Why Competitive Advantages Matter – And How Flywheels Make Them Stronger

How do companies like Spotify and Blackstone dominate their industries? Montaka’s “flywheel” model reveals the self-reinforcing cycles that strengthen competitive advantages—and how investors can spot them early.

Revolutionary ‘coding agents’ are creating even more upside for big tech

When Andrew Macken asked an AI coding agent to recreate his app in minutes—for free—he realized software development will never be the same. From Alphabet to Meta, companies are already using AI to cut costs and accelerate innovation. Here’s what investors need to know…

Looks can be deceiving: Why equities are more attractive than they appear

By adjusting for outlier companies and considering R&D spending’s impact on earnings, a clearer picture of equity value emerges, challenging the ‘expensive equities’ narrative.

When you factor in R&D, innovator stocks like Amazon and Meta are still on sale

Discover how high R&D spending can make innovative companies like Meta and Amazon appear more expensive than they are. Learn about the ‘Raise & Distort’ effect and why these stocks might still be on sale.

The dangers of simple ‘rule of thumb’ PE valuations in today’s market

Ever wondered if a stock trading at 25x is overvalued? Think again! We dive deep into ‘first principles’ thinking to reveal why some of the world’s best companies might actually be undervalued even at high multiples.

5 steps to evolve your investing in the right direction

Investing is a continual evolution and involves learning and extracting the right lessons. Are you looking for ways to enhance and improve your investing strategy? This article covers 5 key steps for advancing your investment strategy in the appropriate direction.

Why Buffett is Buying: 3 perspectives that show stocks are still cheap

In this article, we will explore the investing environment that led the legendary investor Warren Buffet to purchase more stocks in 2022 than in the previous 15 years combined. Despite the popular belief that stocks are expensive and corporate bonds are cheap, Amit Nath, the Director of Research at Montaka, presents three vital valuation perspectives that contradict this notion. These include the Equity Risk Premium (ERP), Corporate bond spreads, and how to measure them with the help of NYU professor Aswath Damodaran.

5 charts that should give investors hope amidst market turmoil

The year so far has been quite shocking for investors who are probably wondering when the turbulence will end. Given that, we take a step back and look at 5 key charts that provide some perspective on the current environment for investors.

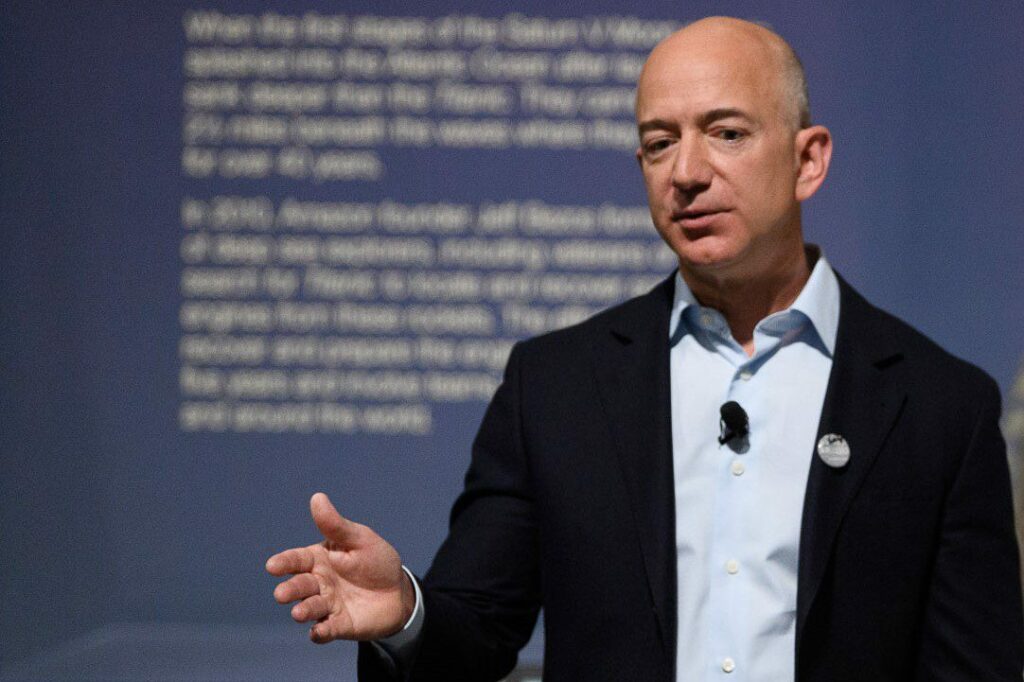

How Amazon founder Jeff Bezos’ shareholder letters made me a better investor – 7 lessons learnt

Investment legend James Anderson said something interesting: that an investor today needed to read not just Buffett’s words, but also the shareholder letters of Amazon founder, Jeff Bezos. I took note of Anderson’s tip and immersed myself in Bezos’s shareholder letters, getting inside the great man’s thinking, and here’s what I learnt.

Why have investors become theme junkies?

In today’s high-gratification world, it is natural for investors to chase these intellectual hits and gravitate towards sources of new themes. The only problem is, it remains far from clear if these new themes are even themes at all.