drain from paying dividends.

Ironically, bonanza profits seem to have emboldened Lufthansa’s workers to go after their share, to the detriment of the company’s future financial performance. Throughout this year workers from pilots to cabin crew and ground staff had been asked by top management to accept lower wage increases and less attractive pension arrangements in order for Lufthansa to manage its unsustainably high costs and remain competitive. Then last week UFO, the union for cabin crew, determined Lufthansa’s proposal fell short of its demands and told its 19,000 members to strike for better terms – for a week. The lure of a €3,000 one-time payment, up from €2,000, and guaranteed wage rises for the next two years couldn’t get the attendants back to work. Nor could urgent court challenges by Lufthansa. The airline is looking at almost 5,000 flight cancellations and could lose more than €100 million.

We don’t expect the strikes to continue indefinitely. Indeed most flights will be back to normal operations over the weekend. Lufthansa will absorb the discrete losses and will also probably go ahead with its dividend plans. But the situation portends a dire future of rigid and rising labor costs, symptomatic of a large and powerful unionized workforce in a country that views airlines as more or less a public service. Lufthansa has already begun to re-evaluate the viability of certain routes in light of “yet unsolved structural cost problems”. And board member Karl Ulrich Garnadt summed it up as neatly as we ever could have:

“It is clear to us, that with this new concession, the urgent and necessary improvements in our cost and competitive position cannot be reached, and the gap between us and our relevant competitors will get larger.”

Montaka Global Fund holds a short position in Lufthansa.

![]() Christopher Demasi is a Senior Analyst with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.

Christopher Demasi is a Senior Analyst with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.