|

Getting your Trinity Audio player ready...

|

For any global investor, consideration of underlying currency exposures is unavoidable. Even for managers of “fully hedged” or “fully unhedged” funds, there must still be a clear understanding and intention around the currencies to which the portfolio is being exposed at any point in time.

The following memo seeks to describe how we manage currency exposures for all investors in Montaka. In designing this approach to currency risk management, we had one simple objective in mind: we seek to deliver the best outcome possible for all investors, irrespective of their geographical origin.

The executive summary of our approach to currency risk management is provided below. Subsequently, we then elaborate on each of the components of the policy.

- In constructing our portfolio, we consider the currency exposures of the underlying earnings streams owned by the individual businesses we are long and short.

- We then view currency risk management through two lenses:

- (i) Global Currency Risk Management – which manages currency risk from the perspective of all global investors; and

- (ii) Local Currency Risk Management – which manages currency risk from the perspective of the geography-specific (e.g. Australian) investor.

Global Currency Risk Management

- When balancing the weighted average net currency exposures of our global portfolios, we are seeking to preserve global purchasing power for the underlying investor, irrespective of that investor’s country of domicile. This is achieved through a sensible level of global currency diversification.

- In addition to preserving global purchasing power, our portfolios are constructed to reflect our views on medium-term currency risks.

- Furthermore, we will take specific actions to protect our investors from potentially adverse currency movements in special situations. To date, such special situations have included:

- Hedging our underlying net GBP exposure for the 2016 Brexit referendum;

- Hedging our underlying net EUR exposure for the 2016 Italian referendum; and

- Hedging our underlying net EUR exposure for the 2017 French election.

Local Currency Risk Management

- We manage the currency risk from the perspective of the geography-specific investor.

- Specifically, we seek to provide local investors a level of protection against an appreciating local currency when we assess that local currency to be undervalued on a purchasing power parity (PPP) basis.

- Montaka has three unique unit classes: AUD, USD and EUR. Specific hedging actions of this nature can be conducted within one specific unit class without effecting the economics of other unit classes.

- Beyond the action described above, our global portfolios will remain unhedged from a local currency risk management perspective.

* * *

PORTFOLIO CURRECNY EXPOSURES

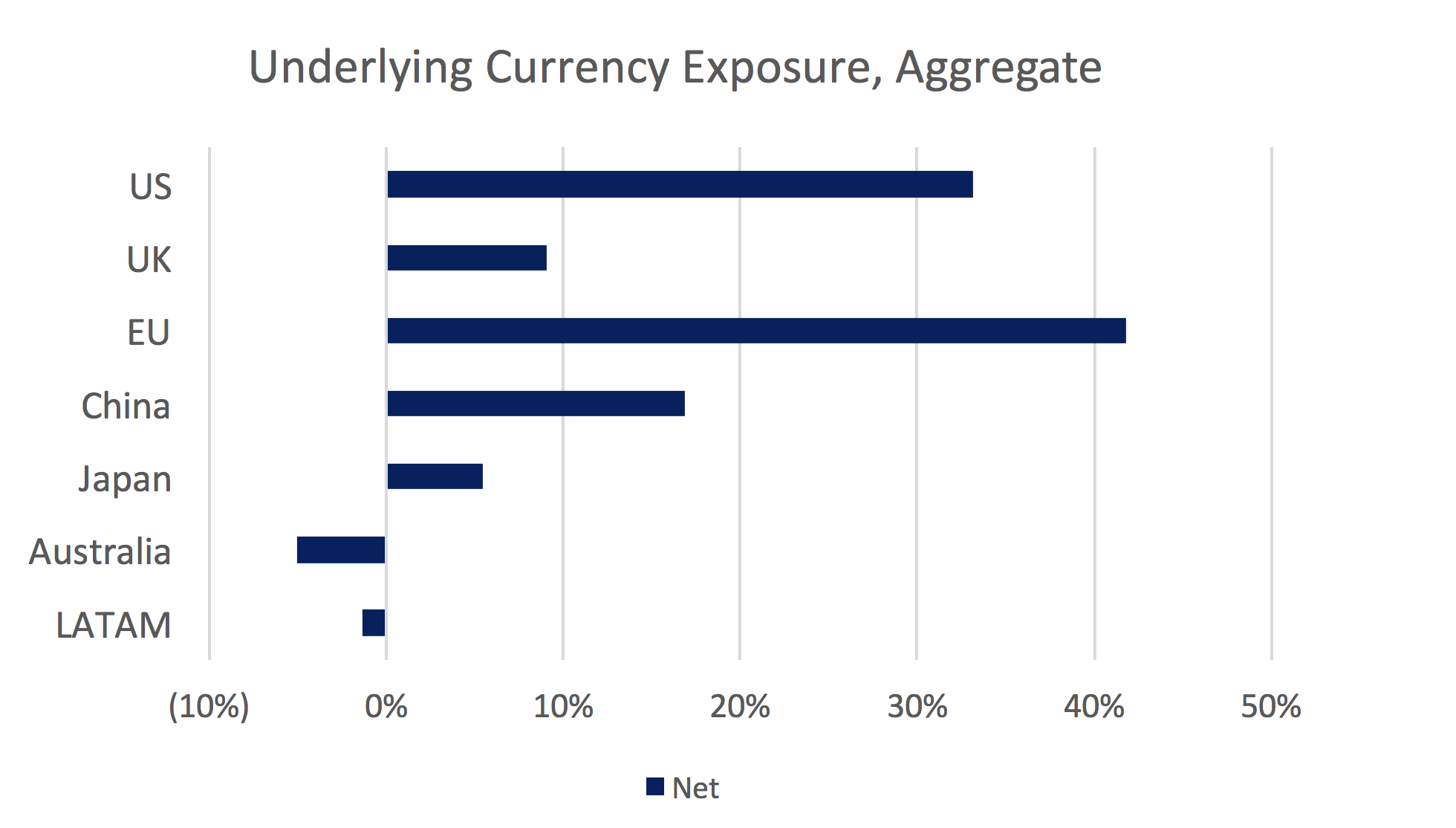

- We first estimate the currency exposures of the underlying earnings streams owned by each of the individual businesses we are long and short in Montaka’s portfolio.

- We then aggregate the currency exposures of each of these earnings streams to form an overall picture of the net currency exposures of the equities contained in our global portfolios.

- In addition, we add the currency denominations of the Fund’s cash assets.

- Shown below are the net currency exposures of Montaka as at the end of July 2017.

Source: MGIM (% of NAV; July 2017)

GLOBAL CURRENCY RISK MANAGEMENT

- The primary objective of global currency risk management is to preserve global purchasing power. This is achieved through a sensible level of global currency diversification.

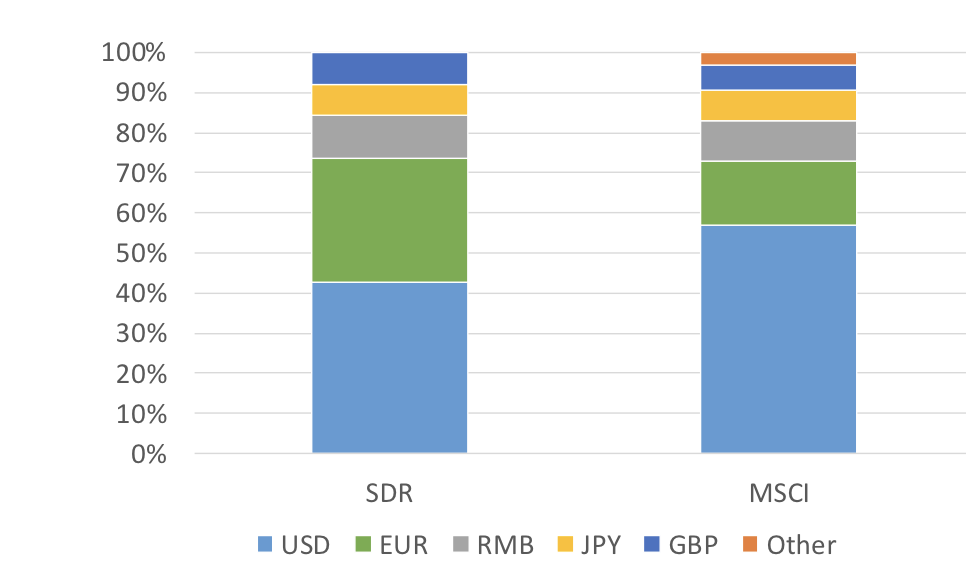

- By way of a starting point for what a sensible level of global currency diversification looks like, we examine the currency composition of: (i) Special Drawing Rights (SDRs)[1], constructed by the International Monetary Fund; and (ii) the MSCI World Total Return Index.

- As can be observed by the chart below, the two benchmarks are fairly similar with SDRs more heavily weighted towards the EUR than the MSCI.

Source: IMF (May 2017); MSCI (May 2017)

- In addition to a sensible level of global currency diversification, we seek to ensure that Montaka’s currency exposures reflect any medium-term views we have with respect to potential currency appreciation or depreciation.

- These views will be expressed in terms of specific currency overweights or underwights relative to the above benchamarks.

- Furthermore, we will take specific actions to protect our investors from potentially adverse currency movements in special situations. To date, such special situations have included:

- Hedging our underlying net GBP exposure for the 2016 Brexit referendum;

- Hedging our underlying net EUR exposure for the 2016 Italian referendum; and

- Hedging our underlying net EUR exposure for the 2017 French election.

LOCAL CURRENCY RISK MANAGEMENT

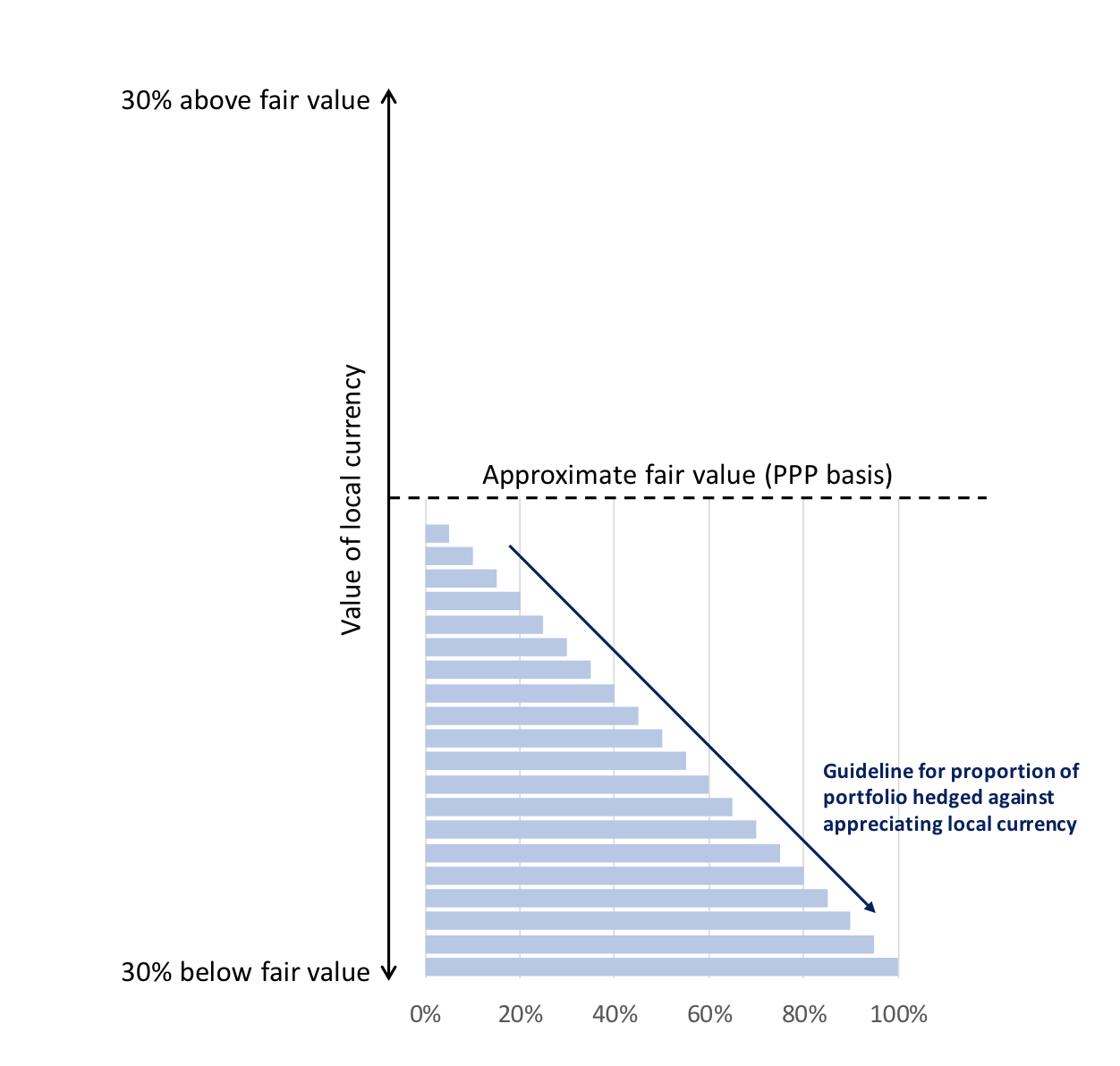

- The primary objective of local currency risk management is to provide investors a level of protection against an appreciating local currency when we assess that local currency to be undervalued on a purchasing power parity (PPP) basis.

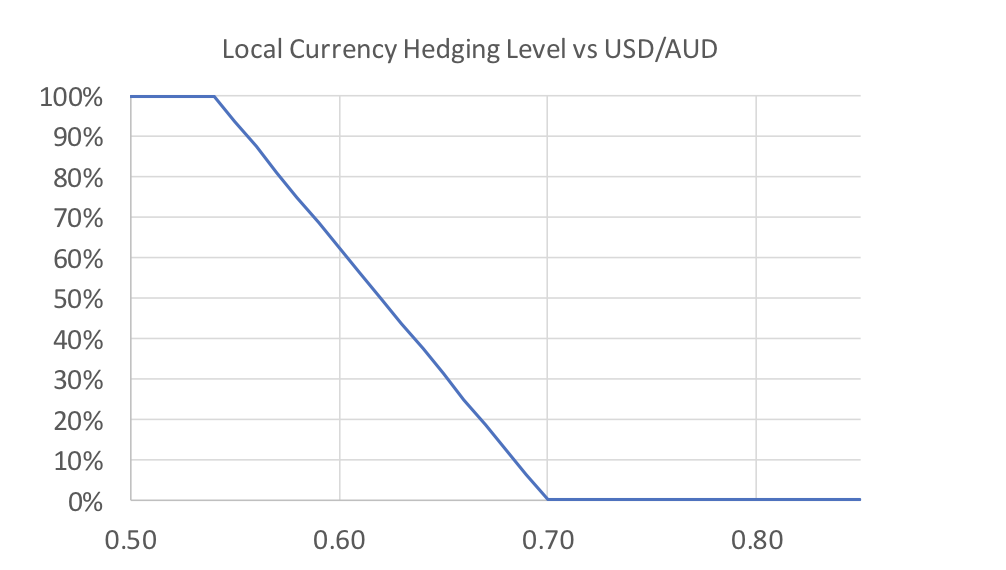

- The degree of hedging increases as the local currency becomes more undervalued, as illustrated by the chart below.

- We have determined that, at around 30% undervaluation, we deem this to be an approximate extreme. At this point, we would expect Montaka to be fully-hedged against an appreciating local currency for those geography-specific investors.

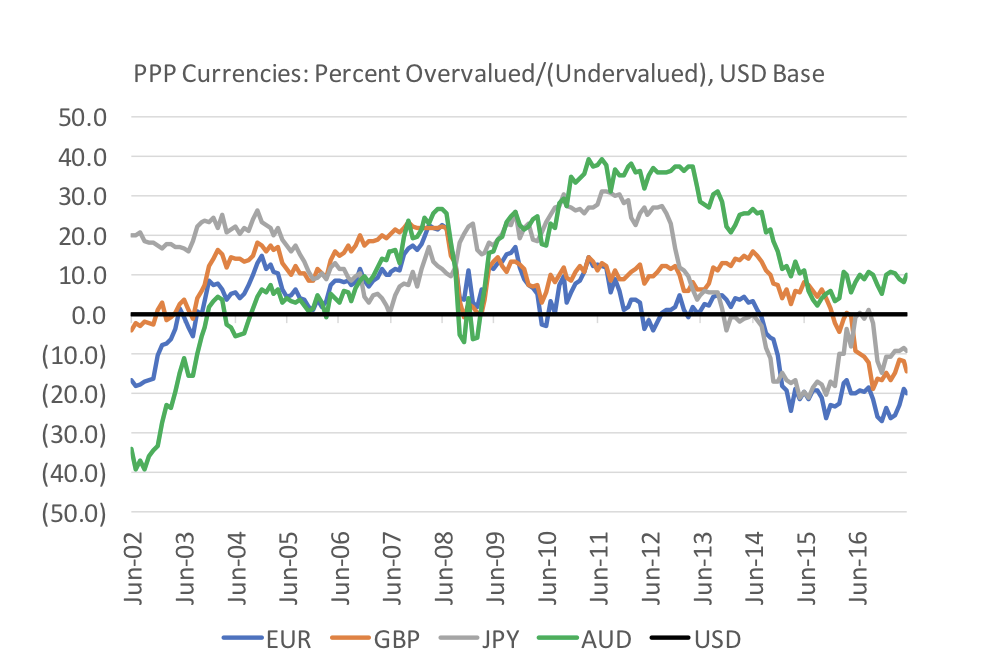

- As illustrated below, historical undervlaution/overvaluation relative to the USD (PPP-basis) is bound at around 30-40%.

Source: Bloomberg

- The methodology we adopt to estimate the “fair value” of a local currency is primarily based on PPP-implied levels.

- For example, we note the following for the AUD:

- Based on the chart above, the AUD is approximately 10 percent overvalued relative to the USD on a PPP basis. This implies fair value is approximately: 1 USD = 1.43 AUD (or 1 AUD = 0.70 USD).

- This implies a 30% undervaluation level of approximately 1 USD = 1.85 AUD (or 1 AUD = 0.54).

- We also note that the Reserve Bank of Australia intervened at 1 AUD = 0.60 USD in October 2008.

- Based on the above parameters, we arrive at the following hedging guideline for investors in the AUD unit class of Montaka:

Source: MGIM

- To date, we have not conducted local currency hedging operations in Montaka on the basis that: (i) currently all of Montaka’s investors are in the AUD unit class; and (ii) the AUD has not been undervalued enough to warrant local currency hedging, based on our assessment.

[1] The SDR is an international reserve asset, created by the IMF in 1969. The basket composition ensures that it reflects the relative importance of currencies in the world’s trading and financial systems.

Andrew Macken is a Portfolio Manager with Montgomery Global Investment Management. To learn more about Montaka, please call +612 7202 0100.