– Chris Demasi

In early October, cousins Henry Kravis and George Roberts announced they were retiring from their co-CEO roles at KKR, the global private equity giant. Kravis and Roberts are investment legends. They pioneered the technique of launching leveraged corporate buyouts (LBOs) of crusty conglomerates, then making billions breaking them up. Their method was made infamous in the book and HBO movie Barbarians at the Gate, which covered their bitter takeover battle for tobacco and biscuit giant RJR Nabisco.

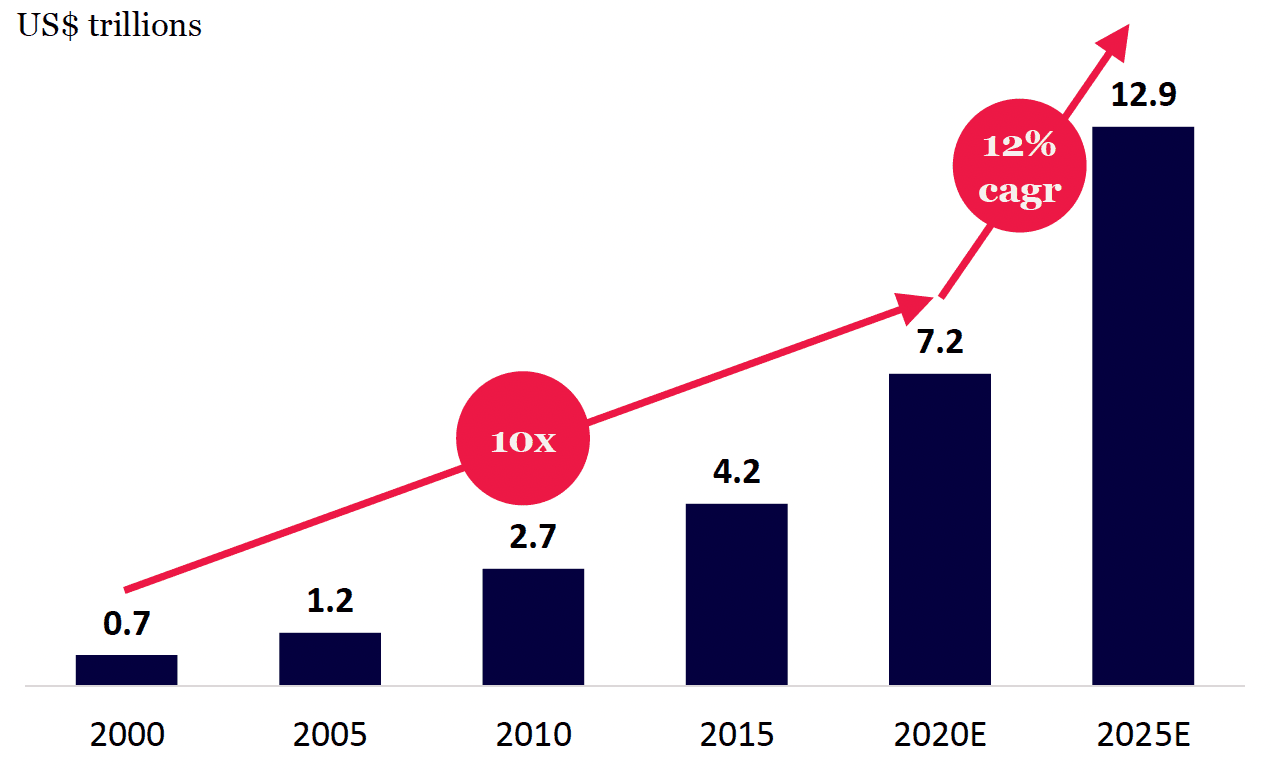

KKR have gone from barbarians to angels and are now firmly part of the financial establishment, managing $US429 billion of funds. KKR’s ascent reflects the broader growth of private capital markets. In the past two decades, private capital markets have surged 10-fold to become a massive $US7.2 trillion industry.

Amazing opportunities

Global private markets AUM

US$ trillions

Source: Petershill, Preqin, Redburn

As more investors discover private markets offer better opportunities and higher returns, they’re expected to surge to $US13 trillion of assets under management by 2025. Private markets have huge room to grow. They are just a fraction of the world’s investments today.

The value of all private equity funds, for example, is $US4.5 trillion, just 4% of all the world’s publicly listed companies. Private real estate makes up just 4% of all global real estate assets; and private infrastructure is just 6% of total project funding.

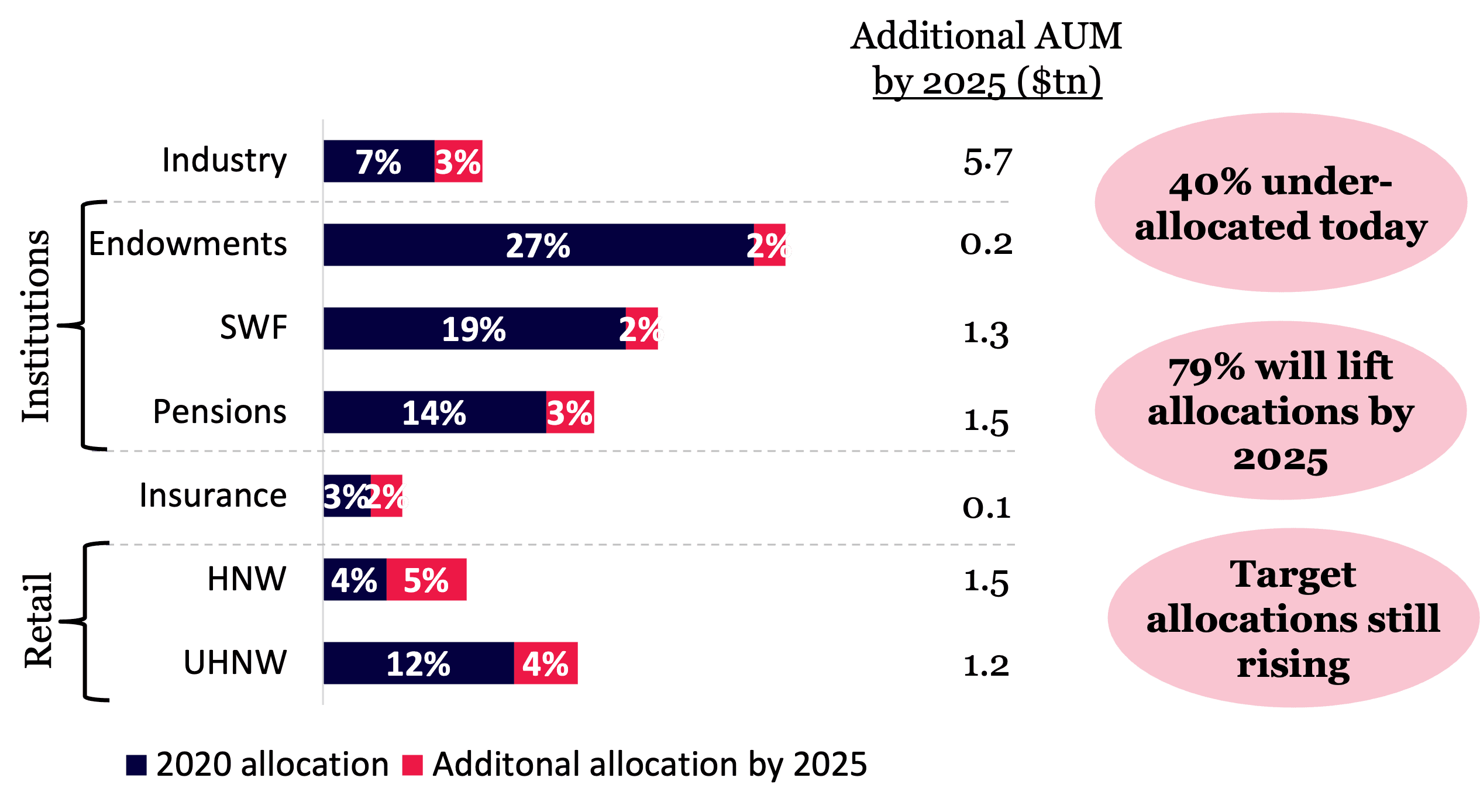

Allocation to private markets by investor type

Percent of portfolio value

Source: McKinsey, Morgan Stanley, Preqin

Allocations to private markets are also expected to surge in the next few years, with allocations set to increase from 7% of portfolios to 10% by 2025, representing an increase of almost $US6 trillion increase. That will continue with many investors, including insurers and high-net-worth (HNW) investors having lots of room to grow their target allocations.

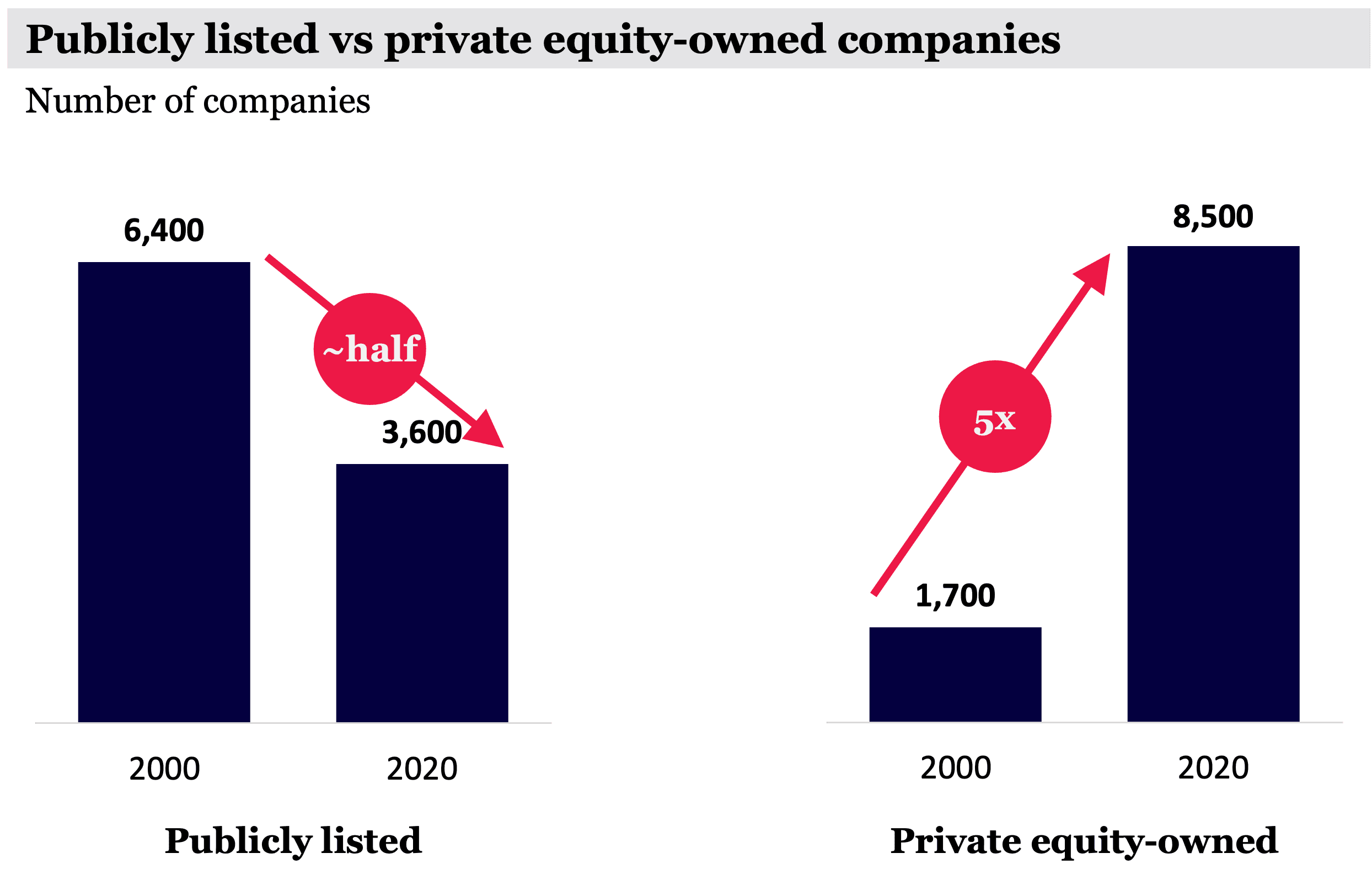

Private markets continue to offer numerous amazing opportunities. Since 2000, the number of publicly listed companies has halved. It now sits below the number of companies owned by private equity, which has increased five-fold over the same period.

Higher returns and lower risk

The best investment opportunities are also staying privately owned for longer. Today there are more than 800 so-called unicorns, privately owned businesses with billion-dollar-plus valuations, with a total worth of $US3 trillion. While Amazon listed after just three years, Airbnb and Uber waited a decade or more to IPO. Most of their combined $US180 billion of market cap has accrued to private investors.

Higher returns with lower risk

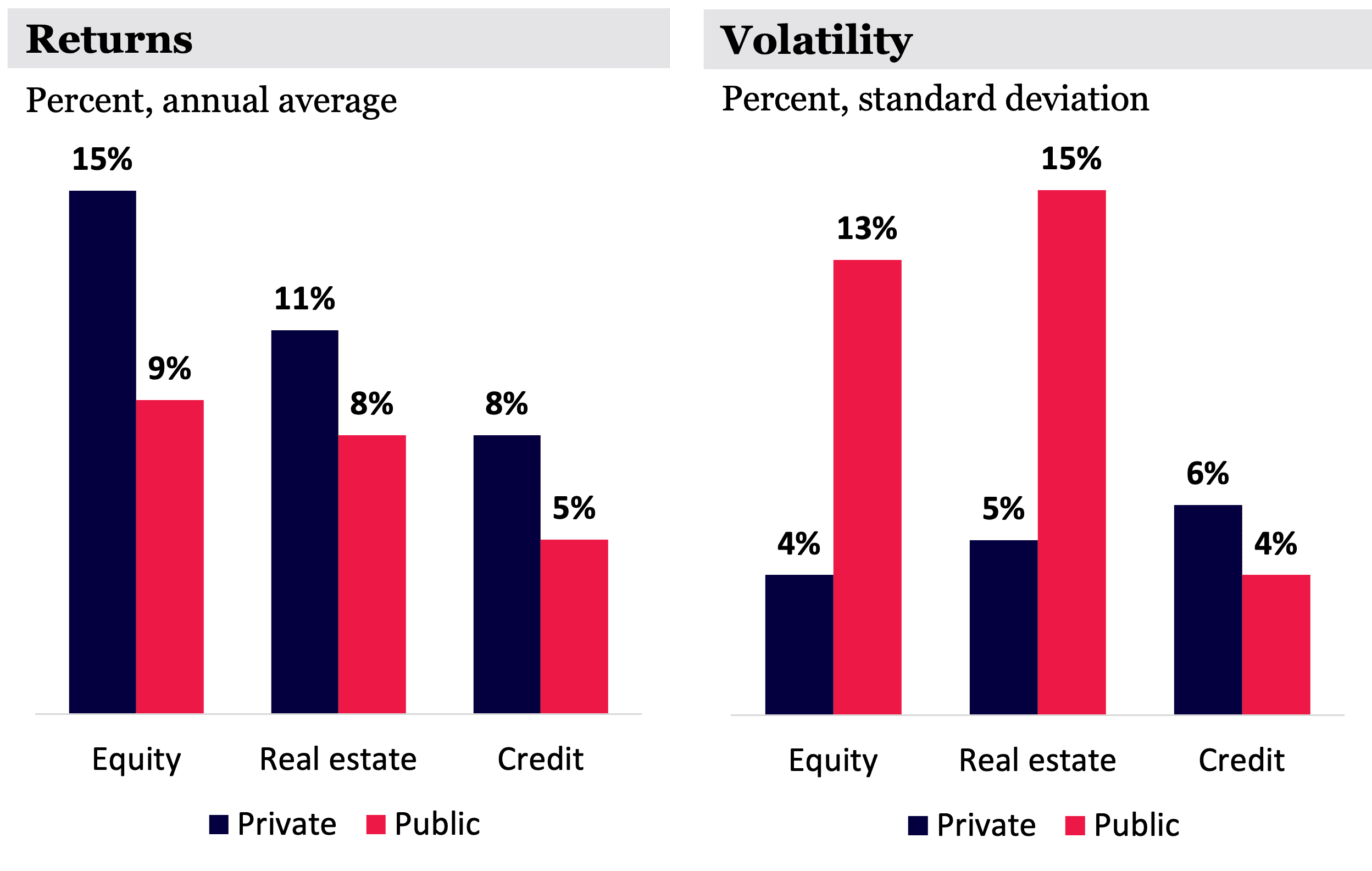

Source: Petershill

Private market opportunities are spreading to other geographies, to different asset styles and new asset classes like credit and real estate. And on average, private markets have materially outperformed their public market counterparts across all asset classes, typically with much less volatility and risk.

Private markets returns are vital in a world of low, no, or even negative interest rates. Investors that need high, stable returns without taking on more risk are turning away from traditional bond and stock portfolios towards private assets.

A better, simpler option

Source: Redburn

But despite this growth and opportunities, many Australian investors, particularly, are underallocated to private markets. Many believe private markets are difficult to access and even enigmatic: the preserve of the ultra-rich and highly sophisticated investors.

Investors might think the logical response to opportunities in private markets would be to overcome this block by investing in a private equity fund or even venture capital. But how would you get into a fund like this? And how would you know which fund is the right one amongst thousands?

The good news is there is a better and simpler way to participate in the tremendous growth and value creation in the global private market universe: investing in the select group of giant, listed private market asset managers – KKR, Carlyle, Apollo, Ares, and particularly Blackstone — that are shaping the space and leading its development.

These giants sit at the centre of the swelling universe of private markets. On one side are big investors – such as institutions and insurers – who have poured more than $US7 trillion of funds into the space. On the other side are thousands of private capital funds – across private equity, private credit, and real assets (such as real estate and infrastructure) — that have been generating outsize returns for years. And in the middle are the largest asset managers, shaping the industry and profiting from its expansion.

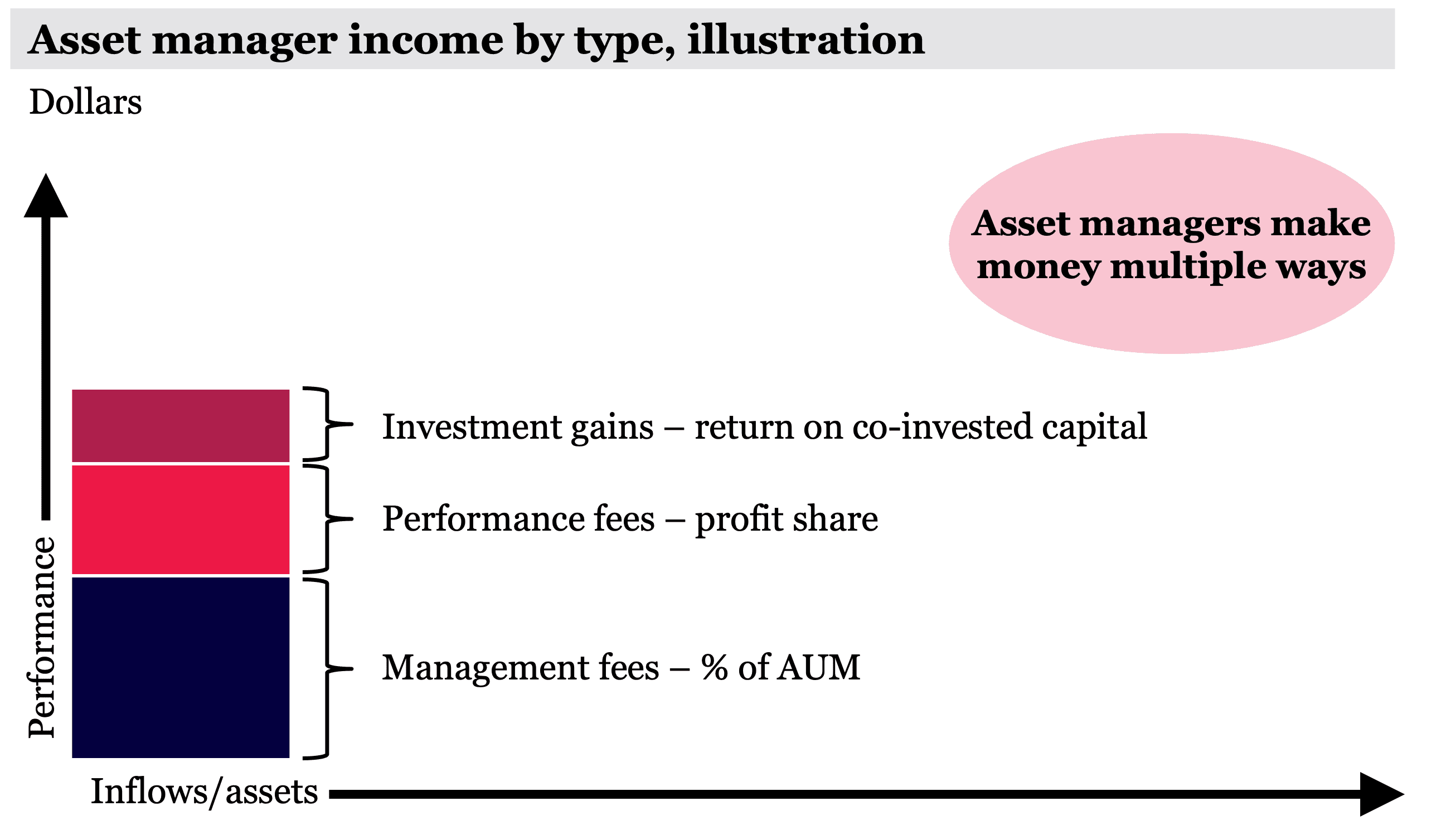

Multiple ways to make money

Source: Montaka

The giants can take advantage of both the fast-growing demand for private funds and the high returns these funds can achieve because they make money in several ways. First, they charge management fees as a percentage of the assets they manage. So, when assets go up with performance or investor capital comes in, so do these fees. They also take a profit share, which rises with better performance and more assets too. And they often also make gains from investing their own capital into their funds.

The giants dominate the industry. While there are more than 11,000 private market asset managers worldwide, just five of them command almost 30% or more than $US2 trillion of the industry’s assets.

The giants are also benefiting from a flight to quality. Investors are putting more of their money with the biggest and the best firms that have performed well, earned their trust, and become a one-stop shop for all their private investing needs. That’s allowed them to grow investor capital the fastest, attract most capital into their funds, and grow profits quickest in the industry.

The Blackstone bonanza set to continue

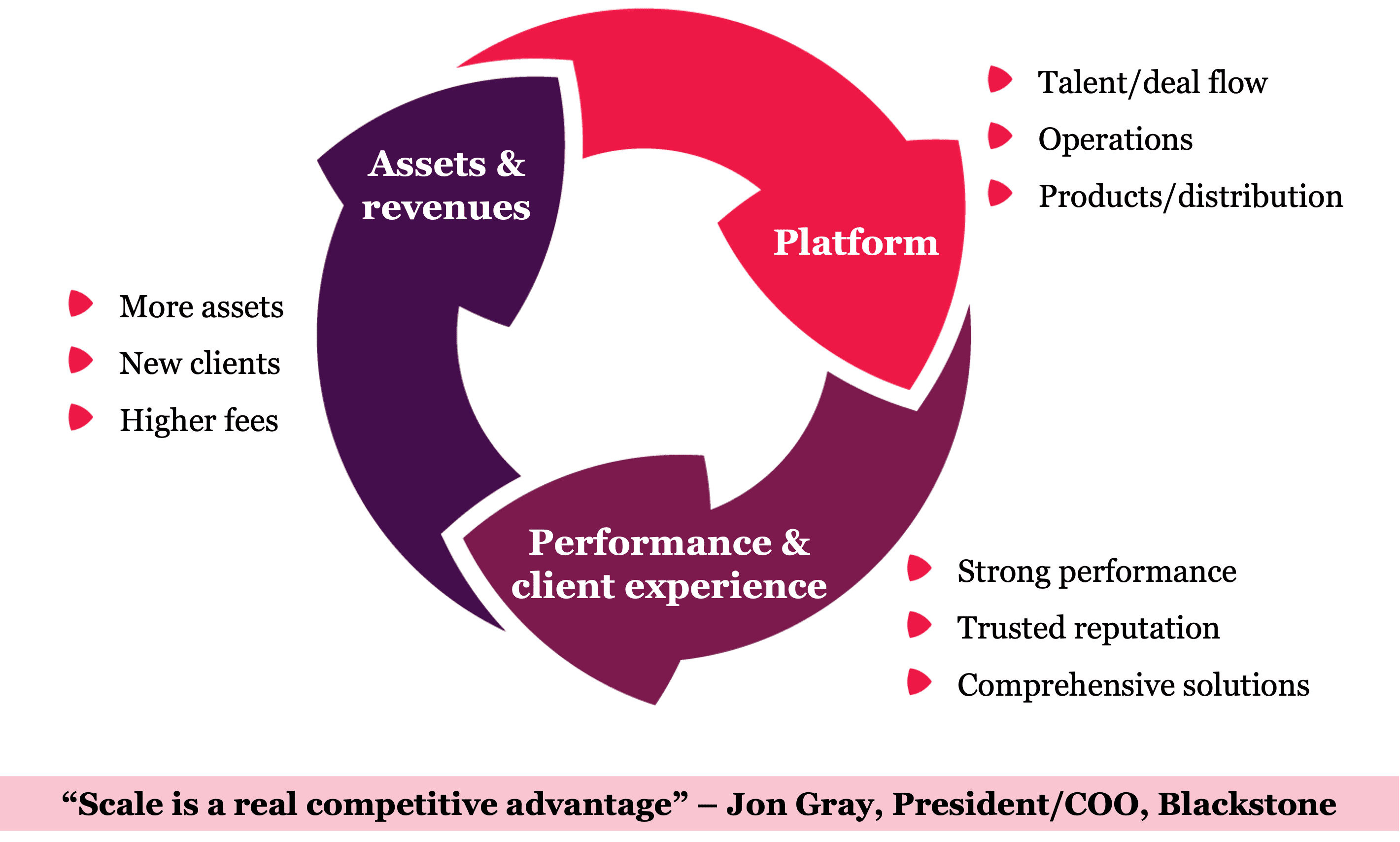

Blackstone’s flywheel of success

Source: Montaka

As we’ve outlined in the past, of the private market giants, our preferred player is Blackstone, the world’s number one player with $US731 billion of assets under management across all asset classes. The company has grown its assets under management by 16% per annum for the last decade. It has created a ‘flywheel’ where its success allows it to attract the best talent and best deals, that lead to further success. Blackstone has been a 10-bagger in the past ten years, and we think there’s more to come because the market is still overlooking Blackstone’s earnings power. The stock is trading at just 8 times future earnings power.

If investors add the private market giants to their portfolios, as we have for some time at Montaka, they can expect strong compound gains for the next decade and beyond.

Note: Montaka owns stocks in Blackstone

Chris Demasi is a Portfolio Manager with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

Barbarians in your portfolio: The best way to access the private markets boom

– Chris Demasi

In early October, cousins Henry Kravis and George Roberts announced they were retiring from their co-CEO roles at KKR, the global private equity giant. Kravis and Roberts are investment legends. They pioneered the technique of launching leveraged corporate buyouts (LBOs) of crusty conglomerates, then making billions breaking them up. Their method was made infamous in the book and HBO movie Barbarians at the Gate, which covered their bitter takeover battle for tobacco and biscuit giant RJR Nabisco.

KKR have gone from barbarians to angels and are now firmly part of the financial establishment, managing $US429 billion of funds. KKR’s ascent reflects the broader growth of private capital markets. In the past two decades, private capital markets have surged 10-fold to become a massive $US7.2 trillion industry.

Amazing opportunities

Global private markets AUM

US$ trillions

Source: Petershill, Preqin, Redburn

As more investors discover private markets offer better opportunities and higher returns, they’re expected to surge to $US13 trillion of assets under management by 2025. Private markets have huge room to grow. They are just a fraction of the world’s investments today.

The value of all private equity funds, for example, is $US4.5 trillion, just 4% of all the world’s publicly listed companies. Private real estate makes up just 4% of all global real estate assets; and private infrastructure is just 6% of total project funding.

Allocation to private markets by investor type

Percent of portfolio value

Source: McKinsey, Morgan Stanley, Preqin

Allocations to private markets are also expected to surge in the next few years, with allocations set to increase from 7% of portfolios to 10% by 2025, representing an increase of almost $US6 trillion increase. That will continue with many investors, including insurers and high-net-worth (HNW) investors having lots of room to grow their target allocations.

Private markets continue to offer numerous amazing opportunities. Since 2000, the number of publicly listed companies has halved. It now sits below the number of companies owned by private equity, which has increased five-fold over the same period.

Higher returns and lower risk

The best investment opportunities are also staying privately owned for longer. Today there are more than 800 so-called unicorns, privately owned businesses with billion-dollar-plus valuations, with a total worth of $US3 trillion. While Amazon listed after just three years, Airbnb and Uber waited a decade or more to IPO. Most of their combined $US180 billion of market cap has accrued to private investors.

Higher returns with lower risk

Source: Petershill

Private market opportunities are spreading to other geographies, to different asset styles and new asset classes like credit and real estate. And on average, private markets have materially outperformed their public market counterparts across all asset classes, typically with much less volatility and risk.

Private markets returns are vital in a world of low, no, or even negative interest rates. Investors that need high, stable returns without taking on more risk are turning away from traditional bond and stock portfolios towards private assets.

A better, simpler option

Source: Redburn

But despite this growth and opportunities, many Australian investors, particularly, are underallocated to private markets. Many believe private markets are difficult to access and even enigmatic: the preserve of the ultra-rich and highly sophisticated investors.

Investors might think the logical response to opportunities in private markets would be to overcome this block by investing in a private equity fund or even venture capital. But how would you get into a fund like this? And how would you know which fund is the right one amongst thousands?

The good news is there is a better and simpler way to participate in the tremendous growth and value creation in the global private market universe: investing in the select group of giant, listed private market asset managers – KKR, Carlyle, Apollo, Ares, and particularly Blackstone — that are shaping the space and leading its development.

These giants sit at the centre of the swelling universe of private markets. On one side are big investors – such as institutions and insurers – who have poured more than $US7 trillion of funds into the space. On the other side are thousands of private capital funds – across private equity, private credit, and real assets (such as real estate and infrastructure) — that have been generating outsize returns for years. And in the middle are the largest asset managers, shaping the industry and profiting from its expansion.

Multiple ways to make money

Source: Montaka

The giants can take advantage of both the fast-growing demand for private funds and the high returns these funds can achieve because they make money in several ways. First, they charge management fees as a percentage of the assets they manage. So, when assets go up with performance or investor capital comes in, so do these fees. They also take a profit share, which rises with better performance and more assets too. And they often also make gains from investing their own capital into their funds.

The giants dominate the industry. While there are more than 11,000 private market asset managers worldwide, just five of them command almost 30% or more than $US2 trillion of the industry’s assets.

The giants are also benefiting from a flight to quality. Investors are putting more of their money with the biggest and the best firms that have performed well, earned their trust, and become a one-stop shop for all their private investing needs. That’s allowed them to grow investor capital the fastest, attract most capital into their funds, and grow profits quickest in the industry.

The Blackstone bonanza set to continue

Blackstone’s flywheel of success

Source: Montaka

As we’ve outlined in the past, of the private market giants, our preferred player is Blackstone, the world’s number one player with $US731 billion of assets under management across all asset classes. The company has grown its assets under management by 16% per annum for the last decade. It has created a ‘flywheel’ where its success allows it to attract the best talent and best deals, that lead to further success. Blackstone has been a 10-bagger in the past ten years, and we think there’s more to come because the market is still overlooking Blackstone’s earnings power. The stock is trading at just 8 times future earnings power.

If investors add the private market giants to their portfolios, as we have for some time at Montaka, they can expect strong compound gains for the next decade and beyond.

Note: Montaka owns stocks in Blackstone

Chris Demasi is a Portfolio Manager with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.

This content was prepared by Montaka Global Pty Ltd (ACN 604 878 533, AFSL: 516 942). The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. You should read the offer document and consider your own investment objectives, financial situation and particular needs before acting upon this information. All investments contain risk and may lose value. Consider seeking advice from a licensed financial advisor. Past performance is not a reliable indicator of future performance.

Related Insight

Share

Get insights delivered to your inbox including articles, podcasts and videos from the global equities world.