|

Getting your Trinity Audio player ready...

|

Decision making is a fundamental skill that every person performs, the quality of these decisions is what differentiates us. Fortunately, most decisions we make have well established cause-and-effect relationships that have become first nature tenants of our daily routine. For example: if I don’t shower I will smell bad; if I don’t wear warm clothes in winter I will get cold; and if I step in front of a speeding bus it might be the last decision I ever make.

These examples are fairly “non-controversial” actions-and-effects which I will call the “consensus view”, however there are people that will disagree. For example: I don’t need to shower because I don’t sweat, so won’t smell bad; I don’t get cold so I don’t need warm clothes; and If I step in front of a speeding bus, it will stop before it hits me. Let’s call these views the “non-consensus view”.

Which brings us to our topic of discussion, variant perception.

A variant perception is a strongly held view that is substantially different to the consensus view. So from our example in the prior paragraph, someone holding the view that they can step in front of a speeding bus and survive, would hold a variant perception and non-consensus view, however that does NOT make it right. This is the complexity of investing, in order to outperform the market an investor has to hold a non-consensus views that is correct, it’s not good enough just to be different, you also have to be correct and have the conviction to act on that belief.

Billionaire founder of Oaktree Capital, Howard Marks elegantly articulates this concept in his book, “The Most Important Thing: Uncommon Sense for The Thoughtful Investor” (which I recommend to every reader):

“The problem is that extraordinary performance comes only from correct non-consensus forecasts, but non-consensus forecasts are hard to make, hard to make correctly and hard to act on” – Howard Marks

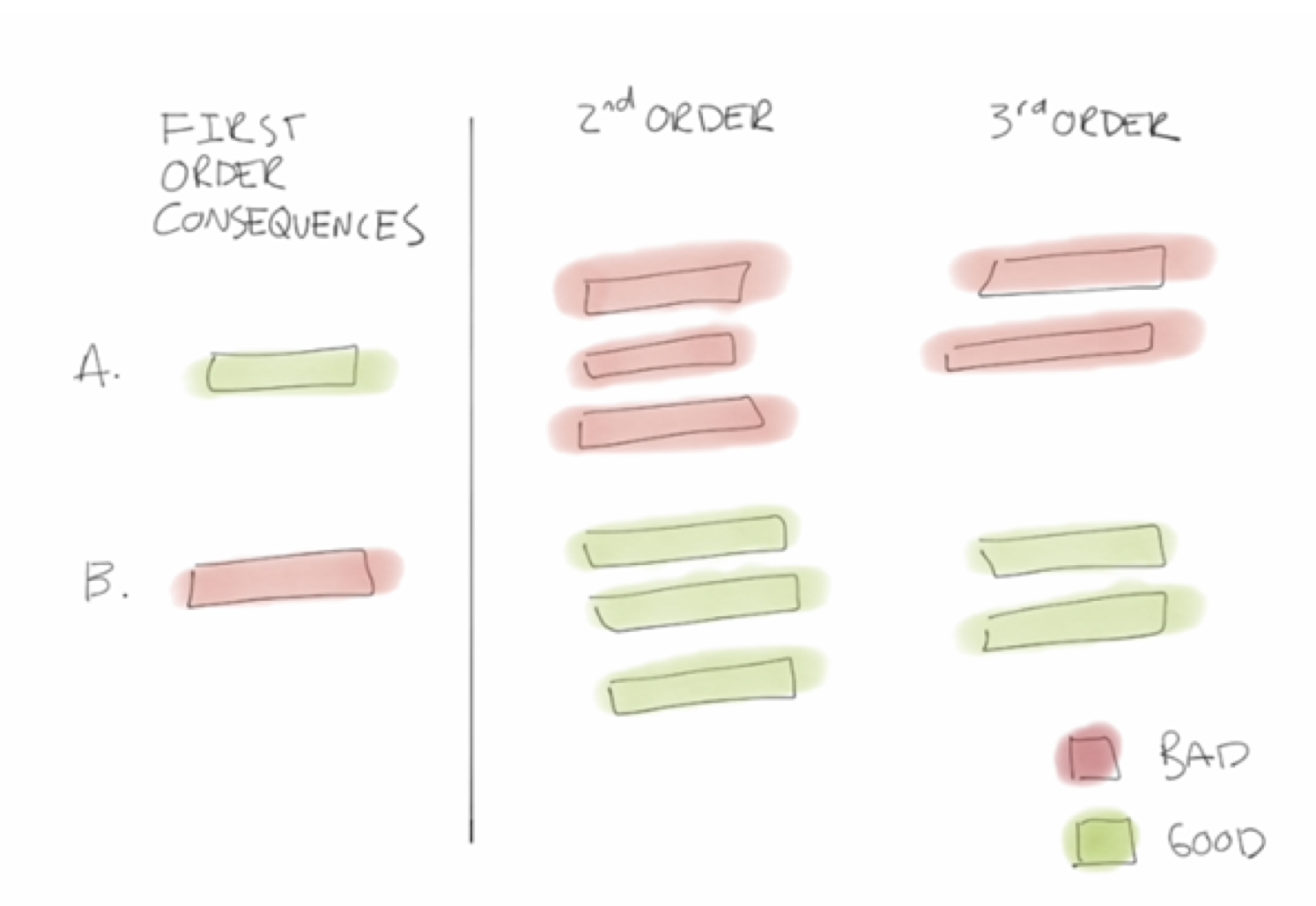

Essentially, the framework for seeking a variant perception boils down to separating “first-order” thinking from “second-order” thinking. First-order thinkers look for perspectives that are simple, easy, and defensible. While this generally works in our daily routines, it fails miserably when looking at complex systems (which I have discussed previously on this blog (Complex Systems: Part 1and Part 2.

In fact first-order thinking will fail to identify a complex system even exists, or if it does, it will make the wrong cause-and-effect linkages (like stepping in front of a bus). It is usually incapable of moving to second-order thought, and more fundamentally, unaware of the need to think in these terms to navigate the system successfully. Second-order thinking takes a lot of work and involves thinking in terms of systems, interactions and time. While this framework when applied to financial markets, companies and industries can get very complicated, so I have [over] simplified it into an analogy. Assume you are late for a very important event (wedding, birth of a child, job interview, etc) and you need to cross the road but a speeding bus is approaching. You can either step in front of it, or wait for it to pass. A first-order thinker would dash across the road in order to get to the event 20 seconds earlier than having waited for it to pass (that’s the upside). In the event the bus hits then, not only will they miss the event, but probably they may never attend another event again (downside). Viewed like this, the upside / downside of first and second order thinking becomes evident and the team at Montaka Global performs this exercise (vastly more rigorously) on every stock we buy or sell in the portfolio.

One of the most famous variant perceptions in history was the “round Earth” theory, which contradicted the widely held consensus view, that the Earth was flat. Additionally, this view (“flat Earth”) was blessed by the Church and by extension God, so challenging such a accepted fact was not only met with extreme ridicule and also came with a great deal of danger as devout followers of the Church interpreted it as blasphemy. That however did not stop Portuguese explorer, Ferninand Megellan (1480 – 1521) from making the highly astute observation, grounded with a second-order perspective (i.e. the shadow on the moon) and challenge a the widely held consensus view that the world was flat.

“The Church says the Earth is flat, but I know that it is round, for I have seen the shadow of the moon, and I have more faith in a shadow than in the Church” – Ferninand Megellan

We at Montaka are hyper focused on identifying stock market “flat Earth” beliefs while avoiding stepping in front of a speeding bus, as we responsibly steward your capital through all types of markets.

Amit Nath is a Senior Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Amit Nath is a Senior Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.