|

Getting your Trinity Audio player ready...

|

To outperform in the equity markets, you need to take a different view to the market – and you need to be right. So one should be very clear about where their view differs to the expectations that are implied by any given stock price. That is, always be clear about your source of “variant perception”.

As readers will no doubt be aware, Apple (NASDAQ:AAPL) is the largest holding in Montaka’s long portfolio. We view it as a business of extremely high quality that is also very cheap – with a P/E multiple of approximately 10 times (upon excluding the net cash on the balance sheet from the numerator).

The Montaka team holds a number of variant perceptions with respect to Apple. One, in particular, relates to the recurring nature of Apple’s earnings. Many in the marketplace argue that Apple is a series of “one-hit wonders” that does not deserve a higher valuation multiple as a consequence.

We disagree with this view. Let me ask you this question: would you pay $3.50 per day for the permanent use of all Apple “kit” – iPhone, iPad, Mac, Apple Watch and Apple TV – including upgrades to new models as and when they become available? The answer is a probably a resounding “yes”. And more importantly, it is a resounding “yes” for many consumers that currently do not own Apple products because they are perceived to be too expensive.

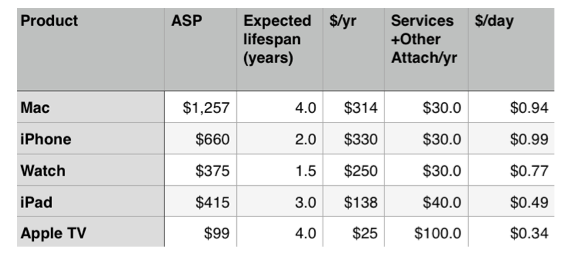

Well, it turns out that $3.50 per day is approximately the cost of all of this kit, based on current prices and estimated product lifespan, according to Asymco’s Horace Dediu (calculations shown in the table below). In a blog post written last month, Dediu argues that Apple’s customers are not merely buying a random set of discrete products; they are instead buying a “mix of hardware, software and services under a brand that assures a certain quality of experience.”

In this sense, Apple is already selling hardware, software and services – as a service. If Apple were merely a series of one-hit wonders, this would imply customers need to make a genuine purchase decision every time a new iPhone version was released, for example. We believe there is no such decision to be made in the minds of most Apple customers. Instead, it is just time to renew the iPhone to the newest latest version – with an associated upfront cost that customers have become accustomed to amortizing over the next few years in their mental accounting.

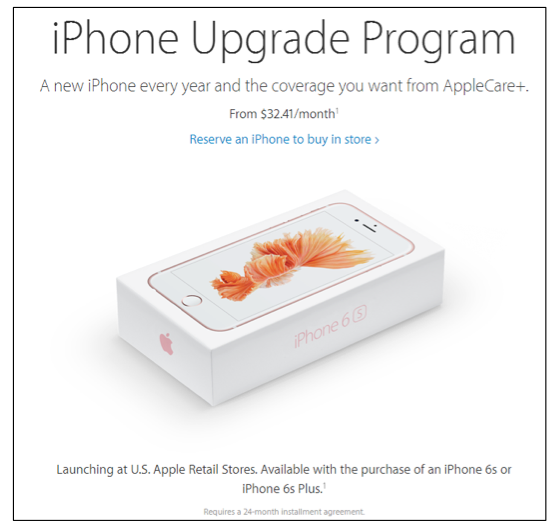

We note that, last month, Apple released its “iPhone Upgrade Program” which explicitly sells the company’s hardware – as a service. Essentially, this is a new way for customers to lease the iPhone instead of buying it. And we believe, this program will increase the effective “total addressable market” of the product by capturing a larger share of those consumers who previously deemed the iPhone too expensive. We also note that millennials are a lot more accustomed to paying monthly fees for products and services, than older generations.

To the extent the market starts to evolve its view of Apple from a series of one-hit wonders, to a more recurring set of earnings streams, we believe the stock’s valuation multiple will appreciate meaningfully.

![]() Andrew Macken is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.

Andrew Macken is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.