|

Getting your Trinity Audio player ready...

|

– Phil Namara

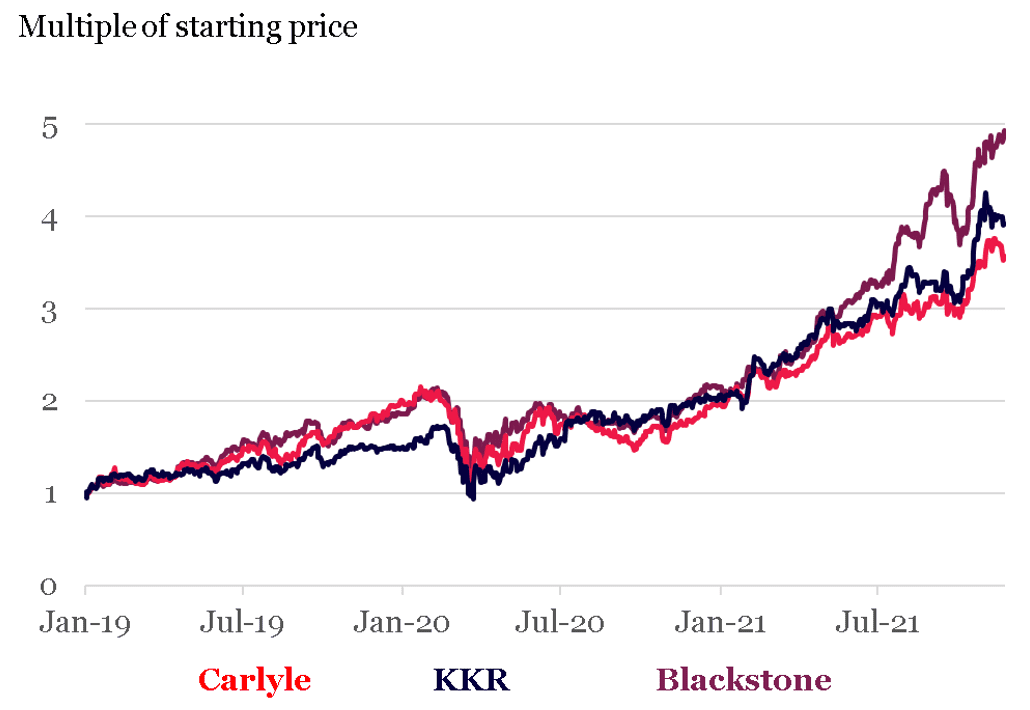

The alternative asset managers, KKR, Blackstone, and Carlyle, have been major winners for the Montaka funds over the last years. In recent articles, we have explained how structurally lower interest rates and persistent asset-class outperformance are driving, not only sophisticated institutional investors, but also high-net worth people to ramp up their allocations to private markets as they search for yield.

Alternative asset manager share performance

Source: Bloomberg as of 24th November 2021

The latest evidence of this structural tailwind came in late November when the world’s seventh-largest private equity investor, California Public Employees’ Retirement System (CalPERS), which manages more than $US495 billion in assets, committed to using leverage to raise the amount they allocate to private equity from 8% to 13%. They also made a new 5% allocation to private debt. These moves from a leading global pension fund have set a precedent and the fund’s peers will follow suit, increasing asset flows to the scaled global managers, KKR, Blackstone and Carlyle.

It’s no surprise that the big private market players have performed strongly, but Carlyle, whilst being up more than 90% year-to-date, has lagged somewhat. We believe there is much more left in the tank for the company as they accelerate and improve their earnings quality.

ILLUSTRIOUS BEGINNINGS

Carlyle was started in 1987 by Bill Conway, Daniel D’Aniello, and David Rubenstein. They were one of many newly formed buyout firms at the time, like KKR. The face of the firm was Rubenstein, a former Washington DC lawyer who had the insight to connect influential people within Washington to successful businesspeople. Carlyle made many prominent hires from the defence industry and government, including former president George H.W. Bush. The firm soon became synonymous with the political elite and boasted connections with the Saudi royal family. When combined with great performance, these power connections helped Carlyle raise larger and larger successive funds.

A GREAT COMPANY STUMBLES

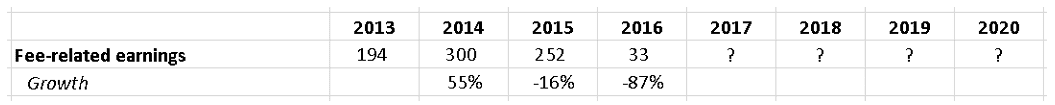

But then performance crashed. At one stage, based on earnings, it appeared the business was dying.

The three founders had continued to run the firm well after its IPO in 2012. They focused on generating fees tied to investment performance rather than management fees. But this led them to getting involved in several less-than-successful investments, including stakes in aggressive hedge funds, risky distressed natural resources bets, and smaller sub-scale regional funds.

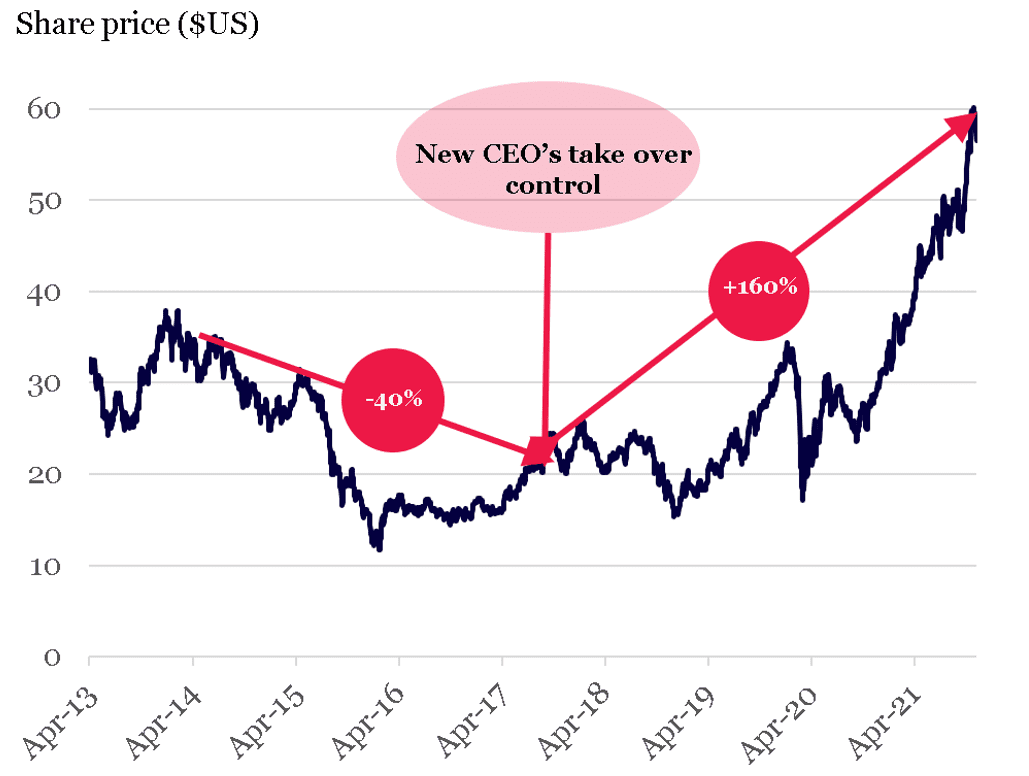

Together, these ‘malinvestments’ triggered big losses. Assets flowed out and earnings fell, damaging investor confidence. By early 2017, Carlyle’s shares had crashed more than 50% from their 2014 peak.

HANDING OVER THE REINS

The crisis triggered change. The co-founders stepped down as Co-CEO’s and anointed their successors, Warburg Pincus executive, Kewsong Lee, and Carlyle’s co-chief operating office Glenn Youngkin, who in keeping with Carlyle’s political connections recently became Governor of Virginia.

It can be difficult for a company to transition to a new management team, particularly in the private equity industry where founders have run firms, such as KKR and Blackstone, for decades. Investors have remained somewhat skeptical about Carlyle’s fund performance and turnaround. So while the stock has posted strong gains, it has underperformed its rivals, particularly Blackstone.

FLOURISHING – FROM UGLY DUCKLING TO BEAUTIFUL SWAN

But we believe that Carlyle is a nascent Blackstone with significant upside potential, not recognised in their share price today.

While Carlyle is several years behind in the development of their global platform, investors are vastly underappreciating the company’s potential to engineer a virtuous cycle of scale after its difficult period.

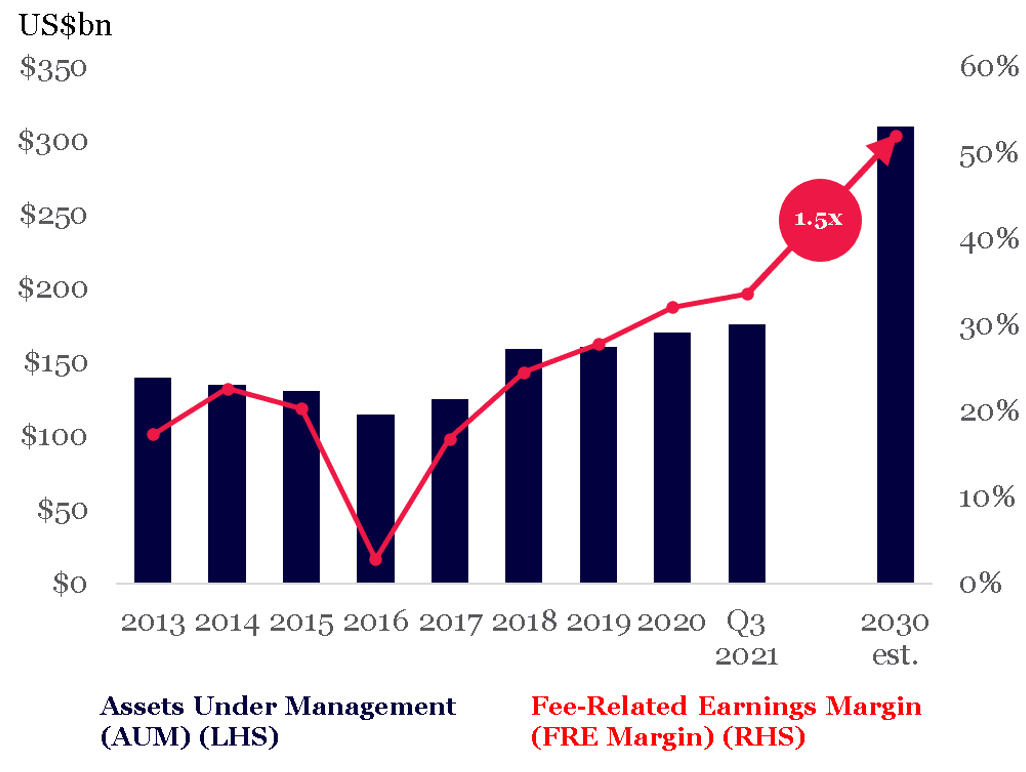

A pivotal shift in Carlyle’s strategy began when Kewsong and Youngkin took hold of the firm. They evolved the business model, progressively moving Carlyle’s earnings mix away from lumpy performance fees earned when private equity assets are sold, and more towards predictable management fee streams, or ‘fee-related’ earnings.

Carlyle has since meaningfully increased margins since the difficulties of 2016 and we can see fee-related earnings margins increasing by almost 20% in the coming years.

Significant margin expansion opportunity

The market awards higher valuations and multiples to management fee-related earnings because of their recurring nature and stickiness. These fees come from closed-end, long-dated funds and have no exposure to underlying fund valuations. In fact, during the Covid-19 crisis in early 2020, Carlyle’s CFO Curtis Buser, when asked about any potential redemption impacts from the pandemic, said:

“In our core business model, 98% of our fee-earning AUM is not subject to redemption. 90% of our fee revenues are long-term oriented, and that’s all good”.

UNDERAPPRECIATED TORQUE

The Carlyle Group hasn’t just improved the quality of their earnings but has also slimmed down its bloated cost structure and shifted the mix more towards stickier revenues. Beyond this, the market continues to underestimate the earnings potential within Carlyle’s soon-to-be-realized private equity funds.

Between 2012 and 2016 when Carlyle Partners V, Carlyle’s largest private equity carry fund was selling its investments, the firm generated on average $665 million in net annual performance fees; that is, cold hard cash after compensation expenses.

Today, their newest flagship fund, Carlyle Partners VI is, which, like its predecessor, accounts for the lion’s share of Carlyle’s net accrued performance fees, is entering harvesting mode with even better performance. It has generated a 28% gross internal rate of return on realized or partially realized investments, more than 4%p.a. better than Carlyle Partners V.

Carlyle’s management, like us at Montaka, recognise the tremendous earnings potential within this latest flagship fund and have already recognised $3.9 billion in accrued performance fees on their balance sheet, with more expected to come.

Carlyle’s performance year-to-date suggests investors are slowly waking up to the firm’s earnings potential.

Market beginning to recognise Carlyle’s potential

Indeed, given the accommodative market environment, we believe Carlyle will generate more than $1 billion in average annual performance fees through 2024, blowing through analyst consensus estimates and their own recently provided guidance of $800m on average, by more than 25%.

LONG-TERM WINNER – REPLICATING BLACKSTONE’S SUCCESS

Standing on the shoulders of giants, Carlyle is following in the footsteps of its larger peers like KKR, Blackstone and Apollo in trimming their cost structure, shifting their mix towards stickier revenues, and launching captive insurance arms, to ensure they are best placed to participate in the structural growth of private markets.

We believe that The Carlyle Group has the potential to evolve into one of the most valuable asset management platforms and the probability of this outcome is not at all reflected in the price today. At the current share price, the market is failing to appreciate both the extent to which Carlyle is already positioned to capture increasing allocations towards private market assets and the performance fee potential within its carry funds.

We think deeply about the expectations for key business value drivers which are implied by any given stock price to ensure that we are not overpaying for any investment. Finally, we seek to construct our portfolios to be consistent with our top-down perspectives and strive to preserve capital wherever possible. On this basis, Carlyle remains a core position within Montaka’s funds today.

Montaka is invested in The Carlyle Group & Blackstone.

Phill Namara is a Research Analyst with Montaka Global Investments.

To learn more about Montaka, please call +612 7202 0100 or leave us a line on montaka.com/contact-us