|

Getting your Trinity Audio player ready...

|

We believe it is virtually impossible to predict the size, shape and pattern of returns that markets will deliver in the future. At the same time, we believe that equity returns face significant headwinds over the coming decades compared to recent decades and consequently are likely (though not necessarily certain) to be much lower. It turns out that we may not be alone in our observations and conclusions according to a new report published by an affiliate of leading global management consulting firm McKinsey & Company

Avid readers of the private Montaka web portal will recall Andrew Macken reflecting on the key drivers of equity returns in his January post “A Low Returning Year Finishes – Has Another One Begun?”. In this article Andrew focussed our attention on the twin tailwinds for equity market returns over the past 30 years: falling interest rates coupled with expanding profit margins. Andrew concluded that the current backdrop of high valuations and peak profitability means that “we should not be surprised at all if future average equity returns were lower than they have been in recent history”.

Last week McKinsey Global Institute (MGI), the business and economic research arm of leading McKinsey & Company, published its own report concluding that “total returns from both stocks and bonds in the United States and Western Europe are likely to be substantially lower over the next 20 years than they were over the past three decades”. The report, suitably entitled “Diminishing Returns: Why Investors May Need to Lower Their Expectations” echoes our own caution to investors that robust returns from markets over an extended horizon will be difficult to achieve.

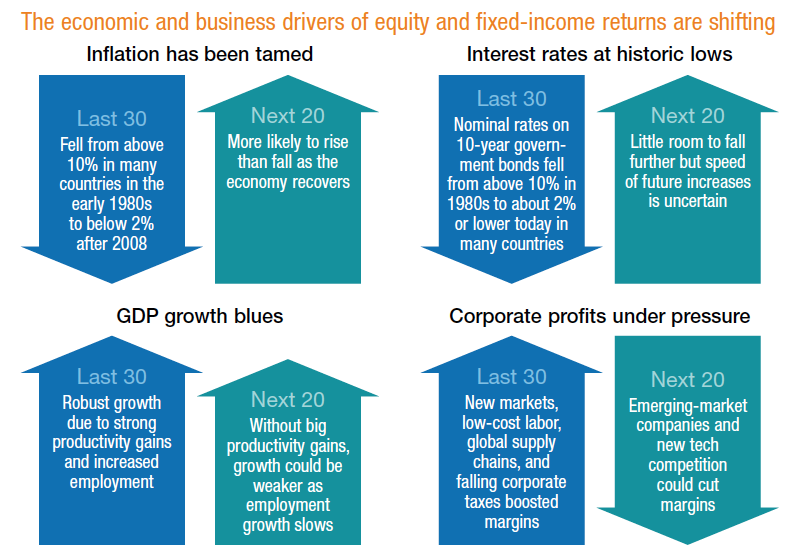

MGI’s reasoning rests on long run shifts in four key economic and business drivers of equity and fixed income returns. The trend of each these drivers of the previous 30 years and the outlook for each over the next 20 years is illustrated in the following chart extracted from the report.

Source: McKinsey Global Institute

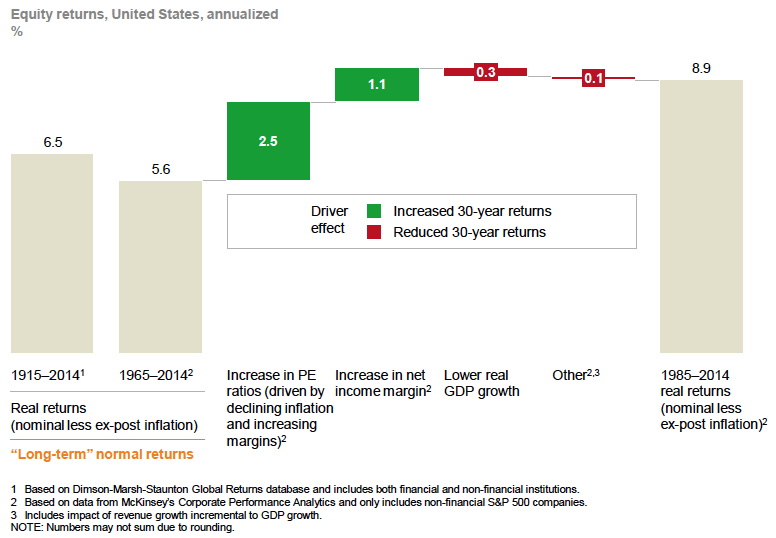

While MGI has chosen to look at returns through the lens of four drivers, it is interesting that just two drivers in particular were responsible for the strong performance in US equities over the past 30 years: rising valuations/falling interest rates and improved profitability. Over this period equity markets outperformed their half-century average by 3.3%, of which higher PE ratios contributed positively by 2.5 percentage points and higher earnings margins contributed positively by another 1.1 percentage points. The below chart shows this decomposition.

Source: McKinsey Global Institute

Looking forward MGI draws the conclusion that both the interest rate/valuation and profitability tailwinds that have propelled equity returns over the past 3 decades are not only running out of steam, but are set to reverse. Specifically, MGI believes that interest rates cannot fall much further when viewed in the context of a theoretical (and arguably practical) zero-bound, and in some geographies they are already rising. The report cites Japan and Europe as examples of economies with near-zero interest rates, while the US has resumed a cycle of rate hikes notwithstanding the baby steps it has taken.

MGI also foresees greater competition for businesses which will crimp profit margins. New competitors from emerging countries, disruptive tech-enabled platforms and indirectly the rise of small/medium business that piggy back off the scale of the digital disrupters will all act as headwinds to corporate profitability. Compounding the problem MGI believes that an ageing global population will act as an anchor on global economic growth.

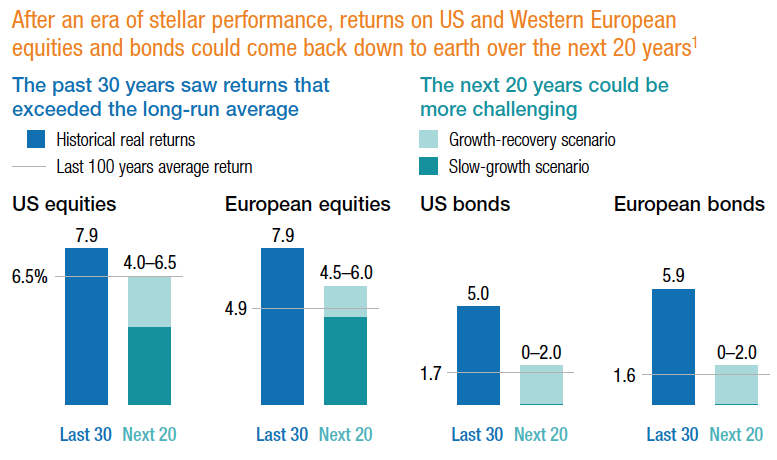

The result according to MGI is that investment returns will revert back to long-run average levels over the next 20 years should the world economy experience a growth recovery. This would mean average annual equity returns in the US and Europe of up to 6.5% and 6% respectively, compared to 7.9% per annum in both regions since 1985. However, if a slow growth scenario plays out across the world MGI believes investor expectations should be even more subdued. In this case the institute thinks that 4% and 4.5% annual returns are more reasonable. MGI’s predictions are summarised below.

In our view, lower expectations for market returns has two important corollaries. Firstly, lower exposure to the overall ebb and flow of financial assets is prudent and comes with lower opportunity cost. In a market environment where broad market returns (or “beta” in industry parlance) is limited, each dollar of an investor’s portfolio that is not invested in the market is not giving up much by way of potential return. The option value ascribed to cash holdings and short positions in stocks of deteriorating businesses is relatively greater.

Secondly, active management is key to generating strong investment performance. Passive management will guarantee the investor the low expected returns available in the market. This makes every additional unit of outperformance (or “alpha” in funds management jargon) proportionately more valuable. By way of example should equities as a group return say 5% in a year then every percentage point added by the active portfolio manager will improve an investor’s profit by 20% that year. Over a 20-year horizon where returns are compounded annually the result is even more stark. Over this stretch the market will turn $100 into $265, yielding a profit of $165. But the active manager who delivers an extra 1% each year to investors will turn $100 into $321, yielding a profit of $221 which is 33% higher than the market’s effort.

Against a backdrop of structural conditions that raise the likelihood for lower market returns over the long run, we believe Montaka is well positioned to provide investors superior investment outcomes. Montaka has significantly less market exposure than typical equity funds and has the opportunity to profit from deteriorating business with falling stock prices. These attributes serve to reduce risk and generate increasingly valuable additional returns.

![]() Christopher Demasi is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.

Christopher Demasi is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.