The GME Saga

Just like any hot stock that disconnects from fundamentals in an extreme way, it becomes a ticking time bomb before it crashes back down to reality. It’s unclear where the GameStop stock will trade over the coming days and months, but trees don’t grow to the sky.

Will this new Game ever Stop?

GameStop was one of a number of stocks identified on Reddit as being highly-susceptible to a short-squeeze. In the month of January 2021, GameStop (NYSE: GME), increased by more than 1,600%, from $19 to $325 per share.

Can high profit margins hurt?

Much has been written about Kraft Heinz (NASDAQ: KHC): a business which names Warren Buffett’s Berkshire Hathaway as its largest shareholder and one with a stock price that has declined by around 70 percent over the last two years. But the recent New York Times piece on the business is worth a read as much […]

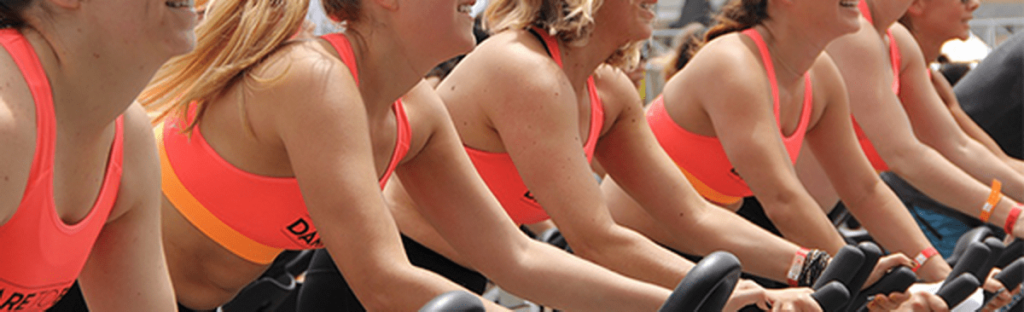

Is Peloton an Apple?

Peloton, the premium Connected Fitness company that sells $2,000 stationary bikes and $4,000 treadmills, recently filed its S-1 for an IPO. One of the more interesting investor debates taking place is whether Peloton is a hardware company or a subscription service. Peloton bears argue that the company is selling overpriced commodity hardware, while the bulls […]

A little bit of our own auditing

Last week George Hadjia wrote an insightful piece that detailed Sports Direct’s difficulties when it comes to retaining and recruiting an auditor and reiterated our short thesis on the company’s stock. You can read it here. This week I want to go a little deeper into an accounting ‘misperception’ that contributes to the short thesis. Over […]

Why short assertions lack the gravitas they used to possess

Jemima Whyte, Jonathan Shapiro and Vesna Poljak published an article in the Australian Financial Review which elaborates Montaka CIO Andrew Macken’s views about why short sellers are increasingly being discredited thanks to quickly dished out half-baked research efforts. Typically, good short reports take a couple of months to play out. Read more on this by clicking here.

Beware When the Auditor Says No Thanks

Envision a scenario where a firm’s auditor declines to be reappointed, and the firm subsequently struggles to find a replacement auditor. Furthermore, that same company asks the government for clarification around the powers of the secretary of state to appoint an auditor to a public company in the event that no replacements can be found. […]

New Media tries to buy time at a high cost

Last Monday, New Media Investment Group, the listed holding company of GateHouse Media, formally announced the previously leaked acquisition of Gannett Co. in a deal that would combine the number one and two publishers of newspapers in the U.S. by circulation volume. In a classic case of buy the rumour, sell the news, positive sentiment […]

What’S (o)up at Campbell’s

The Montaka funds have a long history on the short side of Campbell’s Soup. We’ve researched the company almost since the funds launched four years ago and initiated a short position in Campbell’s stock around three years ago. Over this period our position size has varied, but we have constantly been concerned about Campbell’s highly […]

Who profits from online groceries?

As many millennials are now reaching the age at which they start to take over the grocery shopping responsibilities, it is not surprising to observe significant growth in demand for online shopping. On the one hand, this is nothing new: we have seen the ongoing shift to online shopping across many lines of retail. On […]