|

Getting your Trinity Audio player ready...

|

– Andrew Macken & Chris Demasi

The businesses of Montaka’s largest investee companies continued to perform extremely well and competitive advantages continued to improve. We believe the businesses in Montaka’s portfolio are substantially more valuable than their stock prices imply. This reinforces the focus of, and gives further credence to, Montaka’s investing formula, which we revamped and solidified more than four years ago.

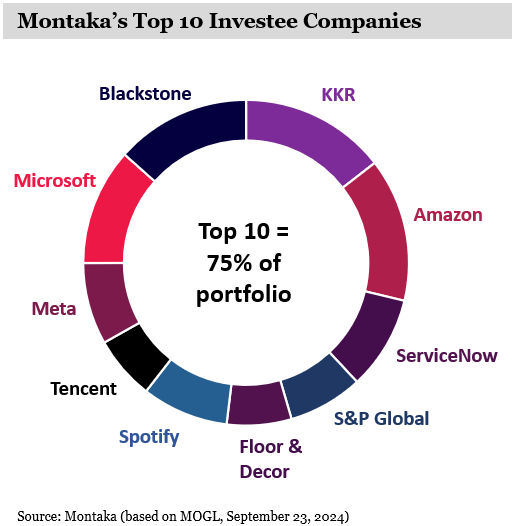

The key to this formula is our disciplined, patient approach to active management, which combines high conviction (Montaka’s top 10 investee companies account for 75% of our portfolio) with long-duration time horizons.

When applied to a handful of undervalued, advantaged companies winning from large transformations, the formula delivers superior long-term compounding of investor capital, alongside our own. (The formula, of course, is backed by empirical and academic evidence, as we have shared in: Concentrated, patient and disciplined. The 3 pillars of active management outperformance.)

* * *

4 Areas of Big Opportunity

Returning to markets, while many investors fret about markets being too high, we continue to see quite a few investment opportunities in global equities today, including several compelling prospects. Look no further than Montaka’s top 10 investee companies for clues on where we think the big opportunities are:

Below, we take a closer look at 4 of the areas in which we see substantial investment opportunity:

- Advantaged Asset Managers

Blackstone and KKR have been successfully investing their clients’ capital for nearly 40 years, and 50 years, respectively. With more than US$1.6 trillion in assets under management between them, world-leading brands, and long-term track records, these managers are uniquely advantaged in their access to talent, capital, and the best deals all around the world.

The ‘alts’ space sits at around US$12 trillion today (out of more than US$300 trillion of global stocks, bonds and real estate) and is set to grow substantially, driven by growth in three underpenetrated markets: Asia, the insurance sector, and the enormous private wealth channel.

As is happening now, this growth will likely disproportionately favor today’s leaders, including Blackstone and KKR, and their earnings growth will accelerate, without needing to make big capital investments. We believe this is not fully appreciated by the market today and that Blackstone and KKR shares remain undervalued.

We also like that, by owning shares in these advantaged alts, Montaka is effectively ‘coinvesting’ with their Principals, who collectively remain significant shareholders.

-

Cloud Computing Platforms

The market for cloud computing is more than US$250 billion (excluding China) and is growing at approximately 25% annually. Yet it only represents around 15-20% of the total IT workloads today, with 80-85% of workloads still residing ‘on-premise’. Cloud-based workloads have a clear value proposition: better total cost, better security and greater flexibility. That will see more and more companies transition their on-premise workloads to the cloud, a trend that will drive strong and sustained growth in this space for many years to come. The AI revolution is also overwhelmingly native to the cloud, and given its inherently higher ‘compute intensity’ of software, will likely drive incremental growth in cloud usage, as we hypothesized several years ago in: Why epoch-defining AI is today’s most important investment theme.

The most attractive feature of the cloud computing space (from an investor’s perspective) is its high concentration combined with very high barriers to entry. Amazon, Microsoft, and Alphabet account for at least 65% combined share of the global (ex-China) market. And these three companies alone spend more than US$150 billion in capital investments and another US$110 billion, or more, in research and development each year, all of which represent extraordinary scale advantages that make it near impossible for others to compete.

Furthermore, as these incumbents grow, so will their competitive advantages as they build unique datasets associated with software, security, and AI, which makes it highly likely they will remain winners in this space over the long term.

Yet, we believe the market continues to underappreciate the long-term durability – and therefore, value – of the revenue and earnings growth that will follow for the likes of Amazon, Microsoft and Alphabet.

-

Financial Services Networks

Montaka owns several duopolists in the financial services industry, including Visa and Mastercard in payments; and S&P Global in credit ratings and financial data services. These businesses have competitively protected and reliably growing core businesses. But they also have newer, high-probability adjacent opportunities. The market, however, is underappreciating this powerful combination, in our view.

For Visa and Mastercard, their core businesses in global payment processing are being complemented by significant growth in two areas:

- New processing opportunities in peer-to-peer, business-to-business, business-to-consumer, and government-to-consumer payments; and

- Value-added services, including risk, fraud-detection, issuance, acceptance, and open banking.

For S&P Global, we are seeing a cyclical rebound in high-margin credit ratings. At the same the company’s software services businesses are rolling out an expansive pipeline of new AI-enabled product features, powered by S&P Global’s large and unique financial datasets.

-

Winners in Data & AI Distribution

To win in AI, investors need to look through the hype of the new and rapidly evolving technologies, and instead focus on enduring business advantages. Two particularly valuable advantages are:

- The ownership of privileged datasets at scale; and

- A distribution channel in the form of a captive customer base through which new value-adding AI services can be distributed.

With today’s AI models, enormous value can be unlocked on the enterprise side through productivity enhancements; and on the consumer side, through engagement boosters (such as Meta’s personalized content recommendations) and new product features. But in most instances, most value is unlocked when you marry AI models with customer data – and, importantly, the ‘meta’ data around the customer data. (Meta data gives AI models the context and grounding to be effective for a specific use).

These dynamics favor incumbents who have been building datasets for decades and who have an existing customer base into which they can distribute new value-adding AI services. Both of these business advantages are nearly impossible for competitors to recreate and therefore represent an enduring source of long-term value creation for investors.

Montaka owns ServiceNow and Salesforce as advantaged owners of unique data sets that are mission-critical for near-term value-adding AI distribution for the world’s enterprises. And on the consumer-facing side, Montaka owns Meta and Spotify for many of the same reasons.

All remain underappreciated by the market today, in our view.

* * *

Taking Advantage of Price Volatility

There has been a lot of focus on the outlook of the global economy and what that means for markets. But the global economic backdrop appears quite favorable for equity investments.

In the aggregate, growth in the US remains solid. There is, however, notable weakness in lower-income household consumption. And growth abroad – including in the EU, UK, China – is also quite weak.

But these weaknesses carry a silver lining: they are disinflationary. That has helped US inflation continue to decelerate and allowed the Federal Reserve to recently commence an interest rate easing cycle.

When you combine solid US aggregate growth, falling interest rates, and reasonable equity valuations (after adjusting for several distortions), it makes global equities fertile ground for investment opportunities.

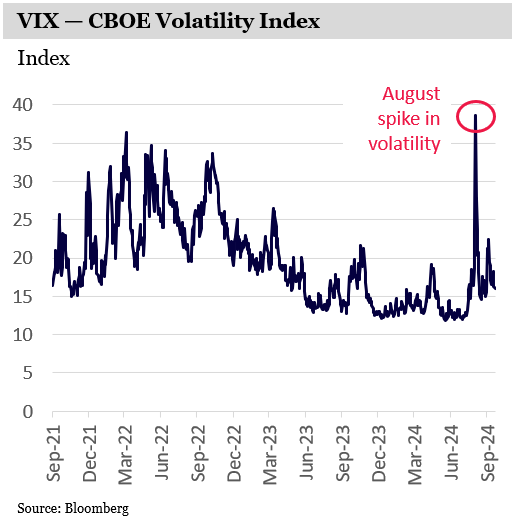

And yet markets have experienced some volatility of late. In August, investors experienced the biggest one-day spike in the CBOE Volatility Index (the ‘VIX’) in 30 years, while Japan’s Nikkei 225 equity index dropped 12% in a day – its largest single-session drop since Black Monday in 1987.

Flare-ups in volatility will likely continue over the coming quarters. Politics alone – whether the upcoming US election, fragmentation to the extremes in European politics, or a potential escalation in today’s two major wars – will no doubt provide ample fodder for financial market volatility going forward.

Yet, as uncomfortable as volatility can feel, it provides opportunities for the prepared investor when short-term stock price declines become divorced from the intrinsic value of their underlying businesses.

Montaka took advantage of stock price volatility in two distinct ways during the September quarter:

- Floor & Decor

Firstly, in July, we established a new ‘compounder’ position in Floor & Decor (NYSE: FND), a big-box specialist hard-surface flooring retailer in the US whose stock price had declined by a third during the preceding months.

The salient feature of FND is its ‘flywheel’ dynamic that builds and strengthens its scale advantages, while reducing prices and increasing value for customers over time.

At just 230 stores today, there is ample room for FND to roll out new stores, and management has targeted more than 500 over time. Importantly, the unit economics of each store is extremely favorable. FND will also benefit from Fed rate cuts rates and a turn in the US residential property market cycle.

Some readers might recall that we presented FND as an attractive investment opportunity at the 2019 Sohn Conference at the Sydney Opera House (the chart below is from that presentation).

We have been actively monitoring the business since then, patiently waiting for the right opportunity to re-establish an investment in this quality business. This is a great example of the benefit of investment team continuity and the long-term compounding of collective experience.

- Amazon

Secondly, in August, we sold some of our holdings in two tactical positions in the tail of Montaka’s portfolio – Advanced Micro Devices (AMD) and Kyndryl Holdings (KD) – to take advantage of a near-20% drawdown in the stock price of Amazon.

We still see plenty of upside in AMD and KD, but Amazon has more substantial and higher-probability upside that demanded we allocate even more of Montaka’s capital to the online retailer.

Investment opportunities always compete for capital. Through this lens, Montaka’s largest investments act as a kind of ‘benchmark’: Any new investment must be more attractive than these holdings to get included in our portfolio.

Because we believe Montaka’s largest investments remain so attractive, our annualized portfolio turnover has been low for many years now – typically around 25%.

We continually identify quality global businesses with upside potential – but few new investment opportunities have greater upside than Montaka’s existing portfolio investments.

While Montaka is focused on investing over the long term, and most days don’t require any action on our part, paradoxically we need to be agile on a daily basis. That is, we must be ready to act if stock price changes throw up attractive investment opportunities.

Pockets of volatility create windows of opportunity. But they may not stay open for long.

FND’s stock price, for example, is already up by around 30% since we established Montaka’s position in July.

* * *

Powerful Evolutions

We are highly optimistic about the prospects of Montaka’s investee companies. As their competitive advantages continue to improve, we believe they will continue to underpin substantial investment returns for Montaka’s investors over the coming years.

Of course, those investors include Montaka’s Principals – and indeed our entire team – who are substantial co-investors alongside you in Montaka’s funds. Also co-investing alongside you is the largest shareholder in MFF who is also the largest unitholder in Montaka’s funds.

Montaka’s new arrangement with MFF delivers substantial future benefits for Montaka’s investors.

Montaka’s existing team will continue to run the funds, but we will gain access to greater resources and experience that will serve to further enhance Montaka’s investment capability.

Furthermore, Montaka’s new structure will provide the permanence we need to continue make and hold long-duration investments that will deliver superior long-term compounding for Montaka’s investors.

On behalf of the entire Montaka team, we thank you for your continued trust, patience and partnership with Montaka, as we continue our exciting long-term investment journey together.

Podcast: Join the Montaka Global Investments team on Spotify as they chat about the market dynamics that shape their investing decisions in Spotlight Series Podcast. Follow along as we share real-time examples and investing tips that govern our stockpicks. Click below to listen. Alternatively, click on this link:

Note: Montaka is invested in Amazon, Floor & Decor, Microsoft, Alphabet, ServiceNow, Salesforce, Blackstone, KKR, Meta, Spotify & S&P Global.