|

Getting your Trinity Audio player ready...

|

In Part 1 of this two-piece article on Apple’s healthcare opportunity, we laid out the size of the opportunity before Apple and discussed the initial steps the company has taken to engage with this market. In this Part 2 we conceptually explore the categories of wasted healthcare spend that Apple could address with its wearables and iOS ecosystem, and how Apple could monetise this opportunity.

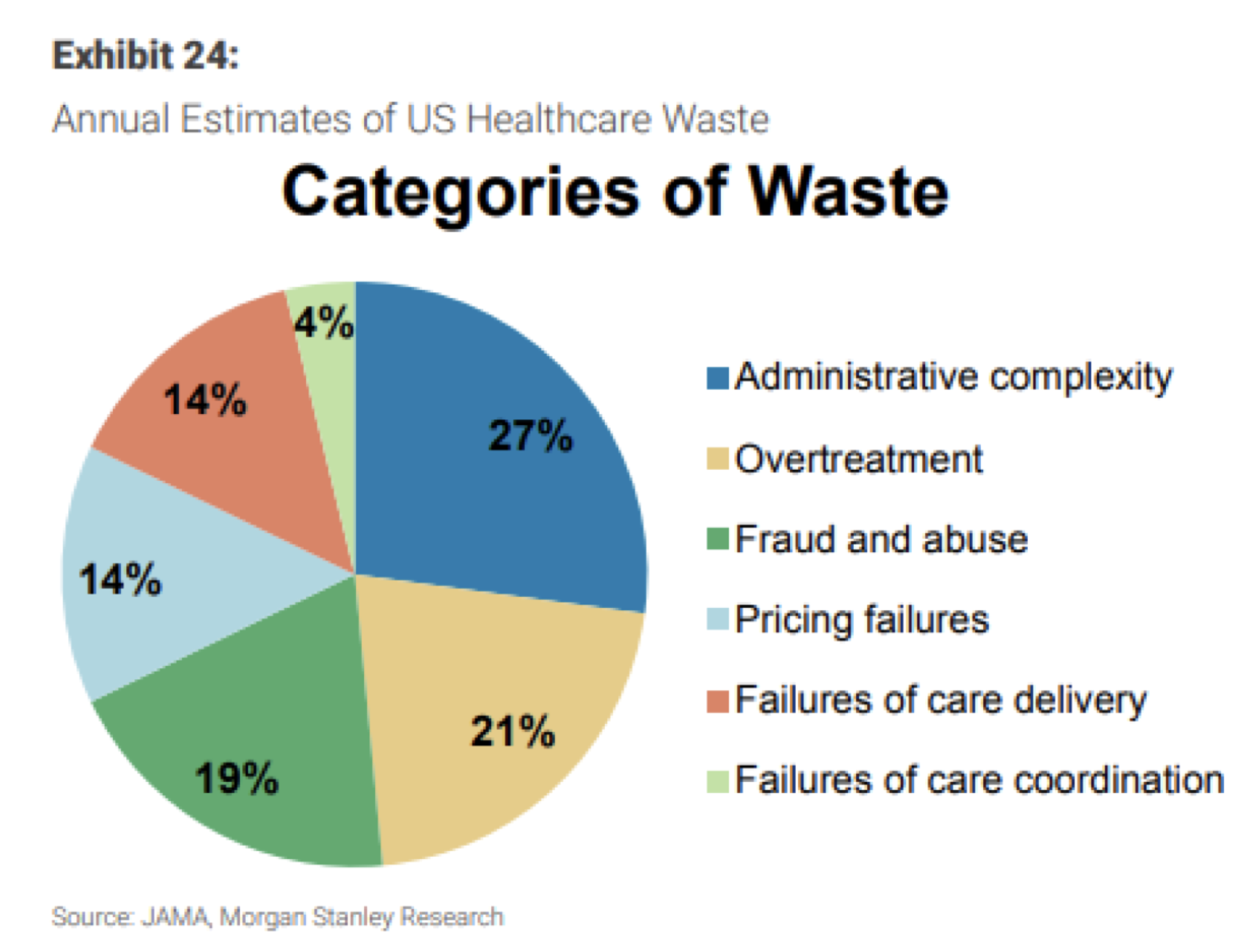

As discussed in Part 1, the US healthcare system wastes as much as $1.2 trillion annually, and that figure could grow to as high as $2 trillion over the next decade. The largest categories of waste according to the Journal of American Medical Association are administrative complexity, overtreatment and fraud and abuse. These three categories account for nearly 70% of wasted healthcare spend and are ripe for Apple to disrupt with its privacy-focused ecosystem and medical-grade consumer wearables.

- Administrative complexity is the natural consequence of the extremely fragmented US healthcare system with its hundreds of hospital systems, managed care organisations, drug verticals and health information exchanges, each with their own standards that inhibit the interoperability of healthcare data. Apple could use its trusted iOS ecosystem and high iPhone market share in the US to distribute a standardised Electronic Medical Records (EMR) platform with holistic patient medical data (the Health app is the beginnings of this). Most importantly, Apple’s EMR platform would be patient-driven (patients want control over their medical records) and portable, unlike current health information exchanges, and hopefully lead to improved data interoperability across hospital systems and managed care networks.

- Overtreatment is a huge area of wasted spend and could easily be reduced by medical practitioners and care providers having access to patients’ full medical records showing prior treatments. Apple’s EMR is contained in a patient’s iPhone (and the iCloud) and thus patients have full access to their complete medical records whenever they visit a new (or existing) physician. Of course, it will likely take years of development and close coordination with the nation’s hospital and care networks before Apple can build a complete repository of patient medical records. Additionally, the Apple Watch and future wearables that monitor patients’ vitals or other signals can help detect medical issues before they become serious, thus encouraging lower-cost preventative care.

- Fraud and abuse of the healthcare system by both patients and care providers can be rife when patient medical records are fragmented across different networks and/or health information exchanges. An easily accessible and complete medical record could help reduce or uncover instances of fraudulent treatment or abuse by all parties.

- Finally, Apple’s wearables can remind patients to adhere to their treatment plans so that patients don’t compromise their treatment outcomes.

If Apple can help reduce the level of wasted spend in the US healthcare system, then it is only logical that the company should capture a share of that efficiency gain. When it comes to monetisation, there are several possibilities. The most immediate monetisation path is to sell more wearables – presently just the Apple Watch. Apple is participating in medical studies with the Watch and if these studies determine that the Watch helps improve patient care outcomes and/or keep wearers healthier, managed care organisations may be willing to subsidise consumer purchases of the Watch. Wider Watch adoption may also encourage developers to create more health apps for the App Store, which would further contribute to Apple’s services revenue.

Longer term, should Apple succeed in building an EMR platform, the most likely monetisation model would be a fee per patient per month. Whether a fee would be charged to iPhone users or to healthcare providers (or both) remains to be seen, but it is likely that Apple will find it easier to charge participating healthcare providers a fee to access patient data across the entire EMR platform. As cost savings build, these healthcare providers may be willing to pay a higher fee – effectively sharing the efficiency gains with Apple. If this sounds familiar, it’s because the App Store already works this way – app developers leverage Apple’s unrivalled distribution channel of 900 million active iPhones around the world in return for sharing 30% of their revenues (or cost savings, in this case) with Apple.

Considering how nascent this healthcare opportunity is, it is difficult to put any hard numbers on its size or value to Apple. For example, Morgan Stanley estimates Apple healthcare revenue at between $15 billion and $313 billion in 2027 – a tremendously wide range. But it is nonetheless helpful for investors to contemplate the opportunity and have at least a framework for sizing it. With Apple’s share price tracking back towards its record high despite the cloudier outlook for the iPhone, investors may increasingly need to pay for the real options that they once received for free.

Montaka owns shares in Apple

![]() Daniel Wu is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Daniel Wu is a Research Analyst with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.