|

Getting your Trinity Audio player ready...

|

– Lachlan Mackay

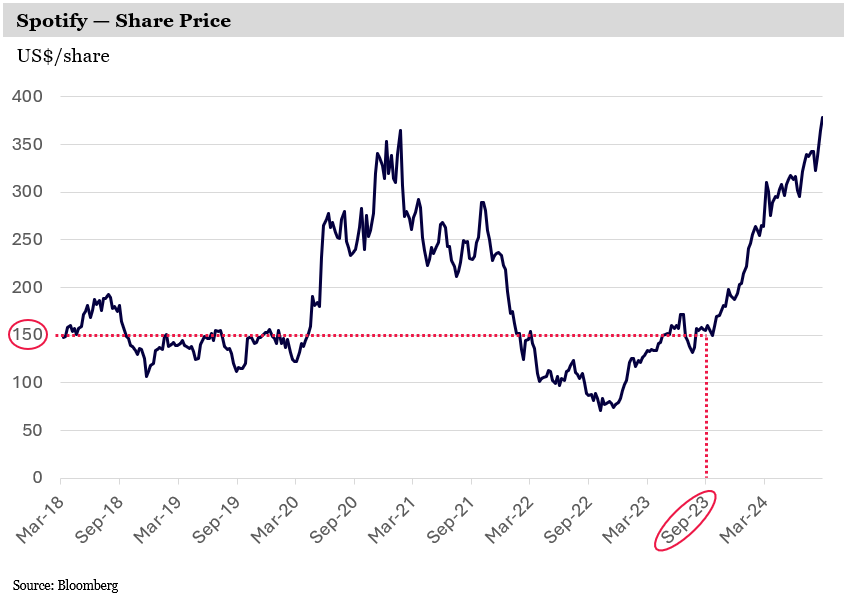

In September of last year, after Spotify’s share price had quickly doubled, we discussed the company’s ongoing underlying strength.

Since then, it’s jumped another 2.5x.

We were outspoken fans of Spotify, but it’s clear now that even we were underappreciating the business’ potential.

At the time, we estimated that in Q3 of 2024 Spotify could realise around €800 million of total annualised operating income compared to consensus estimates at the time of €200 million.

Spotify just guided to Q3 operating income of €1.6 billion, blowing our estimate out of the water and even beating the latest consensus numbers by 36%.

Investors are slowly shaking off the poorly founded belief that Spotify offers a “commodity” music product where price is dictated by the major labels.

So what is driving this incredible outperformance?

1. The ad-supported funnel: A gateway to Premium growth

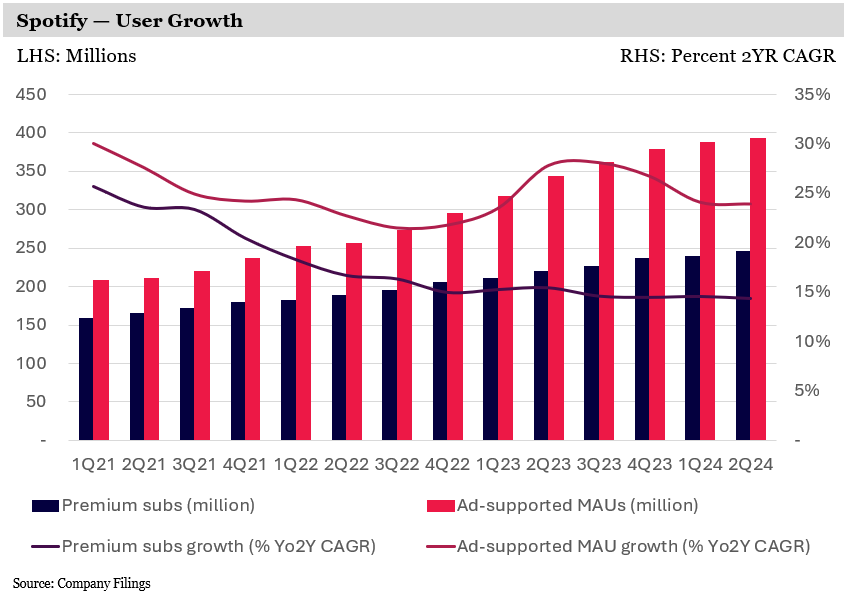

Firstly, Spotify has built a massive top-of-funnel user base which ensures a steady stream of future Premium subscribers, creating a growth engine for years to come.

Spotify’s free, ad-supported tier of 393 million people serves as their most effective channel to grow Premium subscribers. Much like a trial period, the more Spotify’s free users spend listening, the more they discover, as Spotify’s increasingly personalised algorithms enhance their experience.

Product enhancements in recent years have accelerated growth of Spotify’s free, ad-supported base. Yet Spotify has managed to maintain their strong conversion rates to Premium on this much larger base.

Spotify’s Premium subscribers have expanded by 31% from two years ago to 246 million globally, with new and existing subscribers continuing to see value despite multiple price increases. Meanwhile, Spotify’s ad-supported base has expanded by 54% over the same period.

2. Price hikes without pain: The magic of minimal churn

A year ago, we were excited about Spotify’s first US price increase in 12 years. We were confident their product was strong enough to retain its industry-low churn rate.

Spotify has since doubled down, rolling out another $1 per month price increase across the US and abroad. Yet is has maintained minimal churn, underscoring the value of the product to their deeply loyal user base. This has accelerated year-over-year growth in Premium subscription revenue to more than 20% over the past three quarters, with no sign of slowing down.

Spotify’s original music offering has been mixed and matched to every user’s individual taste over the past 15 years, creating a sticky base of data-driven insight and user experience that is near-impossible to replicate. The addition of 250,000 audiobooks and 6 million podcasts only bolsters this value, making the platform even more essential to its users’ daily lives.

Spotify’s US$11.99 Individual plan includes music, audiobooks and podcasts. To access an equivalent set of subscriptions without Spotify it would cost individuals around US$26 per month. So subscribers are getting more than double the value!

3. Gross margin inflection: Bundling is a win-win-win

Spotify’s gross margin has always largely been a function of their mechanical royalty payouts to artists, totalling over $9 billion in 2023.

With the recent addition of audiobooks to create a ‘bundled’ subscription, Spotify will now split this payout with musicians and authors, changing the calculation and their relationship with the major music labels.

For years, Spotify was wrongly criticised for being a ‘price taker’ selling a commoditised service. As Spotify fought to compete with giants such as Apple, Amazon and YouTube, major music labels had the power to command majority royalty share over streaming revenues.

Spotify proudly continued to pay artists the same high rate while investing for the long-term – improving their product offering with the cash flows that remained.

We identified that the negotiating leverage with music labels appeared to flip in Spotify’s favour in 2023. This leverage was further solidified in 2024 with their audiobook bundling strategy. Shareholders are now the beneficiaries as Q2 gross profits grew 47% year-over-year, with margins expanding by over 500 basis points.

But how was this possible?

The irony of competing with the biggest tech companies in the world is that music streaming is less important to their businesses. That leaves Spotify in a league of their own to partner with stakeholders, hire passionate engineers, and connect artists to their biggest fans.

Spotify is now the undisputed leader in global music streaming, with about 36% market share in the US. More importantly, though, Spotify has a near-monopoly on the most loyal segments of many artists’ fan bases. Major labels understand this better than anyone.

In 2023, as the post-pandemic boom in live music had normalised, labels became reliant on streaming again to continue growing organically. Within a year, Spotify has:

- Raised prices to grow the music industry revenue pie;

- Renegotiated deals with labels that have expanded revenue from Marketplace, which has become necessary for labels to promote artists directly to fans and historically the major driver of Spotify’s gross margin expansion;

- Added audiobooks to their platform, re-categorising their service as a ‘bundled’ subscription.

In the US, a ‘bundled’ subscription such as Spotify’s must split their licensing payout between the two services – music and audiobooks – at the relevant royalty rate. Given Spotify believe audiobooks will be a 40% gross margin business at scale, we can infer the royalty rate is less than 60%, compared to around 70% in music. This should deliver another step change in gross margins for the coming year, which we believe the market is still underappreciating.

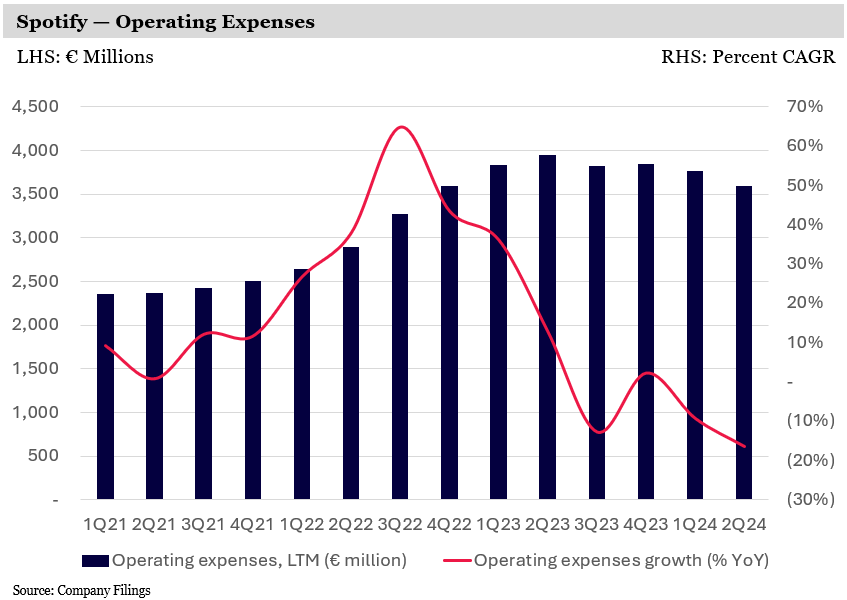

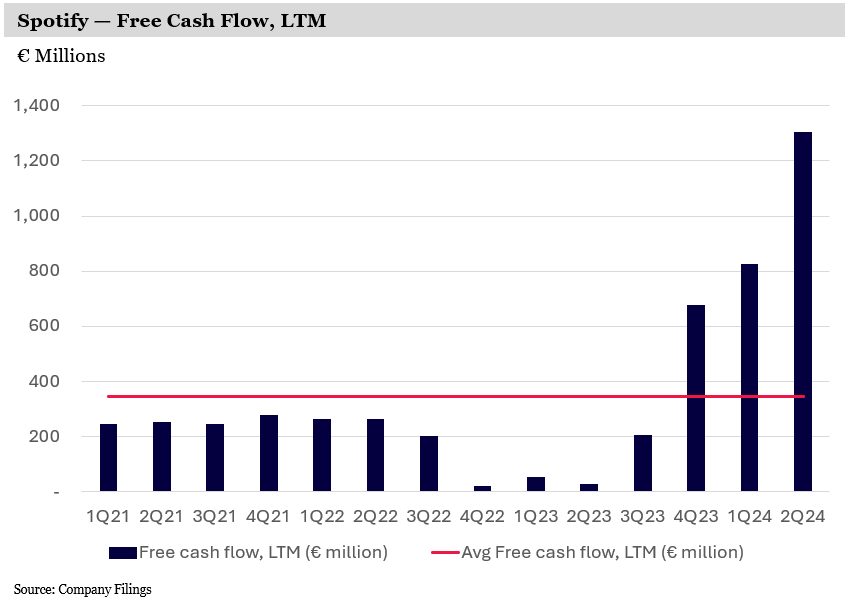

4. Aggressive cost controls: Becoming a free cash flow machine

A year ago, Spotify was in the process of a major efficiency drive. The company ‘right sized’ their workforce and real estate footprint, optimised their marketing spend, renegotiated marquee contracts with podcasters, and digested a one-off increase in music royalty payouts.

Spotify has continued this drive, becoming even leaner and more focused. Despite their rapidly expanding business, including adding audiobooks and video content to the platform, operating expenses have fallen for over 12 months.

Spotify’s operating losses of 2023 and prior have inflected into significant profits. Their guided €405 million profit for the current Q3 is already almost triple their Q1 profit!

Given the capex-light nature of Spotify’s software model, this is resulting in previously unforeseen free cash flow generation, giving the company ample flexibility to finance its future growth ambitions and reward shareholders.

The Best is Yet to Come

Whilst the recent stock price growth is undeniable, the market is still playing catch-up as Spotify’s value proposition increases.

Three more things on the horizon will power the next legs of Spotify’s growth:

1. The deluxe tier: Super-premium for super-users

Spotify has announced plans for a ‘deluxe’ premium tier with higher sound quality, more advanced controls, and exclusive features that could include early access to tickets and new music. This will likely be priced at $17–$18 per month. Universal Music Group estimates that 20% of Premium subscribers in developed markets will be willing to upgrade, which would add incremental revenue of up to €2 billion.

But beyond that, Spotify’s leverage to expand incremental gross margins applies here too. Spotify will likely negotiate more favourable terms with record labels and scale other costs of revenue across a larger revenue base, improving profitability while delivering unparalleled value to consumers.

2. New verticals: Audiobooks to video, concerts, education and beyond

Spotify’s investment in audiobooks is just the beginning.

In the first two weeks of launching, over 25% of Spotify users had already begun listening to audiobooks, adding 2.5 hours each of incremental engagement on the platform.

Audiobooks are an untapped market for many users and a logical extension of their podcast ecosystem. Spotify’s ability to bundle audiobooks alongside music and podcasts in one subscription package offers a unique advantage over competitors such as Audible that charge per book.

But it doesn’t stop there. Increasingly, Spotify’s podcasts feature video content alongside the audio, just as music includes lyrics and music videos. This is unlocking even deeper engagement and advertising monetisation opportunities.

Likewise, when podcasters were allowed to add a paywall in front of their premium content a few years ago, many created educational courses such as how to become a DJ or play the guitar. Spotify took notice and added the tools to create a more optimal education offering, which is now being trialled in the UK.

Most importantly, Spotify is the key connection point for artists to market their concerts and other live events directly to their biggest fans. The opportunity to connect artists with fans more directly remains a unique opportunity for Spotify with untapped potential.

3. The age of AI: Personalisation at scale

In the age of AI, Spotify holds a privileged position atop the world’s history of music and podcast streaming data. Understanding this, Spotify have always sought to leverage their advantage by employing a data-driven approach to innovation.

Their recommendation algorithms have used fundamental machine learning techniques for over a decade, the same techniques that have made AI so popular more recently. AI-generated playlists, personalised recommendations, and automated ad campaigns are just the beginning.

Spotify is leveraging its impenetrable data advantage by applying Large Language Models (LLMs). For users, this makes the platform smarter, more intuitive and personalised, all in real-time and across different languages.

For advertisers, this means better targeting, content generation and more efficient ad spends, for both audio and video. This in turn makes Spotify’s programmatic advertising offerings even more attractive and adds to a seamless user experience.

1 billion in sight

Spotify’s trajectory is the perfect example of a flywheel business. A year ago, we could appreciate it spinning a little faster, benefiting all stakeholders. But as flywheels do, it has only accelerated from there. Spotify has improved their user experience, delivered multiple new ways for creators (and shareholders) to monetise and are now 75 million closer to Founder-CEO Daniel Ek’s 2030 target of 1 billion listeners.

Spotify exhibit many of the ideal qualities we seek in an investment: an entrenched leadership position in an attractive market, easily misunderstood by investors, and an outlier-like upside scenario that becomes increasingly likely as they execute over the long-term.

We remain highly confident in Spotify as global leaders in data and AI, driving the music industry and broader audio ecosystem forward into the future.

Note: Montaka is invested in Spotify.

Tech is dead? Think again. Montaka’s new white paper argues that far from dying, tech is entering a remarkable new era of growth with huge opportunities for investors.

To request a copy of the full whitepaper & know the top 5 stocks poised to lead the tech recovery, please share your details with us: