|

Getting your Trinity Audio player ready...

|

– Andrew Macken

As a young analyst at Columbia University, I studied one of the most famous business case studies in corporate strategy.

In 1985, frustrated by decades of competition with Pepsi, Coca-Cola launched a reformulation of the world’s most popular soft drink: New Coke.

In a drastic move, the company pulled the original Coke from the market.

It was a disaster.

New Coke triggered a consumer uproar, forcing Coke to reverse its decision a few months later and bring back the original formula.

But there was a silver-lining for Coca-Cola: in New Coke, which the company continued to produce, they quickly realized they had a product popular with younger/sweeter segment of the soft drink market, a market to which Pepsi was disproportionately exposed.

As corporate strategy experts, Judd Kahn and Bruce Greenwald, outlined in their foundational book, Competition Demystified, New Coke could be used as an ‘attack’ brand in markets where Pepsi was dominant.

Last month, Microsoft announced the launch of their new AI-powered Bing search engine and Edge web browser.

(The AI here, of course, comes from OpenAI, owner of the viral large-language model ChatGPT, in which Microsoft is a major investor.)

Microsoft’s ‘search war’ immediately reminded me of the famous ‘cola wars’ of the 1980s. Today, it seems that financial history, while not repeating, may well be rhyming.

While Microsoft’s seemingly aggressive move appears to be about web search, it is likely about much more than this. I believe it is about forcing Alphabet, owner of Google, to help accelerate the proliferation of AI further into everyday life.

If successful, one of the biggest winners from this proliferation will be Microsoft (along with fellow ‘hyperscalers’ Alphabet, Amazon and Meta) because it can sell more of the cloud computing and enterprise software that are needed to power AI.

Our thesis is further evidence that, as we outline in our new white paper, Why Reports of Tech’s Death are Greatly Exaggerated, the market is still significantly undervaluing the massive potential and upside of big tech companies, particularly from the looming AI-driven boom in cloud computing services.

Microsoft’s asymmetric weapon against Google

At first glance, incorporating ChatGPT into search-based applications seems logical – and even inevitable.

But why hasn’t Alphabet already incorporated their own large-language models (which are likely even more powerful than OpenAI’s) into their search products?

Firstly, large language models are currently prohibitively expensive to run for Google because it services nearly 9 billion queries per day. And secondly, such a drastic change may also reduce user time or screen space dedicated to advertising. The combination would surely lead to reduced Google profits, at least in the short term.

There are, of course, important differences between Alphabet and Microsoft. Alphabet’s Google has nearly 90% of the global search market, while Microsoft’s Bing’s share is in the single digits. Search drives the lion’s share of Alphabet’s earnings today; its contribution to Microsoft’s earnings is relatively insignificant.

Mutually assured destruction, or peace?

It begs the question, why is Microsoft – a US$2 trillion enterprise – picking a fight with Alphabet, which is around two-thirds its value?

Both are dominating very large, structurally growing (and in some cases, overlapping) markets, with very high barriers to entry. Both are oligopolists in these markets, meaning competition is more limited than usual.

Surely a strategy of ‘cooperation’ or ‘peaceful coexistence’ would be more profitable, would it not?

So what is Microsoft playing at?

Microsoft’s AI-enabled search tools – just like New Coke became for Coca-Cola – could be viewed as an ‘attack’ weapon.

Microsoft CEO, Satya Nadella, has already referred to this new competitive offensive against Google as “asymmetric”. That is, it could impact Google’s core business significantly, while leaving Microsoft’s core businesses unscathed.

But Microsoft also appears to be playing a longer-term, more sophisticated game. It is using its search war to spark Alphabet, arguable the world’s leader in AI, to accelerate its ‘productization’ of AI. The time has come, in Microsoft’s view, to experiment with AI less and ship actual product more.

Microsoft’s likely ultimate goal is to get consumer and employees to demand – and even expect – magical AI capabilities in almost all software applications of its own, and its competitors.

That would be commercial ‘nirvana’ for Microsoft.

Why?

Because the more AI is used, the more cloud computing and enterprise software Microsoft can sell.

Accelerating AI proliferation

Not all investors realise that it is the hyperscaler’s cloud services where they will make huge returns from the AI boom.

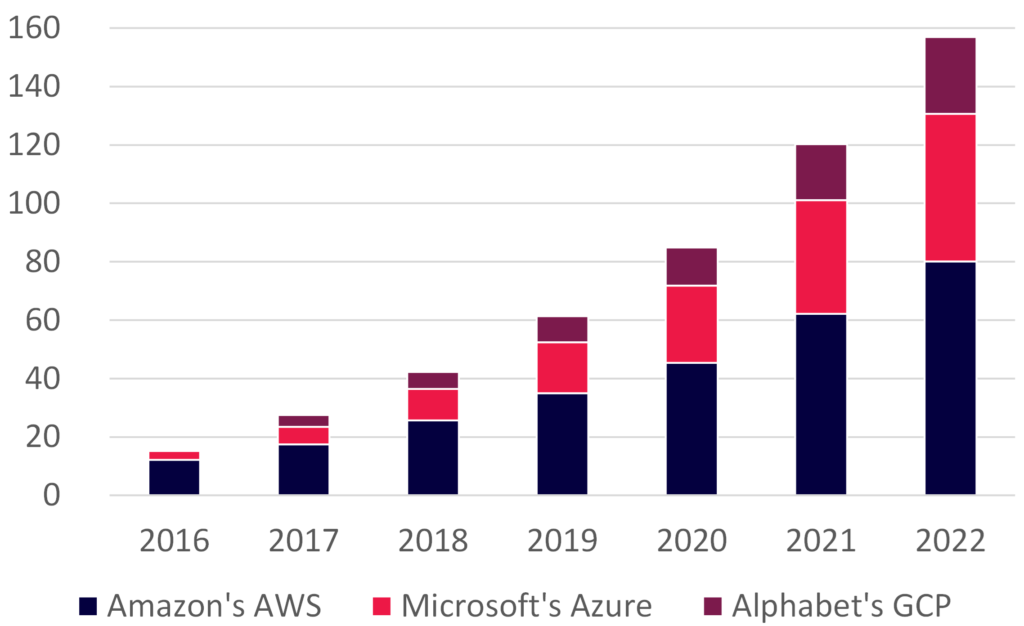

As we outline in Why epoch-defining AI is today’s most important investment theme, the giant ‘hyperscalers, Microsoft, Alphabet (Google) and Amazon lead the world in the core ingredient needed for AI model training and inferencing: cloud and distributed computing services.

As AI penetrates increasing swathes of the economy, these businesses will grow their cloud computing revenues exponentially and at above-average levels of profitability.

That’s why Microsoft is so keen to do everything it can – including pick a search fight with Google – to accelerate the proliferation of AI into more and more parts of our lives and in more and more businesses.

Western Hyperscaler Cloud Revenues, US$B p.a.

Source: Company Filings, Montaka Estimates

Cloud revenues are already enormous for the western hyperscalers, and yet, remarkably, we are only at the ‘tip of the AI iceberg’ today.

A peace of a larger pie (pun intended)

In the short term, Microsoft’s ‘search war’ will surely be viewed as irrational and noncooperative by the folks at Alphabet. And some pain may well be on the horizon.

But Microsoft’s true longer-term goal, we believe, is to drastically accelerate the penetration and adoption of AI into the broader economy as quickly as possible.

The benefits of this AI transformation will likely make the size of the pie much bigger for all incumbent players – including Alphabet.

Microsoft’s Satya Nadella said that he hopes Google will “come out and show that they can dance”. “And I want people to know that we made them dance, and I think that’ll be a great day,” he said.

This was, of course, the final learning of the ‘Cola wars’. As Kahn and Greenwald astutely point out, upon developing an asymmetric weapon against Pepsi, Coca-Cola was able to effect a ‘peace’ with Pepsi after decades of intense competition. Industry profit margins almost doubled in the subsequent years as a result.

If Microsoft can effect an acceleration of large-scale AI proliferation then Satya Nadella will be right: it’ll be a great day, both for Microsoft, and its investors.

To request a copy of our latest whitepaper & know the top 5 stocks poised to lead the tech recovery, please share your details with us:

Note:

Montaka is invested in Microsoft, Alphabet (Google) and Amazon.