|

Getting your Trinity Audio player ready...

|

Aren’t equity markets efficient? The short answer is no. And thank goodness for that – for your author would need to find a different job. By efficient, we are talking about the extent to which “price” and “value” are the same thing. We believe that price and value are two different things and can often deviate from each other over the short and medium term. By identifying these deviations, we can buy and sell mispriced stocks to generate “alpha”, or value-add over and above the average risk-adjusted market returns.

In January this year, Citi published an interesting quantitative analysis on the accuracy of sell-side consensus forecasts, titled: “What Works in Equity Markets”. Consensus forecasts for key business value drivers, such as sales and earnings, are significant drivers of stock price levels. If these forecasts were highly-accurate, the market would be highly-efficient; and, therefore, the opportunity for high-quality active management strategies to deliver outperformance would be small.

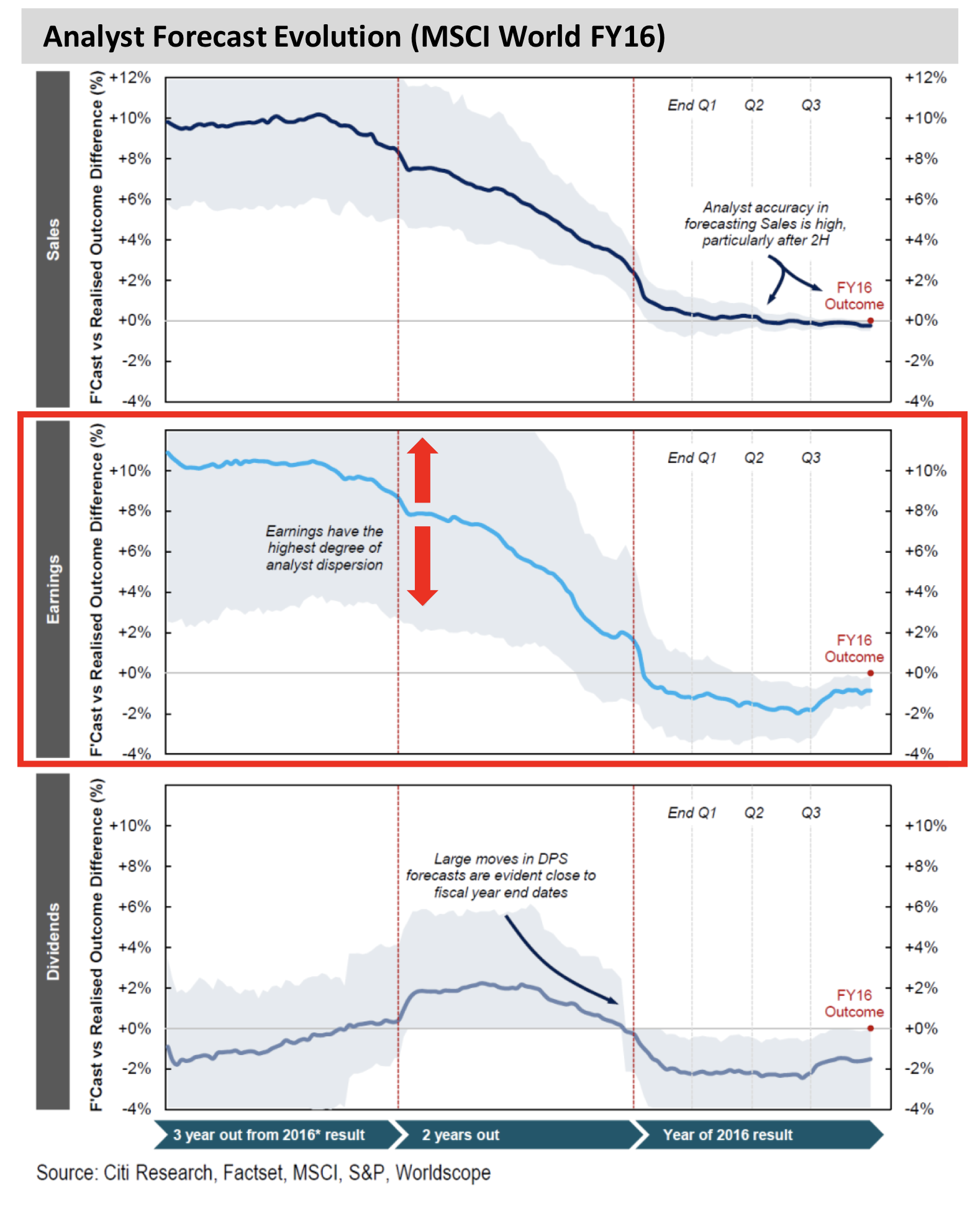

On the chart below, the range of sell-side analyst forecasts are shown for sales, earnings and dividends; three years prior, two years prior and one year prior to the true number being published. As can be clearly observed, two and three year forecasts have significant dispersion – that is, the spread between the highest and lowest forecasts is wide. And for earnings forecasts in particular, this spread is at its widest.

The fact that earnings are not easy to forecast is actually good news for active investors. Inaccurate forecasts create mispriced stocks. And mispriced stocks are the most primary ingredient into successful active management.

Furthermore, Citi’s analysis demonstrates that earnings forecasts typically skew more to the optimistic side, than the pessimistic side. This is not particularly surprising, frankly. There are two basic reasons for this: (i) humans are typically hardwired to be optimistic; and (ii) many sell-side analysts work for institutions that seek to do business with the companies being researched. Therefore, positive reviews can only be helpful for future business prospects.

Overly optimistic earnings forecasts naturally lead to more negative surprises – which often leads to stock price declines. Here is an argument for investors to hold some short exposure in their portfolios, in addition to long exposure.

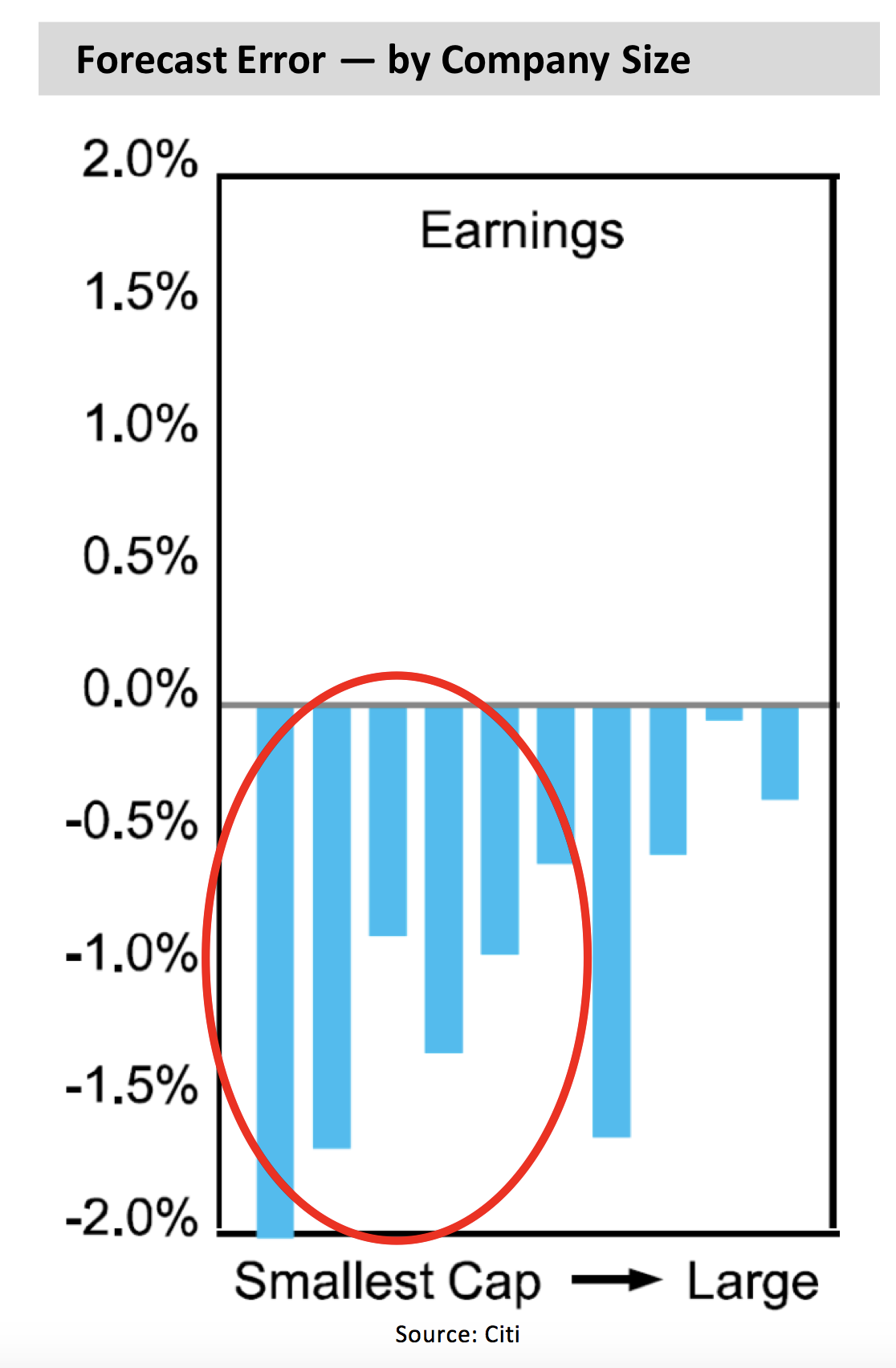

And, as illustrated by the chart above, the degree of forecast error (the difference between consensus expectations and reality) tends to be larger for smaller sized business, and smaller for larger sized businesses.

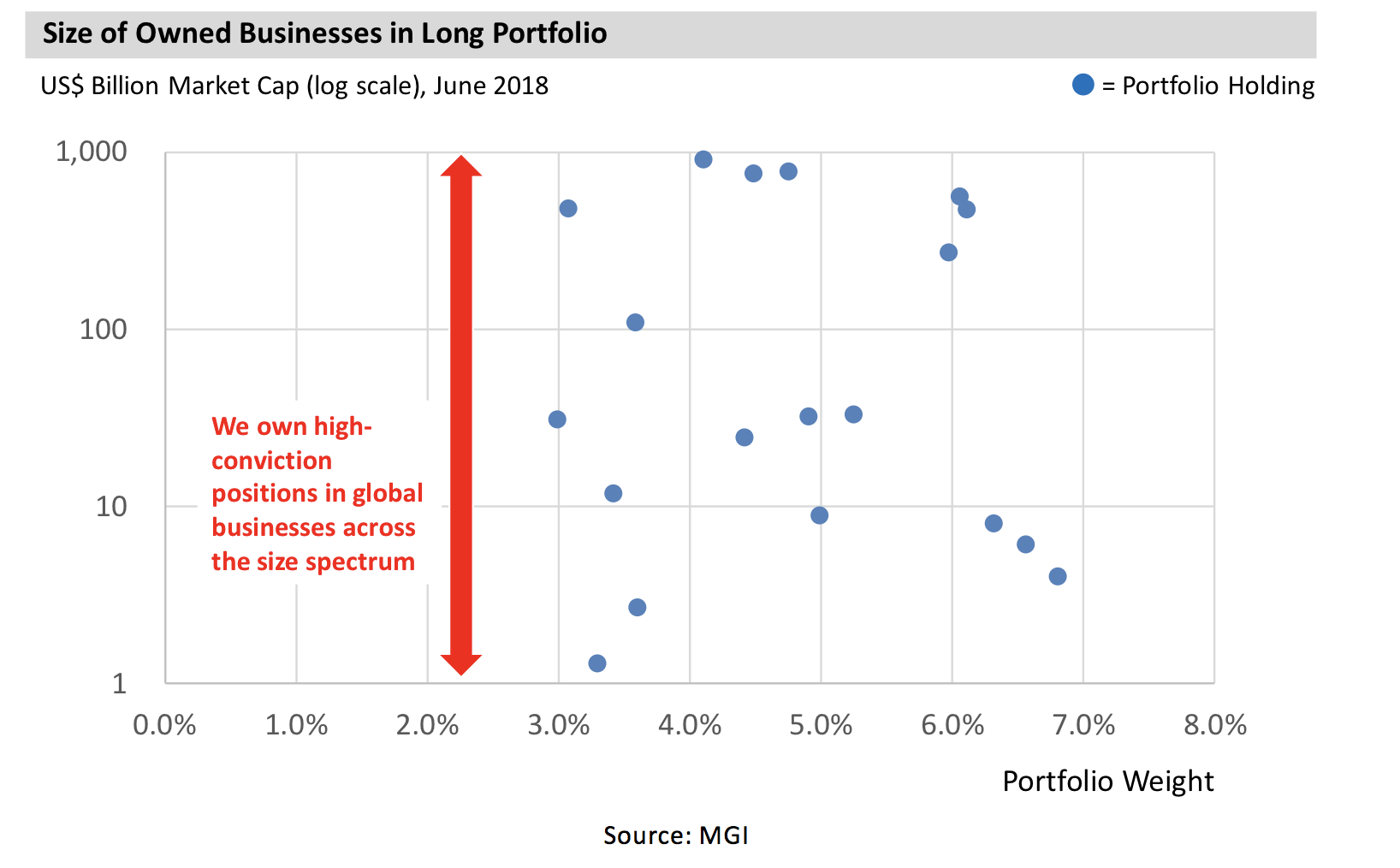

This analysis supports the case for the all-cap approach Montaka pursues. As illustrated by the chart below, Montaka owns high-quality global businesses of all sizes – with our top three holdings in businesses in the single-digit US dollar billions. One’s ability to identify a large number of significant mispricings amongst large-caps only will be limited, according to Citi’s analysis above.

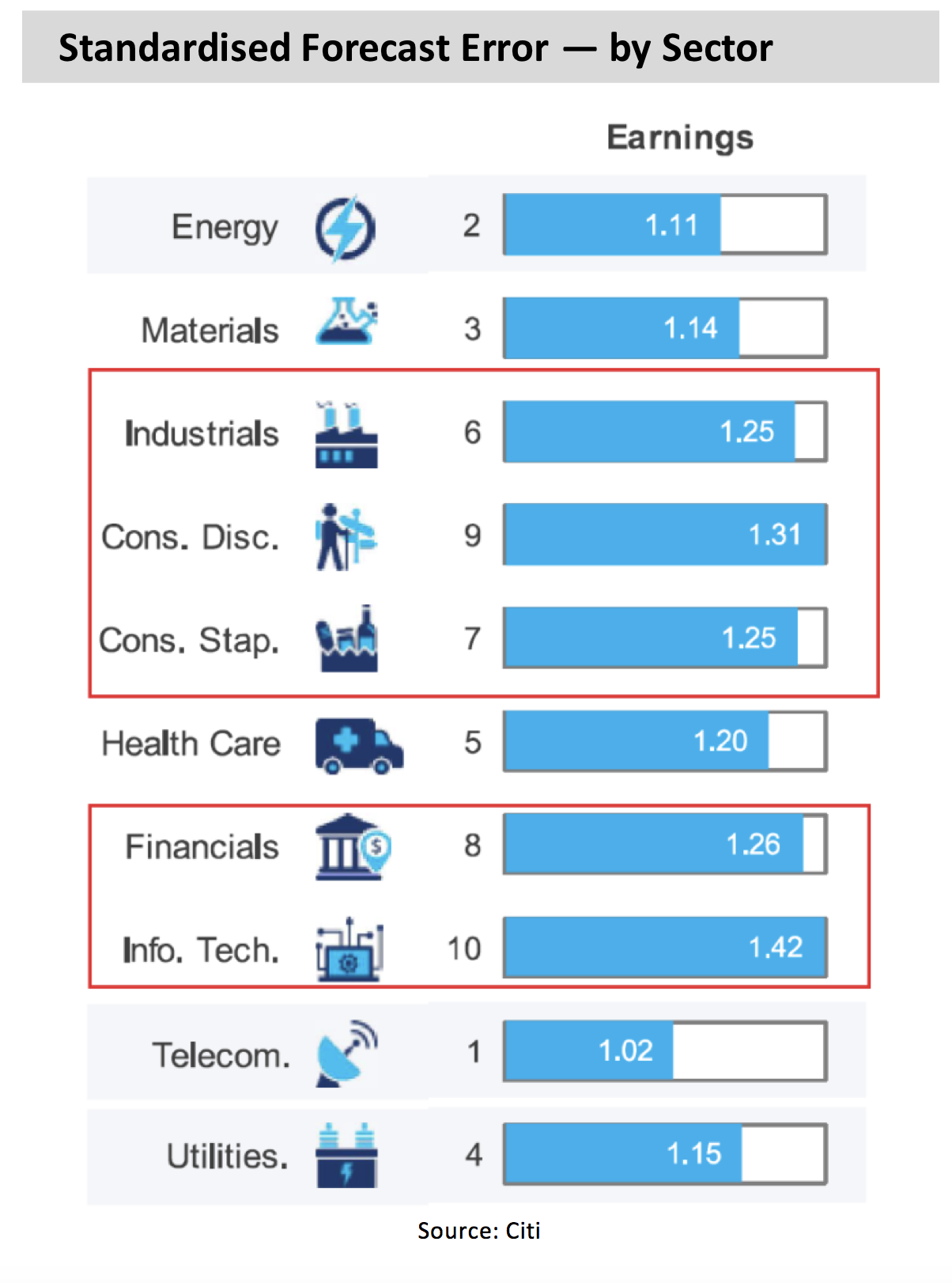

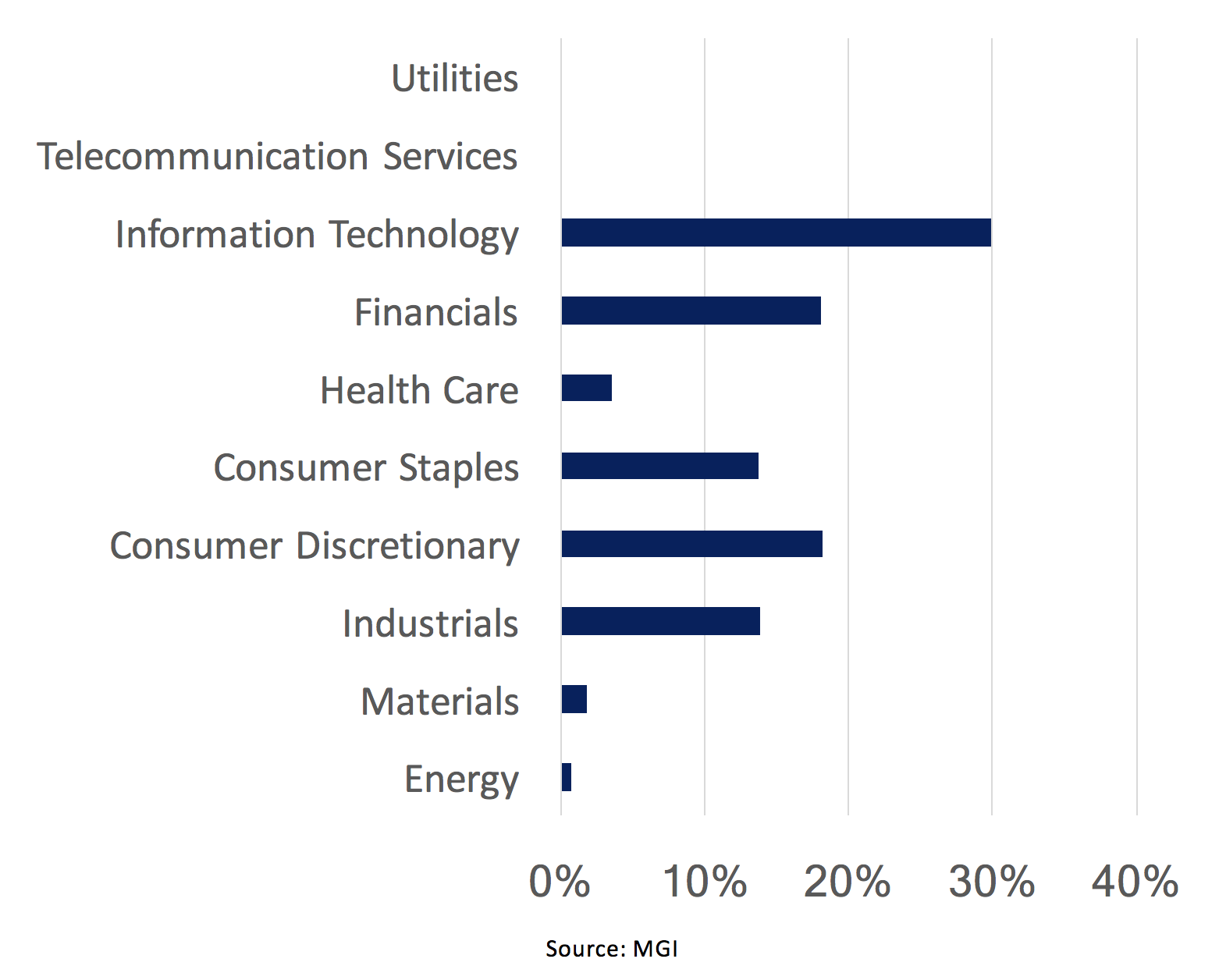

Finally, when it comes to the industries that carry the highest degree of forecast error (and therefore, the highest probabilities of stock mispricings), the top five according to Citi are: Information Technology, Consumer Discretionary, Financials, Consumer Staples and Industrials, as shown below.

Interestingly, the output of Montaka’s investment process yields a similar set of exposures. As shown by the chart below, these five most prospective sectors account for more than 90% of Montaka’s gross exposure, as of June 30, 2018. This was not by design but an interesting output of our process that is consistent with Citi’s quantitative analysis on where mispricings are most likely to be found.

Montaka – Share of Gross Exposure (% of NAV, June 30 2018)

The Montaka research team spends all day, every day, trying to buy a dollar for fifty cents. This is value investing, as defined by Ben Graham back in the 1920s. As was the case then, and is still today, the fundamental premise for value investing is that a stock’s “price” and its “value” are two different things and can deviate from each other.

The analysis above shows how sell-side analyst forecasts for key value drivers, such as earnings, carry with them significant error – especially amongst small companies and in sectors like Information Technology, Consumer Discretionary and Financials. This forecast error is the source of Montaka’s opportunity. Forecast error leads to mispriced stocks. And mispriced stocks are the primary ingredient to strong Montaka performance.

Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.