|

Getting your Trinity Audio player ready...

|

– Andrew Macken & Chris Demasi

We are delighted to round out another strong year for our unitholders.

It is now nearly five years since we substantially enhanced Montaka’s investment formula and capabilities, and those improvements have pleasingly manifested in this year’s strong performance.

As regular readers will know, our investing formula is to identify high probability, ‘advantaged’ long-term winning businesses that are well positioned to benefit from large structural transformations. And we want to own these businesses only while they remain undervalued.

This formula is an evolution from where we started a decade ago. Historically, we were more traditional value investors – focused on valuing cash flows that we could forecast with some degree of confidence, and buying these for less than their intrinsic value. Today, while we retain our discipline around valuation, and continue to remain mindful of risks (including business risk, market risk, and risks of inflation diminishing real capital), we’ve narrowed our focus to advantaged businesses within large structural transformations.

History shows that equity markets routinely underestimate the value of businesses that can reliably grow for extended periods. As growth persists for longer than expected, outsized stock price appreciation quickly follows as the market upgrades its forward-looking growth expectations. This cycle of ‘underestimation-surprise-upgrade’ can repeat itself over and over again.

But growing reliably over long time horizons is unusual. Only truly advantaged businesses have a chance of achieving this valuable feat. Which is why Montaka is so focused on strong, sustainable business advantages.

We don’t mind in which industry these advantages exist. We own businesses in financial services, retail, luxury, technology, and healthcare, for example.

* * *

Owning business advantages, not technology, in AI

One of the major themes of today, obviously, is AI, and it provides a great example of how we own companies with clear business advantages.

As our landmark white paper attests, we were comparatively early in identifying AI as an important investment theme and we have built deep expertise on the technology over many years. Yet, despite the torrent of new and wonderful technological developments within the AI space we remain committed to identifying and owning business advantages, not technologies, per se.

Business advantages are valuable attributes that cannot be easily replicated by competitors. There aren’t many. And breakthroughs in new technologies are typically not advantages because they can be quickly copied by competitors. (Indeed, new technologies, including AI, often represent disruption risks for many businesses – that we strictly seek to avoid).

Business advantages in AI include:

- Economies of scale in the delivery of compute required to train and deploy AI-infused applications. (This favors the ‘hyperscalers’, including Amazon, Microsoft, Alphabet, which we expand on further below).

- Embedded distribution channels to captive customers through which new value-adding AI services can be delivered. (In the enterprise space, for example, this favors ServiceNow and Salesforce; and in the consumer space, Spotify and Meta).

Despite only just scratching the surface of its potential, today’s AI models are already rapidly driving down the effective marginal cost of ‘intelligence’ towards zero. This is catalyzing an infusion of AI into nearly all aspects of life and the broader economy. But only those businesses with sustainable advantages, including those highlighted above, stand to benefit disproportionately from this transformation.

Concentrated and patient

Montaka’s investing formula doesn’t only deal with what to own, and why. It is clear about how we own these businesses: that is, how we design and manage Montaka’s portfolio.

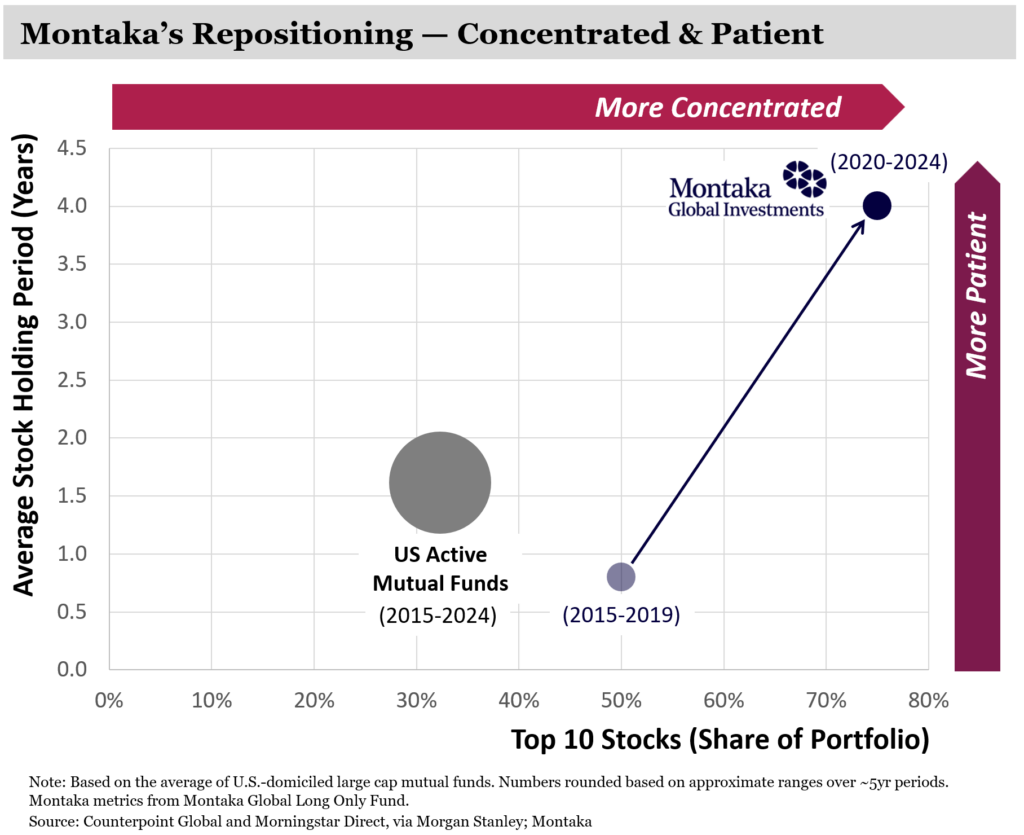

2025 will mark the five-year anniversary of Montaka’s evolved portfolio construction philosophy, when, as mentioned, we moved to the concept of owning relatively few, outsized, long-duration investments. Based on our performance, this formula has greatly enhanced Montaka’s investment capability.

When we repositioned five years ago, we did it knowing that when we made big capital allocations to our best ideas, and then nurtured them with extreme patience (understanding that all great investments draw-down significantly every third year, on average[1]), we had a high probability of delivering outstanding long-term returns.

Our investing formula is backed by empirical and academic evidence which shows that only highly-concentrated and patient investment strategies tend to substantially outperform over the long-term.

And yet, remarkably few investment managers practice this theory. That’s because this formula will almost certainly result in strong deviations in performance from the broader market. With such a high degree of focus placed on month-to-month, relative performance by our industry, most investment managers simply cannot tolerate wide deviations from the market – even if it is at the expense of better long-term returns.

Perversely, we are grateful for this structural quirk of the investment management industry. Indeed, it is likely due to the dearth of managers pursuing our ‘concentrated and patient’ formula that long-term investment opportunities routinely persist to begin with.

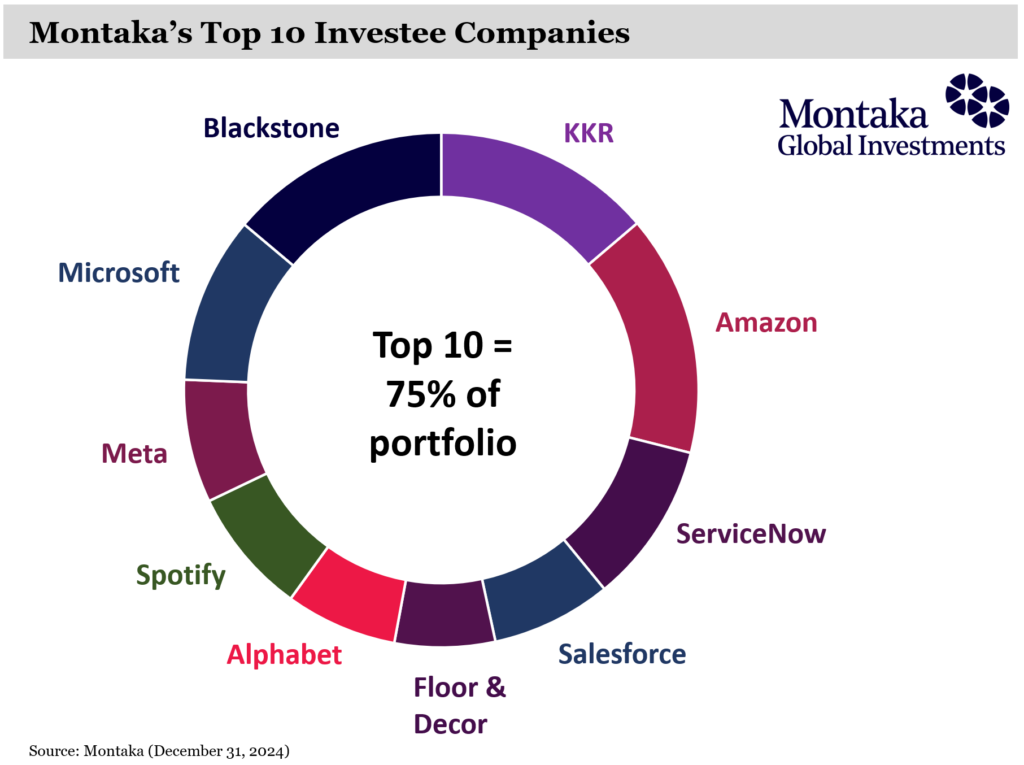

Our top 10 investee companies account for 75% of Montaka’s total portfolio. And our annual portfolio turnover is approximately 25% (representing ~4 year holding period, on average).

This combination is in stark contrast to the average of US large-cap mutual funds, for example, which have ~35% of a portfolio allocated to the top 10, and an average holding period of ~20 months.

You can see this in the chart below, along with the significant extent to which Montaka has repositioned from nearly five years ago.

Montaka’s long-term investing success depends on the successful execution of the investing formula described above. We believe Montaka’s tie-up with MFF substantially increases the probability of success.

MFF tie-up strengthens our ingredients of success

One of our most important learnings over the last decade is that long-term investing success requires more than just the right investing formula. It also requires the right conditions for that formula to be executed.

Ultimately, long-term investment returns are the result of four ingredients:

- Formula (described above),

- Culture (required to execute the Formula),

- Structure (required to enable the Culture), and

- Luck (which remains out of our control, unfortunately, but arguably reduces in significance over long time periods).

Over the last five years, enabled by the extraordinary patience of our unitholders, Montaka has substantially strengthened these ingredients. And our strong results over this period reflect these changes.

It is within this context that Montaka’s impending tie-up with MFF is so important. When we combine with MFF, it will further strengthen the ingredients listed above.

Not only will Montaka gain access to greater resources and experience; but the new ownership structure will provide the permanence Montaka needs to make and nurture the large, long-duration investments that are key to driving superior long-term compounding for unitholders.

Said another way, Montaka’s investment capability should continue to grow stronger under these new arrangements.

Outlook for 2025 and beyond: Four Cyclical Upswings

Montaka’s long-term success will ultimately stem from the identification and ownership of businesses with advantages that allow them to grow reliably for longer durations than the market expects.

What’s interesting about 2025 specifically – and we suspect quite underappreciated by many – is that, in addition to our favored structural trends continuing, four cyclical upswings that are relevant to Montaka’s portfolio are likely to emerge:

- Alternative asset monetizations,

- Enterprise deployments of AI applications,

- Government policy tailwinds, and

- A US housing rebound.

We explore these in more depth below.

1. Alternative Asset (‘Alts’) Monetizations

With a collective US$1.7 trillion in assets under management, and with access to the best talent, capital, and deals all around the world, Blackstone and KKR, two of Montaka’s largest holdings, are highly advantaged alternative asset managers.

They are uniquely positioned to benefit from three structural tailwinds that have commenced:

- The structural growth in Asian wealth combined with increasing allocation to alts in the region;

- The structural growth in US$85 trillion global private wealth allocations to alts; and

- The increasing strategic partnerships between insurers and alts managers, which unlocks access to manage the US$30+ trillion assets of the insurance industry.

These dynamics will reliably underwrite the next decade of growth for Blackstone and KKR. But there is another favorable cyclical dynamic that we expect to accelerate in 2025: monetizations. Monetizations are simply when investments that have been made historically are finally converted to cash, typically via a sale.

In October, KKR highlighted that ‘monetizations’ of historical investments had recently ticked up. Management expects these to accelerate in 2025 across the industry – a view that shared by Goldman Sachs[1] and others[2].

Monetizations turbocharge businesses, like Blackstone and KKR, in two ways:

- First, they boost the profits of the alts manager because performance fees are realized on investment gains.

- And second, as compounded capital is returned to clients, this gives the alts manager an important opportunity to raise this capital back for new funds. Capital ‘recycling’ is a primary source of funding for new vehicles and has been running at cyclical trough levels for the last two years. We believe this is about to change to the benefit of Blackstone and KKR.

2. Enterprise Deployments of AI Applications

There are multiple structural trends in the enterprise software space, including (i) the ongoing cloud migrations and digital transformations of enterprises, and (ii) the infusion of AI into software applications.

While the former remains in its early innings (80-85% of enterprise workloads still reside ‘on-premise’ – many of which will ultimately move to public clouds), the latter remains in its infancy.

Given all the hype of late, it’s hard to fathom that large-scale deployments of AI-based enterprise applications have barely even started. It’s all still to come. And we believe 2025 will be the first year that we really start to see meaningful deployments and adoption of these kinds of applications.

Consider another of our top 10 holdings, Salesforce, for example. Its revenue growth is at a cyclical low. Indeed, at just +8% per annum, as reported in the company’s most recent quarter, its rate of revenue growth has never been lower.

But in 2025, not only will price increases that were announced two years ago boost Salesforce’s revenue growth, but the year will also mark the early stages of adoption of the company’s new ‘Agentforce’ (released only weeks ago). This is a new platform that lets businesses build and deploy their own custom AI agents to automate tasks, improve efficiency, and enhance customer experiences.

Agentforce is uniquely positioned to unlock big productivity gains for customers (e.g. the cost of a $100 human call can be reduced to a $2 agent call) by leveraging a system of large language models (LLMs) that interact with unique customer knowledge sets (>200 petabytes) built up on Salesforce over the last 25 years.

Agentforce is likely to succeed across many customer use-cases, and this should substantially increase Salesforce’s total addressable market, and long-term value.

Salesforce’s core business advantages are (i) their existing mission-critical position within an enormous enterprise customer base, combined with (ii) their enormous accumulation of customer knowledge built up on the platform over decades. Through this lens, AI is a ‘multiplier’ of existing business advantages for Salesforce.

We apply the same competitive lens to fellow top 10 holding, ServiceNow, another mission-critical enterprise software platform that is rolling out new AI-enabled features to significantly boost customer productivity. Like Salesforce, we believe 2025 will be a pivotal year for the adoption of these new features.

At the heart of this AI transformation is structurally growing demand for compute – mostly supplied by the three major (and highly-advantaged) hyperscalers, Amazon, Microsoft, and Alphabet, all three of which sit in our top 10 holdings.

And while these businesses grew strongly in 2024, growth was actually constrained over this period by insufficient capacity. We expect these capacity constraints to begin to ease in 2025 as data centers are built and expanded, representing another accelerating force to growth.

3. Government Policy Tailwinds

The broader global investing environment will also likely improve cyclically in 2025. The global monetary tightening cycle has now peaked, and we are in the early days of an easing cycle – including in the US, the Eurozone, and China (collectively representing nearly 60% of global GDP) – which will likely continue in 2025.

While there is no shortage of political upheaval around the world, in 2025 we will exit a trough of ‘political dysfunction’ in the world’s largest economy, the US (to which a majority of Montaka’s portfolio is exposed).

Political dysfunction stems from the different legislative bodies being controlled by different political parties that tend to disagree on most topics.

The surprise clean sweep in the November general election, however, means that Republicans will control the White House, the House of Representatives, and the Senate, and can pass new laws with relative ease.

We expect to see a lot of new government policies enacted, including along the dimensions of tax reduction and deregulation, at least until the midterm elections in two years.

These collective conditions will benefit the shareholders of many businesses.

One of our major holdings, S&P Global, for example, which has already commenced a cyclical recovery in its Credit Ratings business, will likely see a new recovery in its Market Intelligence business as buy-side and sell-side market activity recovers.

Similarly, luxury giant, LVMH, which also sits in our portfolio, will benefit from increasing wealth levels (noting that a fresh record was recently set in the US[3]) as well as any improvement in the Chinese domestic economy – which is being increasingly supported by policymakers and growing from a very depressed base level.

To be clear, while we have taken a moment to consider what 2025 might bring, we are ultimately driven by what the longer-term future holds for these businesses. And the answer to this question remains firmly grounded by the strength and trajectory of business advantages. S&P Global’s privileged market position in Credit Ratings, for example, is almost impenetrable. Similarly, LVMH’s best brands are nearly centuries old and can never be recreated. These attributes place these businesses in unusually good stead over the long term.

4. US Housing Rebound

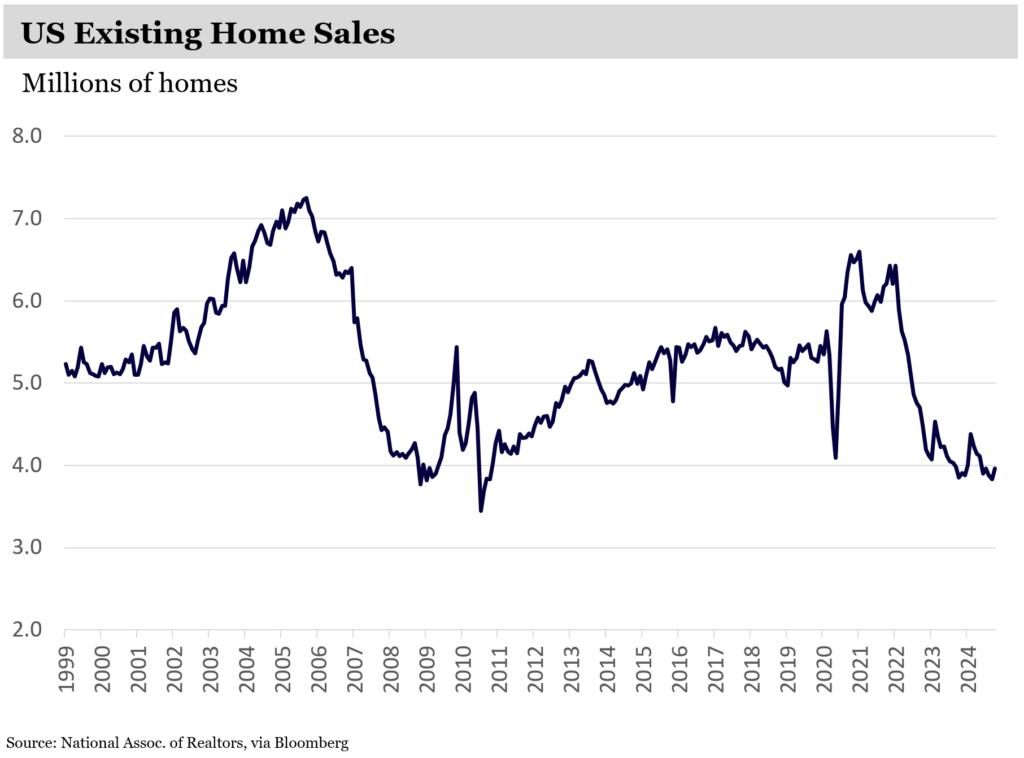

We also expect a recovery in the all-important US housing market to accelerate in 2025. It’s worth highlighting that high mortgage rates, combined with recession fears over recent years, resulted in a collapse of existing home sales.

Even today, they remain at the lows of the 2008 GFC, as shown below.

But under the hood, households are in far better financial health, on average. Indeed, most homeowners have large equity cushions in their home. Mortgage debt in the US, as a percentage of GDP, is 45%, down from a peak of 73% during the housing bust following the GFC[4].

A recovery in the US housing market would be helpful for US consumption, and the health of the broader economy. And it would be particularly potent for big-box specialist hard-surface flooring retailer, Floor & Decor (FND), a top 10 holding in Montaka’s portfolio. As home sales increase, so too does demand for home renovation inputs, including hard-surface flooring.

During the cyclical downturn of the last few years, FND has continued to build momentum in its ‘flywheel’ that builds and strengthens its scale advantages, while reducing prices and increasing value for customers. Over this period many competitors have suffered and ceded market share to FND.

As the US housing market recovers, we believe FND is positioned for accelerated growth. Not only will existing stores do better, but new stores will be rolled out more quickly. And at just 240 today, there is ample room for FND to roll out new stores, with management targeting more than 500 stores over time. Importantly, the unit economics of each store are extremely favorable.

Portfolio Positioning: Our advantaged Top10 + MongoDB Add

Below we provide the composition of Montaka’s top 10 investee companies at year end.

Consistent with our investment philosophy all these are businesses have strong – and strengthening – business advantages over their competition. They are all positioned within favorable structural transformations and tailwinds. And, even with strong recent stock price performance, they remain materially undervalued.

Said another way, we continue to see substantial long-term upside in Montaka’s portfolio.

While the bulk of Montaka’s portfolio exposures continued to remain relatively stable over the December quarter, we did undertake some modest hands-on portfolio management in the tail-end of the portfolio.

We exited three of Montaka’s smallest portfolio names: Kyndryl Holdings (at a profit), UnitedHealth Group (at a profit), and Alibaba (at a loss). While we see long-term upside in all of these names, we see more upside elsewhere. Hence, we reallocated these proceeds to (i) scale up Montaka’s investment in Alphabet on increased probabilities that its advantages in Google Search are strengthening (not to mention the group’s numerous growth options increasing in probability – from YouTube, to Waymo, and even quantum computing); and (ii) to establish an initial ‘outlier’ position in database software provider, MongoDB (MDB).

We view outliers as ‘option-like’ in that their upside potential is very large, but the probability is far less certain. On this basis, we deliberately restrict Montaka’s aggregate portfolio allocation to outliers – which currently stands at less than 7%. The remaining 93% of Montaka’s portfolio is allocated to businesses we classify as ‘compounders’.

As a database provider for large production-ready applications, MDB has suffered of late because software developers have overwhelmingly focused on small, experimental AI-based ‘proof of concepts’ rather than production deployments. We expect this cycle to turn in 2025 and beyond, and it’s possible (though not certain) that demand for MDB accelerates materially.

There are strong arguments for why MDB should thrive in a world in which AI is infused into applications. These include:

- As one of the largest and well-established database offerings available for ‘unstructured data’, MDB should benefit from new AI applications on the basis that 80-90% of the world’s data is inherently unstructured.

- Relational databases (e.g. Oracle) that handle structured data that align to a fixed schema, lack the flexibility required to handle the rapid changes and evolutions that are taking place in AI.

- New AI coding agents can now automate the (previously too time consuming) transfers of data from a relational database to a more flexible MDB. Given MDB’s market share of the overall database market is only approximately 2% today, small changes in market share would likely translate into outsized percentage gains in MDB’s value.

As is the case with all of our outlier positions, we limit Montaka’s investment exposure to a small position because we are not certain if MDB will be successful. But if it is, the upside in value is likely enormous.

* * *

At Montaka, we strive to strike the right balance between awareness of the many investment risks that are always out there, and the many exciting long-term opportunities emerging before us.

Amazon founder, Jeff Bezos, recently pointed out that we humans tend to overweight risks and underweight opportunities.

That’s food for thought, particularly as he also said that we’re currently in “multiple golden ages at once,” led by AI, but also space technology, drug discovery, quantum computing, and many other opportunities.

While we remain mindful of risks (including business, market, and inflation risks) and manage these over time, we believe that our approach is well placed to unlock substantial future returns for unitholders amidst today’s golden ages.

And as part of MFF going forward, we believe we will have the structural and cultural advantages needed to execute this formula successfully.

Note:

[1] (Montaka) Mind the 4 demographic truths of equities, December 2023

[1] (Reuters) Goldman CEO says dealmaking could surpass 10-year averages in 2025, December 2024

[2] (FT) US set for IPO comeback as private equity firms seek to offload holdings, January 2025

[3] (Bloomberg) US Household Wealth Climbs to a Record on Higher Stock Values, December 2024

[4] Federal Reserve Flow of Funds

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stockpicks. Click below to listen. Alternatively, click on this link:

Note: Montaka is invested in Amazon, MongoDB, Salesforce, S&P Global, LVMH, Blackstone and KKR.