|

Getting your Trinity Audio player ready...

|

Graham Hand with Chris Demasi

As featured on Firstlinks.

GH: You’ve been writing on the need to invest and think long term. Would you describe short-termism in equity markets as the biggest problem facing investors?

CD: Absolutely. The myopic nature and increasingly short-term views mean investors are taking their cues from short-term movements in stock prices, and that’s how they measure the success of their fund managers or the companies they invest in. The geopolitical and financial market uncertainty makes horizons shrink and it’s a travesty but it also creates a lot of opportunity for people who stay the course, pick up bargains and hang in for the long term. I say travesty because they forgo a lot of the extraordinary gains they could otherwise make by staying the course and focussing on a long-term view. They should be thinking about the fundamentals of the business and the opportunities in front of them rather than short-term share price fluctuations.

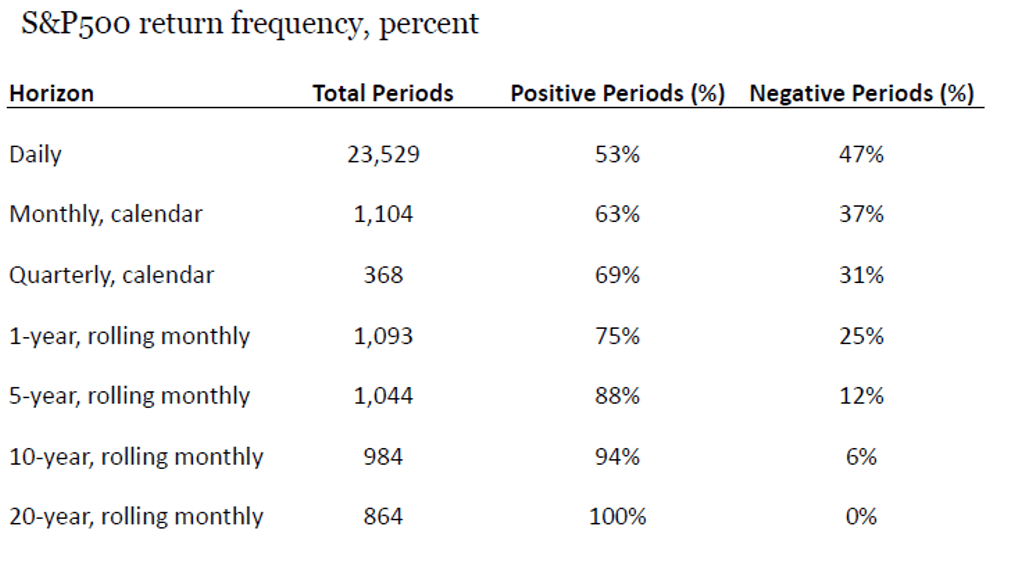

We use a chart which shows over the long-term, the chance of a positive return on a daily hold of the S&P500 is only 53%. But go out to one year, and it’s 75%, then five years is 88%, 10 years is 94% and there are no negatives over a 20-year period.

Stock market performance over different horizons

Source: Fisher Investments

GH: Do you believe good opportunities still exist in today’s market of inflation, rising rates and a fear of recession?

CD: Even today, we see many examples where excellent companies have expanded their addressable markets, they are growing their revenues, their earnings power is increasing, often exponentially. The business value is going one way but the share price is moving completely opposite. And therein lies the opportunity for investors that stay the course.

Go back to the experience of Alphabet over the last decade. It’s a company that has grown earnings by seven times and over a decade, it’s an eight-bagger, but few shareholders would have retained it over that time. They are too busy timing the buying and selling but if investors had simply followed the path of the earnings power and the business fundamentals, they would be rewarded handsomely. Alphabet’s share price is down 22% in the last quarter. There have been periods where the stock has gone down by 30% and it’s often fallen by 15% but that’s the cost of entry to the opportunity.

GH: Yes, and the same with Amazon that had a 90% drop in the tech wreck, but how many people hung in through that experience?

CD: Yes, and we don’t wish for falls like that, but Charlie Munger and Warren Buffett say that if you can’t tolerate a 50% sell off, you shouldn’t be investing in equity markets. Morgan Housel says in The Psychology of Money that volatility is the price of admission and the prize is superior compound returns. While some of these drawdowns can be painful and nobody wants them, the best performers have all had large drawdowns. In fact, Apple has had three.

Apple’s large drawdowns

Investors need to understand this to give them confidence to stay the course, but not in every company. It applies for excellent companies that have opportunities to grow exponentially for long periods of time when their leadership positions and moats are sustainable.

There are great examples of that not being the case. Peloton had a pull forward in demand during the pandemic for their digitally-enabled bikes but the fall in its stock price has been led by an earnings drop. The same is true for some brick and mortar retailers such as Bed Bath & Beyond in the United States with unsustainable earnings estimates. But if you look at the best companies, such as Apple, Amazon and Microsoft, their future earnings potential continues to grow.

GH: You’ve also written about how long-term returns are driven by surprisingly few companies and the majority don’t contribute over time. So it’s not a matter of simply investing for the long term in anything.

CD: In our analysis over 10-year periods, most companies don’t hold their value and only one in four stocks turn $1 into $5 and one in 16 turn $1 into $10 and it’s those that create all the value in the stock market. So to deliver superior compound returns over a decade, we need to focus on finding outstanding businesses leading transformations in their markets, and buy them when they’re undervalued.

GH: Is this message of accepting the inevitable drawdowns resonating with your clients?

CD: It’s always a difficult message and that’s a reflection of human nature, we just don’t like to see prices go down. But, yes, the message resonates when we present the evidence as it builds a degree of confidence that this is the right way to approach equity markets.

GH: But what might you also look for as an exit point for some of these companies, because if you if you look at an Alphabet or Microsoft, there’s a case to own them forever.

CD: This is our playbook. If the thesis changes or something happens that we don’t understand, that triggers a review of the position. It might be competition or regulatory change or something else that disrupts a leadership position. Or if the market size is not evolving as we expect and the growth potential is lower or riskier than we thought. And of course, the one that we like is if the price goes up a lot more than we can justify. We have a good example in Microsoft at around US$250 today. We think the business will reach a value of US$1,000 to US$1,200 over a decade based on growing cash flows into future, so we’re playing for four or five times in 10 years for one of the highest-quality companies in the world. We take a ‘private equity’-like approach to public markets, so if the public equity market takes Microsoft to US$1,000 by the end of the year with nothing else changing, that might trigger a sell because that was all of the upside we were playing for.

The flipside is that if we still believe in the thesis but the share price halves, now we’re playing for a 10-bagger. We might have capacity to add to our position, and investor with money on the sidelines can improve the future return potential.

GH: How do you weigh up for the geopolitical and macroeconomic factors that also feed into the market, as well as the company specific?

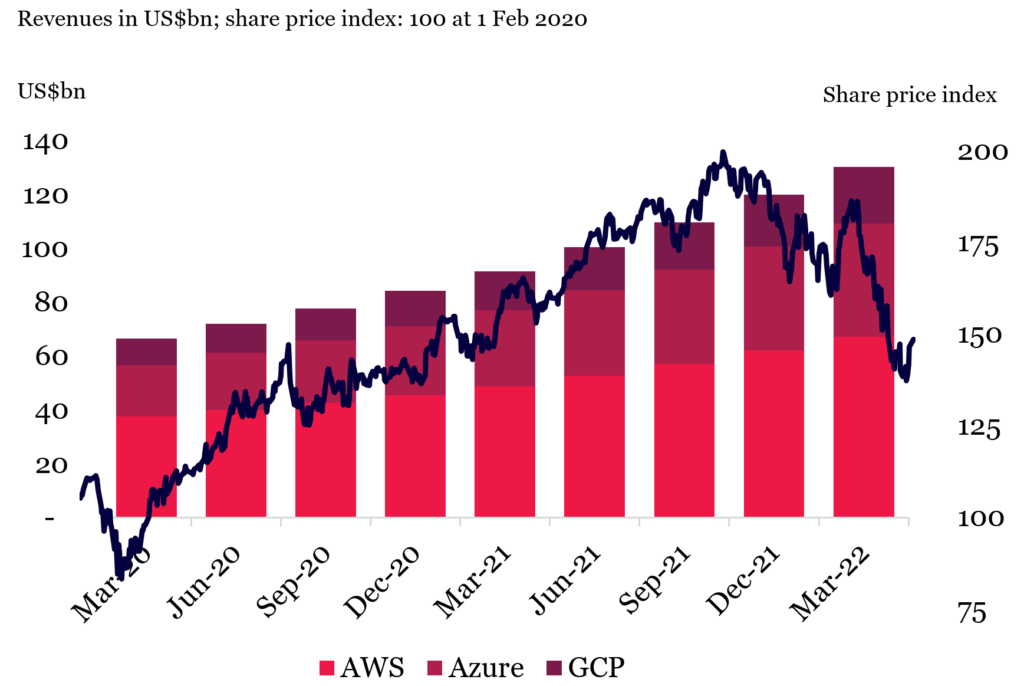

CD: Because we focus on a concentrated portfolio of opportunities, we think less about geopolitical events and macro. We appreciate they can change the mood and sentiment in the market but if it doesn’t change the drivers of business value and earnings power over time, then it’s much less relevant in most cases. Extending the Microsoft example, virtually all the increase in value over the next 10 years will come from cloud computing and artificial intelligence, and that’s not dependent on a war in the Ukraine or inflation or interest rates over that time. We don’t typically change the portfolio to play the short term.

Hyper-scaler cloud LTM revenues and share prices

Source: Bloomberg, company filings

(Note, AWS (Amazon) holds 33% of public company cloud market share, Azure (Microsoft) holds 21% and GCP (Alphabet or Google) holds 10%).

GH: You’re a global equity manager but do you have any Australian stocks in your portfolio?

CD: We’ve held REA Group for a while. It’s one of the world’s best businesses, which sounds funny because it’s in a small pocket in a corner of the world but it’s almost a monopolist in an industry that favours winner-takes-all, and it still has room to grow as we shift from offline to online. It will take a greater share of real estate marketing budgets. It’s not a Microsoft or Alphabet but it’s an excellent position and it’s still a growth business.

GH: You have two ASX-listed vehicles, the Global Long Only (ASX:MOGL) and the Global Extension (ASX:MKAX). What does ‘extension’ mean and what’s the difference between these two funds?

CD: They both invest in the same core portfolio of stocks and today there are 23 stocks so it’s a concentrated portfolio with the top 10 making up about 70%. The extension allows us to run a small short portfolio of companies we believe are in trouble or in industries that will deteriorate over time, and that’s about 30% worth of the portfolio. We use the proceeds from shorting to apply more exposure to the core portfolio of 23 on the long side.

GH: Okay, it’s typically a 130/30 fund of your selected winners and losers. Can you give an example of a stock you like but has disappointed and it made you think about any lessons you might learn about your investment process?

CD: The biggest lesson is the other way around, where we have let go of one of these high-quality compounders too soon. We’ve been too sensitive to a run up in prices, for example, selling Apple and Microsoft. The trick is to recognise the difference between price and value and stay the course and not be tempted to sell out, either up or down. We’re less inclined now to take shorter-term profits because we’re playing for so much more in the future.

GH: Is there a company that you expect to own for the next 10 years or longer?

CD: Almost all the companies in the portfolio, unless the public market gives us an opportunity to reap the multiples we expect much sooner. An example is Blackstone, the private capital and alternative asset manager. We can see so many new market opportunities for them not captured in the current valuation. They’re only just starting as far as money allocated to the alternatives sector is concerned. Institutions are underweight private capital and the retail market of private banks and clients is an US$80 trillion untapped opportunity. Blackstone’s been building distribution and sales for the last 10 years. We expect them to manage many trillions of dollars in the years ahead but the macro themes and lumpiness of asset accumulation will test investor patience and staying power, while throwing up opportunities to buy more shares.

GH: Final question. If valuations are so good at the moment, what are you doing with your own money?

CD: I can’t understand the divergence between the business values created in the companies we hold in the portfolio and the selloff in their stock prices, so sharp and dramatic. Microsoft down over 20% year-to-date, Amazon even worse, 35%. We’ve been putting more and more of our own money into our funds and will continue to do so. We’re eating our own cooking.

Graham Hand is Editor-At-Large for Firstlinks. Christopher (Chris) Demasi is the Portfolio Manager at Montaka Global Investments, a sponsor of Firstlinks. This article is general information and does not consider the personal circumstances of any investor.

To learn more about Montaka, please call +612 7202 0100 or contact us on https://montaka.com/

Read our latest AI whitepaper now by sharing a few details with us: