By Chris Demasi

Morgan Housel, in this book ‘The Psychology of Money’, used a nice thought experiment on Warren Buffett to demonstrate the tremendous impact time has on creating extreme wealth from compounding.[1]

When Buffett was 30 years old, he had a net worth of US$1 million, or just over $9 million in today’s money. He had started investing when he bought his first stock at the age of ten. He started the investment firm, the Buffett Partnerships, in his 20s.

As we all know, Buffett kept investing for the rest of his life – he is 91 currently – compounding his capital at 22% annually and achieving net worth close to $120 billion today which has made him the world’s fifth-richest man.

Berkshire Hathaway’s 25-year performance

Source: Bloomberg

Impatient Warren

But Housel considers the path of a different Warren Buffett. What if Buffett started his career much later and he retired much earlier? What if Buffett had saved $25,000 by the time he was 30, then retired at the age of 60 … but had still managed to compound his capital at the same 22% per annum of the real Buffett? In that case, Buffett’s net worth today would be closer to just US$12 million or just 1/10,000th of the real Buffett’s fortune.

There are two interesting insights to come from this result. The first is that starting his investing career earlier and sticking with it longer has worked exponential wonders for Buffett. Secondly, while Buffett achieved stellar results, he has built one of the world’s greatest fortunes without achieving the highest returns.

Many investors that have generated annual returns above 30% for years or decades, but none for as long as Buffett. Housel noted that Jim Simons, founder of the world’s most successful hedge fund Renaissance Technologies, has compounded at 66% annually since 1998 – triple the rate Buffett achieved – yet he has a net worth of (just!) $26 billion, or around 1/5th of Buffett.

Indeed, time is the friend of compound returns.

This result seems counterintuitive: the world’s richest investor is not the world’s greatest investor, at least by annual returns over any sufficient period.

Remember the power of compounding

In the current environment of heightened volatility, it’s vital that investors keep in mind these lessons about the power of compounding.

In the past year, some of the world’s greatest businesses – businesses growing exponentially as they transform industries and markets at an accelerating pace – have sold off sharply.

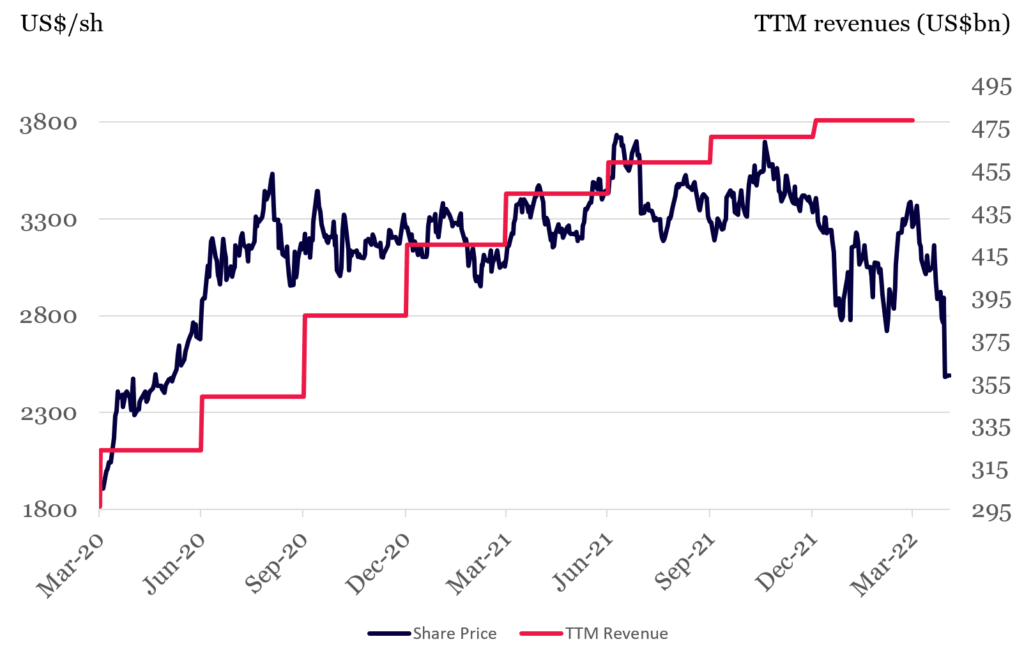

Amazon diverging price and fundamentals

Source: Bloomberg

Amazon leads in online retail, cloud computing and logistics. Its revenues grew 7% and its share price has declined 25% ytd. Alphabet runs the world’s largest online ad business (Google) and top cloud platform. Revenues were up 23% and profits up 22% while the stock price has fallen 20% ytd. Microsoft is the other global leader in cloud computing. Its sales up 18% and profits up 19% but its shares have experienced a price decline of 15%.

These businesses and markets will produce sustainably high double-digit returns for the rest of this decade and well into the next, compounding earnings and value for shareholder.

A defensive trap

Yet sectors that have failed to generate strong returns in the past are up significantly this year, benefitting from higher interest rates and geopolitical difficulties confronting the world. Stocks of companies in the energy sector, for example, as measured by the Energy Select SPDR ETF, have risen by 33% this year. Others like consumer staples that have poor growth prospects, but are seen as safe havens and inflation hedges, have risen 2% ytd as measured by iShares US Consumer Staples ETF.

Investors should not be distracted and chase these sectors and companies in attempt to make a quick buck or rotate into them to try and limit short-term portfolio volatility.

Unless these sectors and companies somehow change their stripes and generate sustainably high returns, it is more likely they are temporary beneficiaries of today’s market and macro environment.

Sticking with the great businesses

As Buffett’s example shows, the key to becoming very wealthy is strong compounding, repeated over time.

We prefer to stay the course and hold our investments in the excellent businesses, like Amazon, Alphabet and Microsoft, that are transforming their markets and growing value exponentially. Not only will they achieve high returns, but we are confident they will be sustainable for decades and deliver strong compounding over time. That is the key to long-term, sustainable wealth.

Note:

[1] Compounding refers to the exponential growth in capital over time as returns are earned on returns. Compound interest earned in deposit accounts with banks is a typical example of this in the real world. A depositor earns interest each year at a set rate on the initial deposit and the interest earned in previous years. In the early years gains come gradually but then accelerate and deliver surprising sums over many years or decades.

Chris Demasi is the Portfolio Manager at Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or contact us on https://montaka.com/

Read our latest AI whitepaper now by sharing a few details with us:

Don’t forget the keys to unlocking big wealth are compounding and time

By Chris Demasi

Morgan Housel, in this book ‘The Psychology of Money’, used a nice thought experiment on Warren Buffett to demonstrate the tremendous impact time has on creating extreme wealth from compounding.[1]

When Buffett was 30 years old, he had a net worth of US$1 million, or just over $9 million in today’s money. He had started investing when he bought his first stock at the age of ten. He started the investment firm, the Buffett Partnerships, in his 20s.

As we all know, Buffett kept investing for the rest of his life – he is 91 currently – compounding his capital at 22% annually and achieving net worth close to $120 billion today which has made him the world’s fifth-richest man.

Berkshire Hathaway’s 25-year performance

Source: Bloomberg

Impatient Warren

But Housel considers the path of a different Warren Buffett. What if Buffett started his career much later and he retired much earlier? What if Buffett had saved $25,000 by the time he was 30, then retired at the age of 60 … but had still managed to compound his capital at the same 22% per annum of the real Buffett? In that case, Buffett’s net worth today would be closer to just US$12 million or just 1/10,000th of the real Buffett’s fortune.

There are two interesting insights to come from this result. The first is that starting his investing career earlier and sticking with it longer has worked exponential wonders for Buffett. Secondly, while Buffett achieved stellar results, he has built one of the world’s greatest fortunes without achieving the highest returns.

Many investors that have generated annual returns above 30% for years or decades, but none for as long as Buffett. Housel noted that Jim Simons, founder of the world’s most successful hedge fund Renaissance Technologies, has compounded at 66% annually since 1998 – triple the rate Buffett achieved – yet he has a net worth of (just!) $26 billion, or around 1/5th of Buffett.

Indeed, time is the friend of compound returns.

This result seems counterintuitive: the world’s richest investor is not the world’s greatest investor, at least by annual returns over any sufficient period.

Remember the power of compounding

In the current environment of heightened volatility, it’s vital that investors keep in mind these lessons about the power of compounding.

In the past year, some of the world’s greatest businesses – businesses growing exponentially as they transform industries and markets at an accelerating pace – have sold off sharply.

Amazon diverging price and fundamentals

Source: Bloomberg

Amazon leads in online retail, cloud computing and logistics. Its revenues grew 7% and its share price has declined 25% ytd. Alphabet runs the world’s largest online ad business (Google) and top cloud platform. Revenues were up 23% and profits up 22% while the stock price has fallen 20% ytd. Microsoft is the other global leader in cloud computing. Its sales up 18% and profits up 19% but its shares have experienced a price decline of 15%.

These businesses and markets will produce sustainably high double-digit returns for the rest of this decade and well into the next, compounding earnings and value for shareholder.

A defensive trap

Yet sectors that have failed to generate strong returns in the past are up significantly this year, benefitting from higher interest rates and geopolitical difficulties confronting the world. Stocks of companies in the energy sector, for example, as measured by the Energy Select SPDR ETF, have risen by 33% this year. Others like consumer staples that have poor growth prospects, but are seen as safe havens and inflation hedges, have risen 2% ytd as measured by iShares US Consumer Staples ETF.

Investors should not be distracted and chase these sectors and companies in attempt to make a quick buck or rotate into them to try and limit short-term portfolio volatility.

Unless these sectors and companies somehow change their stripes and generate sustainably high returns, it is more likely they are temporary beneficiaries of today’s market and macro environment.

Sticking with the great businesses

As Buffett’s example shows, the key to becoming very wealthy is strong compounding, repeated over time.

We prefer to stay the course and hold our investments in the excellent businesses, like Amazon, Alphabet and Microsoft, that are transforming their markets and growing value exponentially. Not only will they achieve high returns, but we are confident they will be sustainable for decades and deliver strong compounding over time. That is the key to long-term, sustainable wealth.

Note:

[1] Compounding refers to the exponential growth in capital over time as returns are earned on returns. Compound interest earned in deposit accounts with banks is a typical example of this in the real world. A depositor earns interest each year at a set rate on the initial deposit and the interest earned in previous years. In the early years gains come gradually but then accelerate and deliver surprising sums over many years or decades.

Chris Demasi is the Portfolio Manager at Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or contact us on https://montaka.com/

Read our latest AI whitepaper now by sharing a few details with us:

This content was prepared by Montaka Global Pty Ltd (ACN 604 878 533, AFSL: 516 942). The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. You should read the offer document and consider your own investment objectives, financial situation and particular needs before acting upon this information. All investments contain risk and may lose value. Consider seeking advice from a licensed financial advisor. Past performance is not a reliable indicator of future performance.

Related Insight

Share

Get insights delivered to your inbox including articles, podcasts and videos from the global equities world.