|

Getting your Trinity Audio player ready...

|

At Montaka, we believe a little diversification makes a lot of sense; and a lot of diversification makes little sense. Through this lens, Montaka always remains somewhat globally diversified – but via a handful of concentrated clusters of exposure in areas in which we see opportunities.

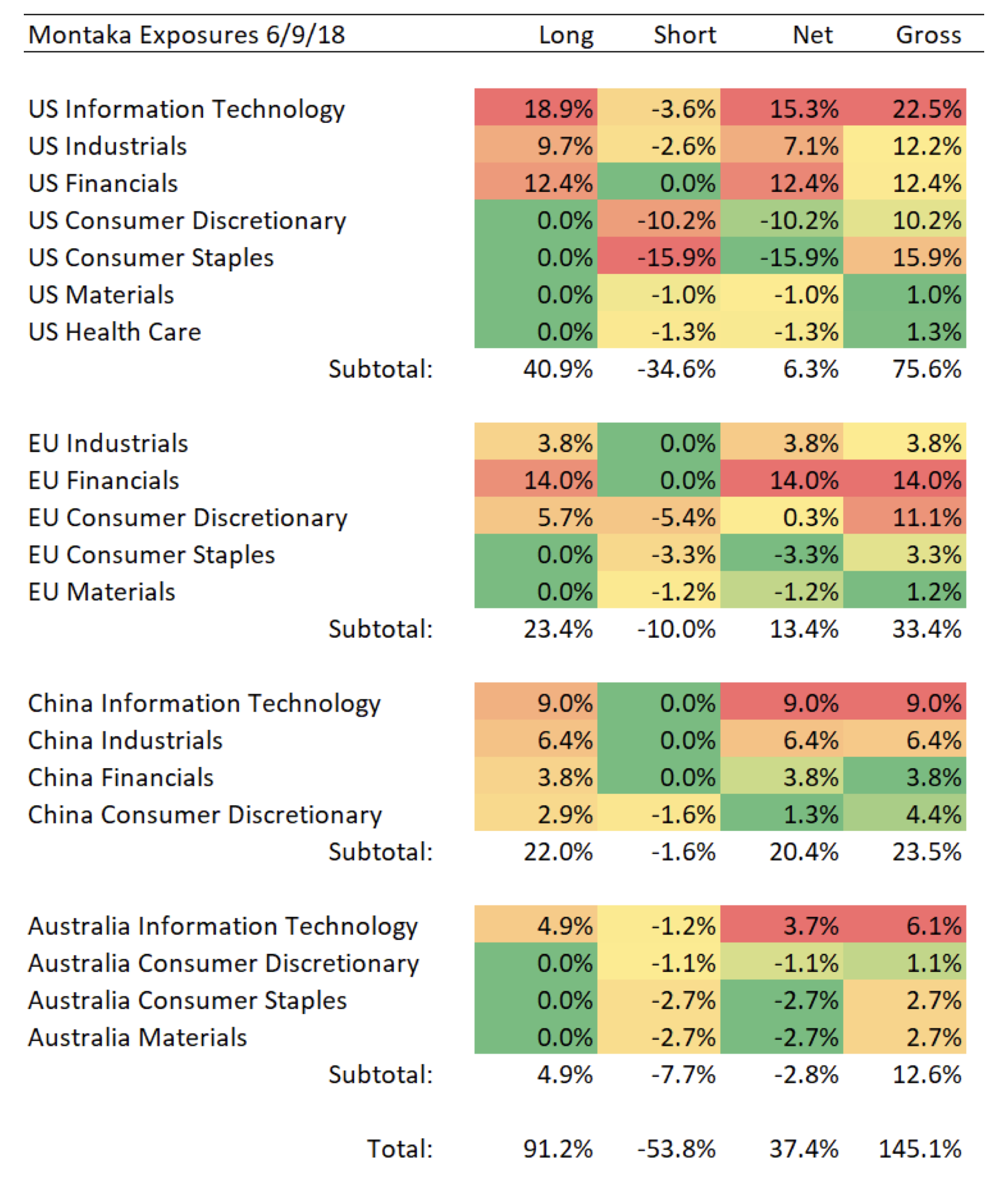

The table shown below illustrates this concept. It shows the aggregated exposures Montaka has to different sectors in different geographies (measured in percent of NAV). As can be observed, as of September 6, 2018, major clusters of exposure included:

- US tech (long) 19%

- US financials (long) 12%

- Chinese (long) 22%

- Chinese tech (long) 9%

- US consumer staples (short) -16%

- US consumer discretionary (short) -10%

- US (short) -35%

While we view every stock in Montaka’s portfolio as having its own company-specific thesis, it is important to monitor the aggregated exposures of the portfolio. Why? Because adverse market rotations can leave the portfolio exposed. And that has been Montaka’s unfortunate experience over the last few weeks.

MARKET ROTATION

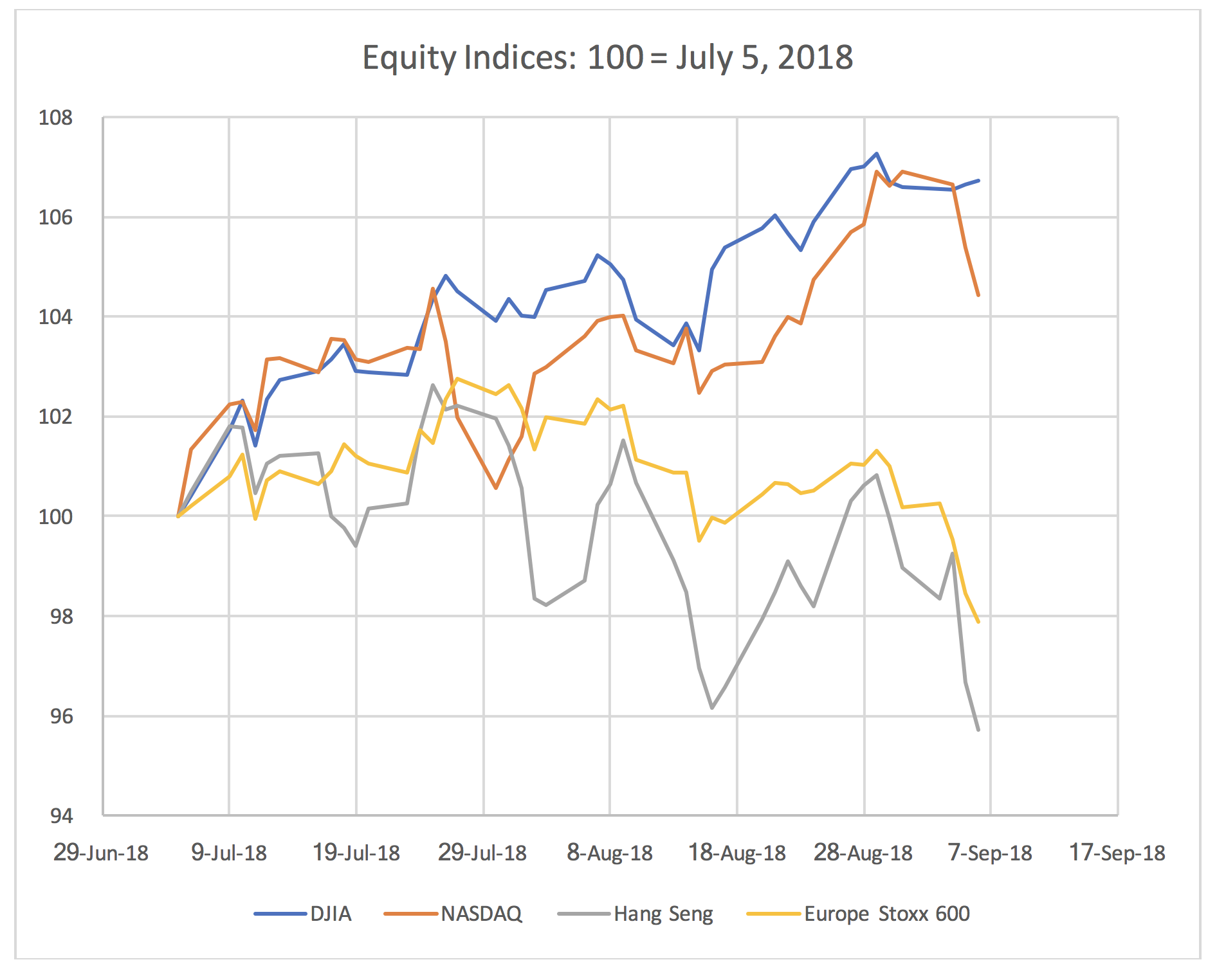

Shown below is a chart that compares the performance of key equity indices by region:

- Dow Jones Industrial Index (US non-tech)

- Nasdaq (US tech)

- Hang Seng Index (Hong Kong equities)

- Europe Stoxx 600 (European equities)

What we can observe is that US equities have materially outperformed Asian and European equities. Given Montaka’s exposure clusters – which includes net long Asia, net long Europe and more neutral US exposures, shown above, one can see that this market rotation would naturally lead to some difficult performance. And it has.

ASSESSING THE SITUATION

Market rotations include indiscriminate selling and buying of large groups of stocks based on specific factors, such as geography or industry. They are often temporary in nature because indiscriminate selling and buying of stocks typically result in stock mispricings which reverse subsequently over time. That said, a rotation with any degree of persistency needs to be managed carefully by the portfolio manager.

Our assessment of the drivers of this rotation can be simplified as follows:

- President Trump’s escalating trade war is increasing the risk aversion of global investors, especially with respect to Asian and European equities.

- US monetary policy, heightened risk aversion and the expectation of a declining US trade deficit are all pushing the US dollar higher. This in turn is wreaking havoc in some emerging market economies – especially those which have significant outstanding US dollar-denominated borrowings.

We then make an assessment as to the persistency, or otherwise, of these drivers that have led to the equity market rotation we are currently observing. Our assessment is that President Trump has a political incentive to continue to act aggressively until the Midterm Elections on November 6. Such tough action resonates well with his political base. Similarly, Chinese and European policymakers have an incentive not to back down prior to the Midterms on the basis that Democrats have a meaningful chance of taking back control of the House of Representatives. Such a win for the Democrats would significantly constrain President’s Trump’s future protectionist trade measures (and a reversal of this market rotation would likely ensue).

On this basis, the Montaka research team has assessed that the current rotation will likely persist for the next two months.

TAKING ACTION

While we believe the current rotation will be temporary from a long-term perspective, two months is long enough to warrant some degree of short-term risk management. As such, on the basis of Montaka’s positioning and the team’s analysis of the drivers and persistency of the current rotation, the following portfolio changes were made:

- Montaka’s long China exposure was reduced from 22% to 13%; and

- Montaka’s short US exposure was reduced from -35% to -27%.

For other names in the portfolio, we are using any price weakness to add to positions opportunistically.

We believe this action is decisive and will serve to reduce any pain from an extended market rotation over the coming two months. From the Midterm Elections and beyond, we will look to take advantage of the many market mispricings which are being created today.

Andrew Macken is Chief Investment Officer with Montaka Global Investments. To learn more about Montaka, please call +612 7202 0100.