|

Getting your Trinity Audio player ready...

|

We have recently increased our exposure to high-quality USD-denominated earnings streams and USD-denominated cash positions. This comes around six months after we increased our exposure to European assets following the result of the French election (and associated abatement of a significant tail-risk associated with a potential failure of the European Monetary Union).

Informing this view is a confluence of long-term trends and short-term trends. From a longer-term perspective, we note that the health of the US consumer has improved significantly over recent years. And this is important for consumption – by far the largest component, to the tune of around 70 percent, of US aggregate demand.

From a shorter-term perspective, the weakening US dollar over the last nine months is an effective form of monetary stimulus. Combine this with a renewed prospect of genuine corporate and personal income tax cuts, and we have the potential for a very real boost to US economic growth. This would likely be positive for US equities, and the US dollar.

AN IMPROVING US CONSUMER

Since the Global Financial Crisis (GFC), the US consumer has experienced a significant deleveraging and corresponding increase in household wealth. A wealthy consumer spends more and takes more risk – both of which are positive for economic growth.

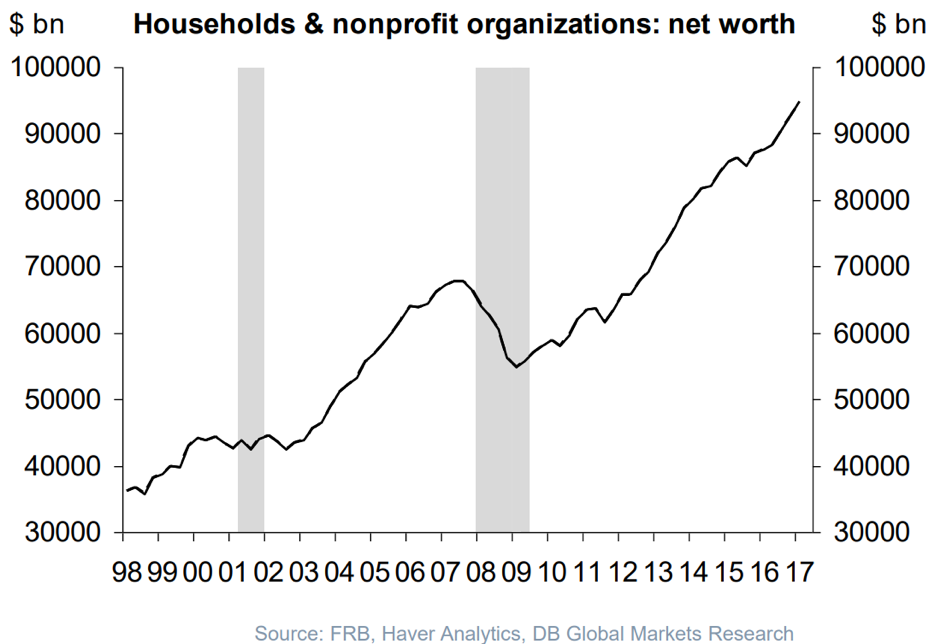

In the chart shown below, we can see that US household wealth has recovered significantly since the GFC and has never been higher. In large part, this gas been driven by a recovery in the US housing market – arguably the most important asset class for the health of the US economy.

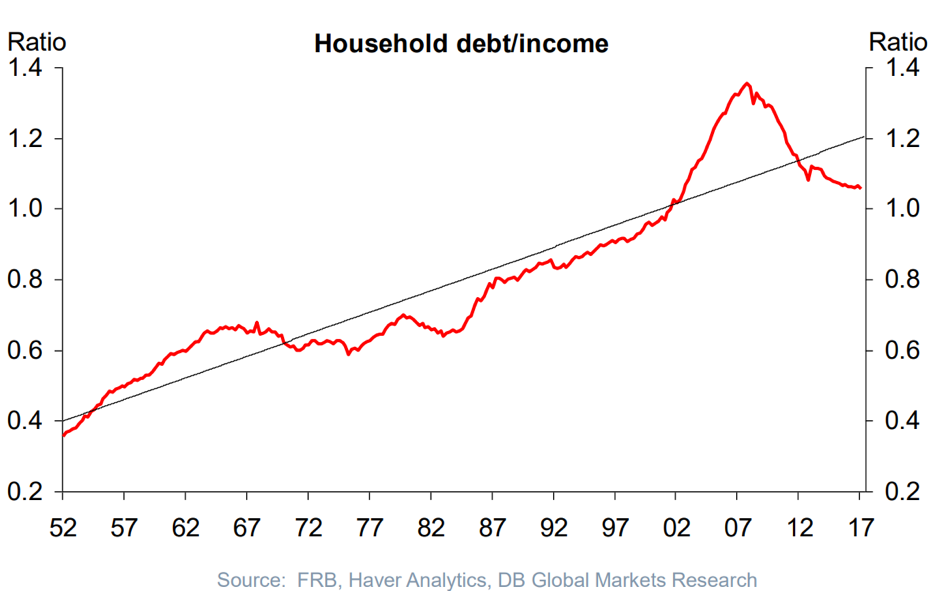

At the same time, household debt levels have reduced relative to incomes since the GFC, as shown below. The deleveraging process is a negative contributor to aggregate demand. And the worst of this seems to be behind the US household.

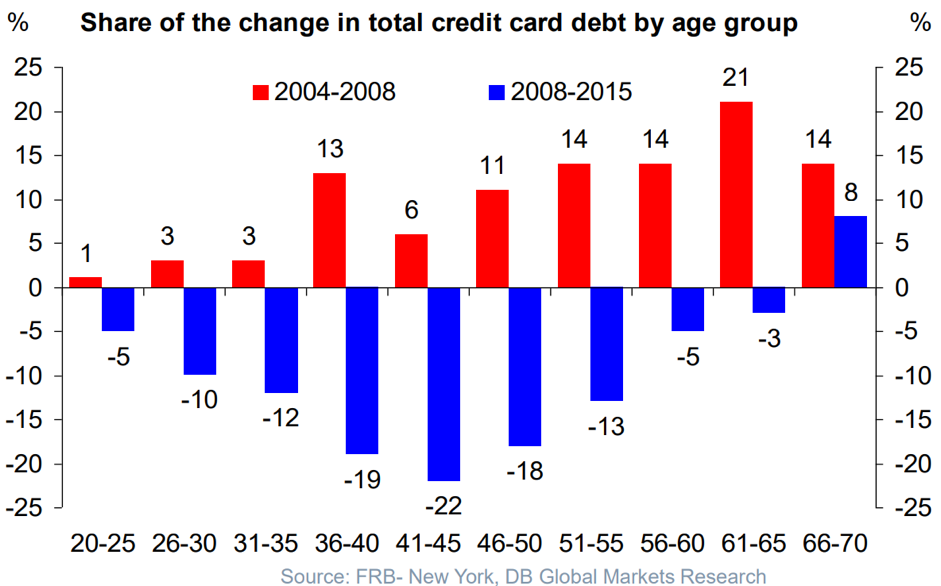

Finally, it is interesting to note that 30-55 year-olds appear to have de-levered the most since the GFC. This is interesting because (i) this age cohort takes the largest share of total wages; and (ii) this cohort may well be ready to lever up again in the not too distant future.

A WEAKER US DOLLAR

As we rang in the new year of calendar 2017, the US dollar commenced a steady weakening against other major currencies. (This is illustrated in the chart below by the white line which represents the US dollar index against a trade-weighted basket of currencies. The green line shows the same for the Euro).

Regular readers will know that, soon after the result of the French election in May, we significantly increased our exposure to European equities and Euro cash holdings. As shown by the significant recent appreciation of the green line in the chart below, this turned out to be a sensible course of action.

USD (white) and EUR (green) vs trade-weighted basket of currencies:

Source: Bloomberg

The weaker level of the US dollar means that US produced goods and services are now around 10 percent cheaper in foreign currency terms than they were nine months ago. This drives higher demand for these goods and services and represents a form of stimulus to the US economy.

In early September, we pared back our currency exposure to Euros, increased our exposure to US dollars and increased our exposure to high-quality USD-denominated earnings streams.

NOW, GENUINE FISCAL STIMULUS?

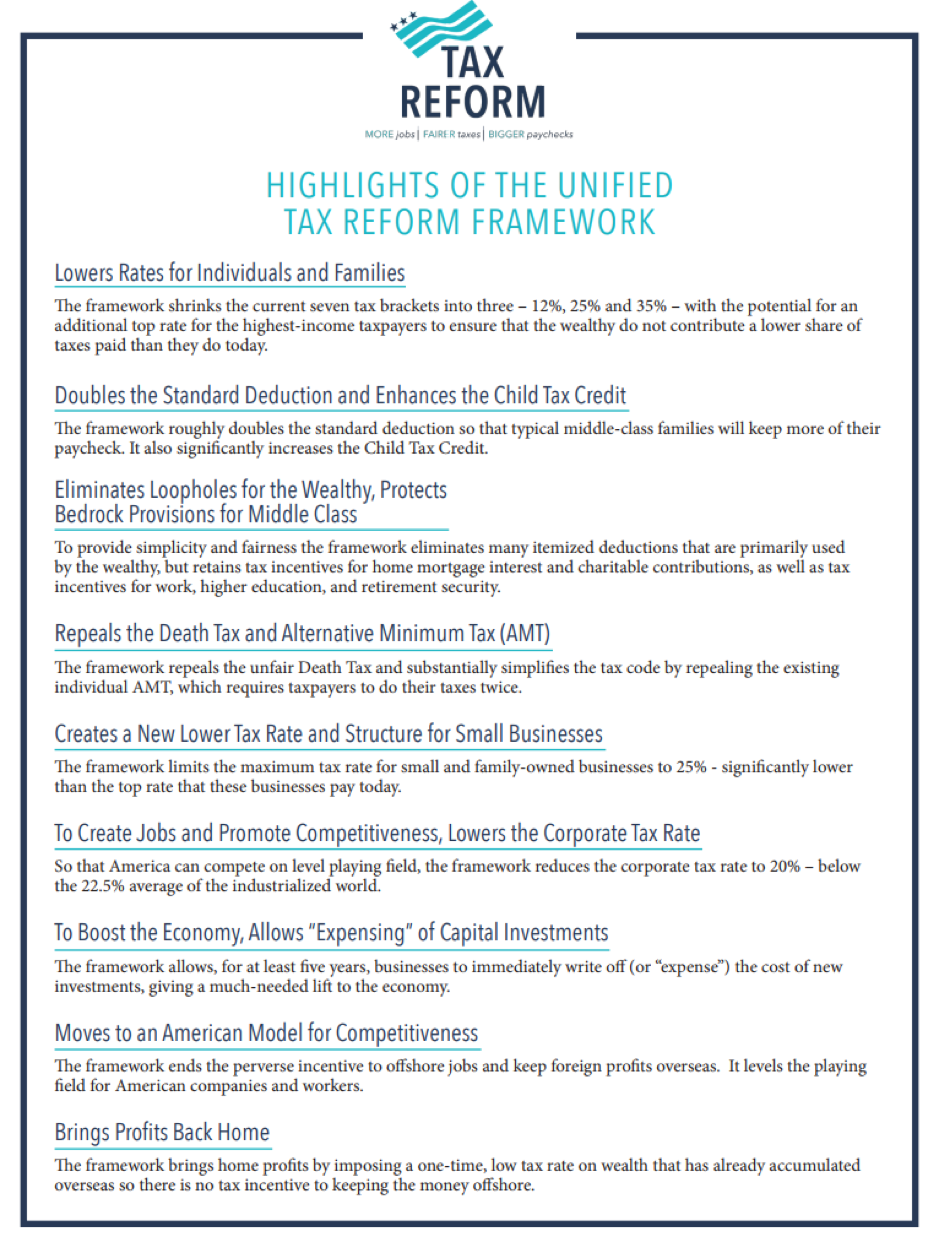

The most significant economic news to come out of the US in recent days was the Trump Administration’s release of its proposed tax reform framework. Summarized below, it seeks to provide significant income tax relief for individuals, as well as significant corporate income tax relief. It is not difficult to see many of these measures being popular with the general electorate.

Source: Whitehouse.gov

Source: Whitehouse.gov

Of course, free money for all sounds great – until one remembers that a government’s expenditures are funded by their revenues and increased borrowings. So the question is: how will these tax cuts – which some have estimated to be worth US$5.8 trillion[1] – be “paid” for? Remember, the Republican party has been the party of deficit reduction for the last eight years – through President Obama’s entire two terms.

Now that a (pseudo) Republican controls the White House, however, Republicans are being far less vocal on the issue. From the New York Times last night: “[Deficit reduction is] a great talking point when you have an administration that’s Democrat-led,” said Representative Mark Walker, Republican of North Carolina and the chairman of the Republican Study Committee, a group of about 150 conservative House members. “It’s a little different now that Republicans have both houses and the administration.”[2]

One way we believe many Republicans may come to terms with these significant tax cuts is to simply believe (or assume) significantly higher economic growth as a direct consequence of the cuts. Taking a smaller percentage of a bigger pie can mean tax cuts can pay for themselves, right? In theory yes, though history has shown this not to be true. Regardless, if the experiment fails, it will be a problem for future administrations, so the politics of today remain favourable.

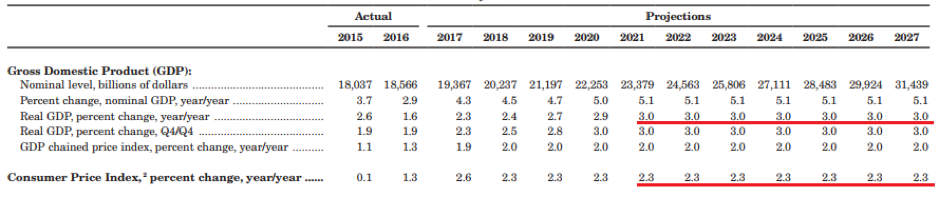

The Trump Administration’s Office of Budget and Management (OMB) has already hinted that such a belief (or assumption) would be incorporated into the official economic forecasts. Shown below are the key forecasts of the Fiscal 2018 budget. Note the +3.0 percent real economic growth and +2.3% percent inflation rates annually starting from 2021. Such average rates of growth have not been seen for decades and many debate if they will ever be achievable again given the aging population and technological deflation we are currently experiencing.

Budget of the US Government: Fiscal Year 2018

Source: Office of Budget and Management

We believe the probability that a substantial portion of these tax proposals make it through the Republican-controlled Congress. There are a number of reasons why the politics of this look favourable to the Trump Administration:

- According to Axios this week: “Tax reform is now an existential issue for House Speaker Ryan and Senate Leader McConnell. If they botch this, as they did health care, both chambers could lose their Republican majorities.”[3]

- We believe Republicans may even gain some Democratic support. After all, if these measures are popular with the electorate, then voting against them will be dangerous for many Democratic senators facing re-election in the 2018 midterm elections.

- As explained by FiveThirtyEight, there are 10 Democratic senators running in states that President Trump won, five of whom are from states that Trump won by about 20 percentage points or more. Meanwhile, there are only two Republican senators up for re-election in states Hillary Clinton came within 5 points of winning in 2016.[4]

- And let’s not forget: this tax package was designed by… wait for it… a Democrat. Former Goldman Sachs Executive, Gary Cohn, is the primary architect of this tax framework. And yes, he is a Democrat, not a Republican.

So there we have it. Improving long-term fundamentals of the US consumer, combined with two short-term stimulatory boosts: (i) a monetary boost from a weaker US dollar; and (ii) a likely fiscal boost from Trump’s tax proposals. On the basis of this assessment, we have increased our exposure to high-quality USD-denominated earnings streams and USD-denominated cash positions.

![]() Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

[1] (Axios) The math behind Trump’s 5.8 trillion tax cut, September 2017

[2] (NYT) With Tax Cuts on the Table, Once-Mighty Deficit Hawks Hardly Chirp, September 2017

[3] (Axios) GOP’s “nightmare scenario”, September 2017

[4] (FiveThirtyEight) Why The 2018 Senate Elections Are Looking Bad For Both Parties, May 2017