|

Getting your Trinity Audio player ready...

|

-Andrew Macken

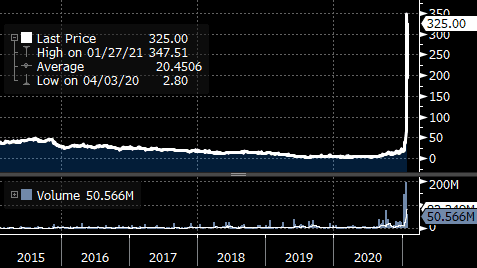

The world of single-stock short selling will never be the same again. In the month of January, 2021, the publicly listed equity of videogame retailer, GameStop (NYSE: GME), a highly-shorted business arguably in structural decline, increased by more than 1,600%, from $19 to $325 per share.

GameStop stock price (US$/share)

Source: Bloomberg

And this was not the only highly-shorted stock that increased by multiples over the month. Stocks including AMC Entertainment and BlackBerry increased by more than four times.

The financial consequences for many top global hedge funds were severe. Monthly declines as high as 50 percent characterised some of the world’s most prestigious investment firms who were short .

What happened?

What happened can only be described as the world’s largest short squeeze, inspired and coordinated on social media channels, such as Reddit and Twitter.

More specifically, GameStop was one of a number of stocks identified on Reddit as being highly-susceptible to a short-squeeze. It was already highly-shorted (reflecting the view by many investors that the business was in structural decline and overvalued); the underlying company size was relatively small and the stock had limited trading volume – enabling excess buying of the stock to move the price in a disproportionate way; and options on the stock were available to buy (more on this below).

Now, while investment and trading tips and perspectives are exchanged online all the time, the stocks identified above, and GameStop in particular, went viral and were promoted by a number of widely-followed instigators.

Followers were given the “encouragement” to buy call options on GameStop. A call option is simply a contract that gives the owner the right to buy the underlying stock at a predetermined price before a defined expiry date. If over this period, the stock price goes above the predetermined price, then the difference between the two represents the profit that will accrue to the owner of the call option.

Now, the seller of the call option – typically a broker – will buy the underlying stock at the exact time of sale of the call option to ensure they have the stock ready to be purchased should the owner of call option choose to do so.

So, when thousands or millions of internet blog readers chose to buy GameStop, or call options on GameStop at the same time, this created significant buying in the underlying stock by the sellers of these call options. Given the relatively limited trading volume, this buying in the stock pushed the price up quite considerably. For investors who were short the stock, this increase in price resulted in a materially larger liability. (Short sellers need to borrow the stock to sell up front, but retain a liability to repurchase the stock in the future and return it to the lender. This liability becomes more expensive the higher the stock price rises).

To manage the risk of this larger liability, short sellers needed to rapidly move to reduce their position. They did this by buying the stock in the open market and returning it to the lender from whom the stock was borrowed originally. But this created more buying – and the stock moved even higher – forcing even more short sellers to reduce their position even further, creating more buying and pushing the stock even higher. And so it went on with no fundamental limit to how high the price could rise.

So, what’s the problem?

At first glance, one might view a substantial increase in a stock price as a great thing. After all, the owners of this stock – or call options on the stock – got rich, on paper at least. What’s the problem with this?

First, what has taken place in the stocks of GameStop, AMC Entertainment, BlackBerry and others is short-squeeze-induced bubble. The price rise was and is totally disconnected from the prospects or value of the underlying businesses.

And bubbles in the value of any asset are not good for society as a whole. Yes, bubbles will increase the wealth of those who were lucky enough to buy before the top and sell before the bubble bursts. But for those who were unlucky to buy near the top, they will stand to lose a lot when they try to liquidate their position following the bursting of the bubble. Bubbles are nothing more than a transfer of wealth from those in the latter category, to those in the former. And speculating on bubbles is not a terribly productive use of time for large swaths of the population.

It should be noted that such a wealth transfer between buyer and seller does not happen when stock prices reflect the approximate value of the underlying business. Under this scenario, sellers and buyers will ultimately win on their transaction based on the future trajectory of the underlying business. The better it performs, the higher the stock price goes and the more value that accrues to the owners of the stock.

This was always how public equity markets were intended to function – so much so that market manipulation has been outlawed for almost a century. As per the Securities Exchange Act of 1934, it is unlawful for one or more persons “… creating actual or apparent active trading in such security, or raising or depressing the price of such security, for the purpose of inducing the purchase or sale of such security by others.”

By this reading, the law appears to have been broken in the month of January. Though whether (or even how) the SEC pursues legal action is far from clear.

Why short sell at all?

Many professional equity investors do not short sell – they simply remain “long only” meaning they own stocks when they believe they are undervalued (and will simply avoid owning stocks they believe are overvalued). Indeed, after the events of the last few weeks, it would not be surprising if this style of investing becomes even more popular.

Long/short equity investing involves using short positions as a source of correlated funding for long positions. It is used to manage risk in the portfolio – should markets fall, for example, the profits made in the short portfolio help offset the losses in the long portfolio.

It should be noted, however, that in practice substantially all of the profits made by long/short equity investors are generated in the long portfolio, not the short portfolio, over the long run.

What does this mean for the future long/short equity investment industry?

In our view, short portfolio management strategies will evolve to drastically reduce the inclusion of single-stock shorts going forward – with the exposure being replaced by ETFs. ETFs are, by definition, much more diversified across many stocks – though are grouped into similar industries, geographies or other thematic baskets which are helpful investment management tools.

This view is based on our recent experience in our global equity long/short equity offerings. As a firm that managed short portfolios with the use of single-stock shorts solely until 2020, we observed the beginnings of these social media-induced short squeeze risks in the depths of the pandemic and the subsequent share market rally. While we had always screened-out short candidates that we deemed were susceptible to a short squeeze, we took the additional step to move to an ETF-dominated short portfolio structure, complemented by a small number of high-conviction single-stock shorts in names that carried very low susceptibility to a short squeeze. Indeed, it was because of this new approach that our short portfolio emerged from this social media stock mania unscathed.

Andrew Macken is the Chief Investment Officer at Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.